- AERO has experienced a remarkable +1200 surge in the last year.

- The primary driver of this growth has been Base – will this trend continue?

Aerodrome crypto [AERO] has witnessed significant growth due to the rapid expansion of Base, an Ethereum [ETH] L2.

Aerodrome plays a crucial role as a central liquidity provider in the Base ecosystem, functioning as a decentralized exchange (DEX) and automatic market maker (AMM).

The growth of the L2 platform has been instrumental for the protocol. In 2024, Base’s TVL (total value locked) surged by 6x (from $500 million to nearly $3 billion).

During the same period, Aerodrome Finance’s TVL jumped from $100 million to over $1.3 billion (13x).

Its native token, AERO, has been a standout performer with a remarkable +1200% increase over the past year. With further growth expected for Base, should AERO be on your radar?

AERO’s Potential

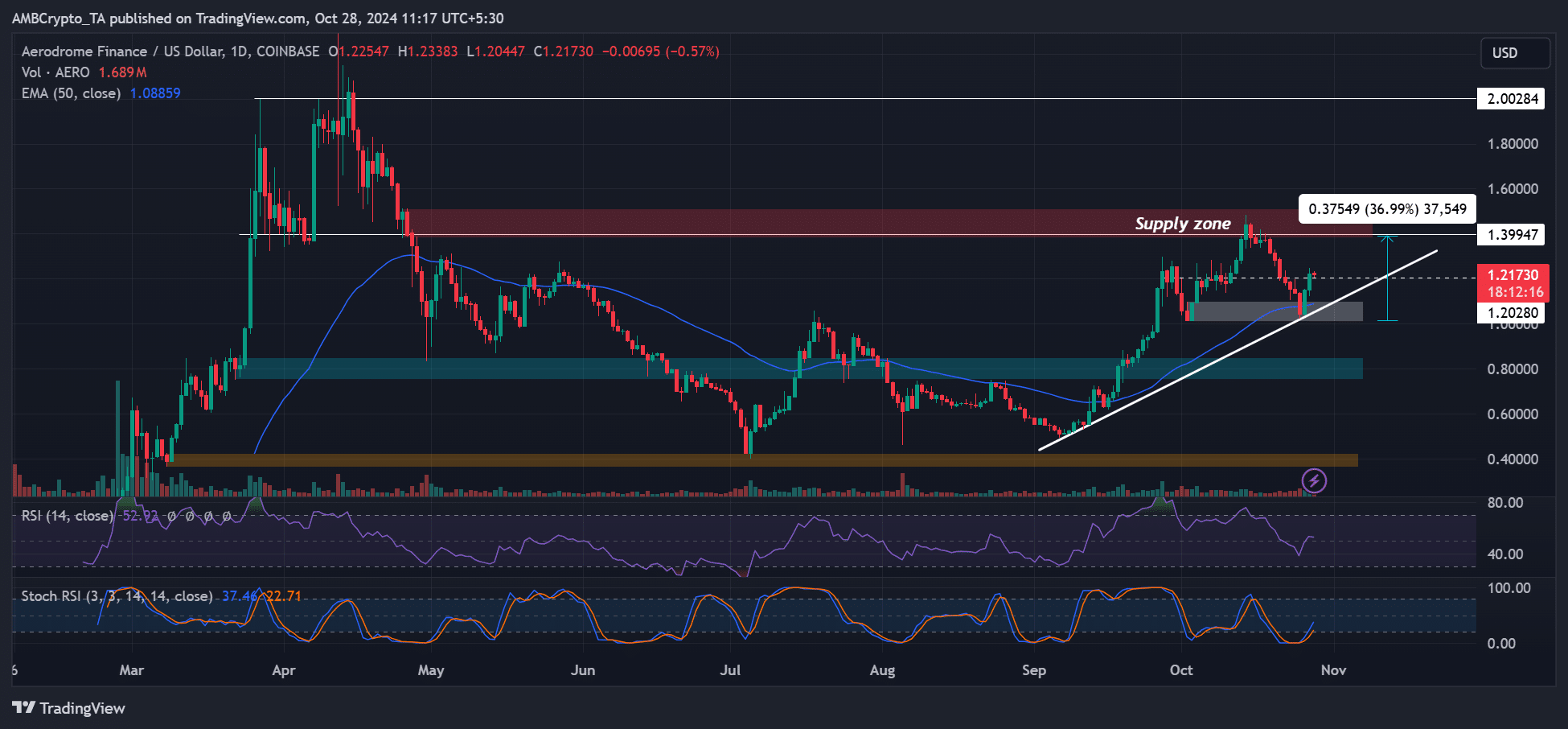

Source: AEROUSD, TradingView

AERO recorded a recovery of over 140% during the broader market rebound in September. However, it faced resistance at the $1.3 – $1.5 range (red, supply zone).

Nevertheless, the pullback found support near the $1.2 level, making it a critical area to monitor.

A continued uptrend towards $1.5 could trigger a 36% recovery, while a more aggressive move to $2 could potentially yield close to 100% gains.

Key technical indicators on the chart suggest room for further growth as they are not yet in overbought territory.

However, with market uncertainty and volatility expected due to the upcoming US elections, a break below $1.2 could present an opportunity to buy at a discounted price of $0.8.

Weekend Spot Demand

Source: Coinglass

Read Aerodrome Finance [AERO] Price Prediction 2024-2025

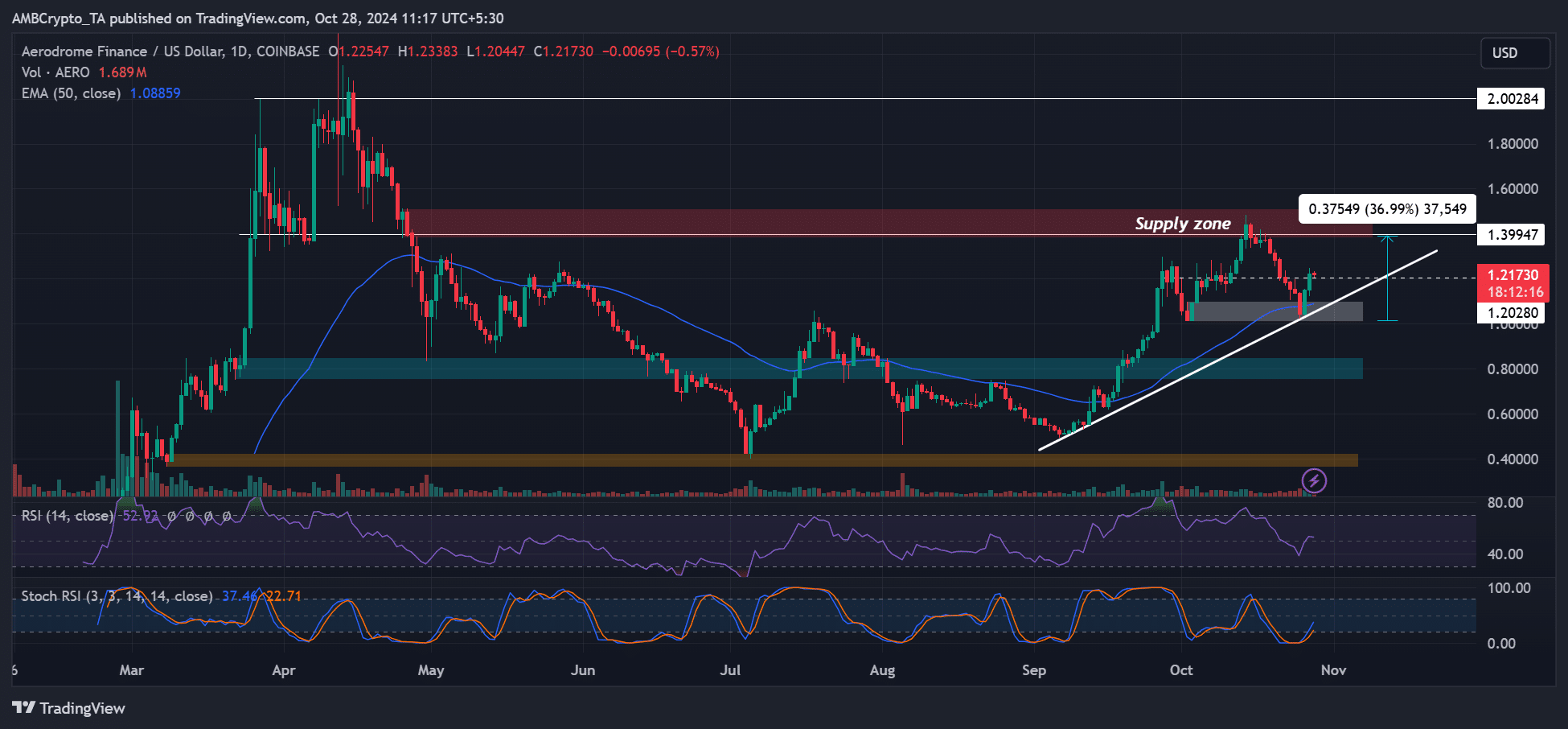

The recent 18% increase over the weekend was predominantly driven by spot demand, evidenced by a spike in spot CVD (Cumulative Volume Delta).

This metric measures the difference between buying and selling volume, indicating a surge in buying volume and bullish sentiment.

However, interest in the Futures market slightly declined, as reflected in a nearly 1 million AERO drop in open interest (OI) rates. If this trend continues, the move to $1.5 could be postponed.

Disclaimer: The information provided should not be considered as financial, investment, trading, or any other form of advice and represents solely the author’s perspective.

sentence to make it more concise: “Can you please provide me with the information?”

“Could you give me the information?”