- The integration of Akash Network into NVIDIA’s product Brev led to a 573% increase in trading volume for the former.

- AKT also saw a surge of 20.18% in the past week.

On August 23rd, the entire cryptocurrency market experienced a significant upturn. Since then, there has been increased volatility, with investors seeking external factors to drive further gains.

During this period of market fluctuations, Akash Network also witnessed a notable upward trend.

The movement in price has sparked curiosity about the factors driving the rally for this AI-focused altcoin.

Integration of Akash Network with NVIDIA’s Brev

NVIDIA’s Director of Tech Development, Nader Khalil, announced the integration of Akash into their new product, Brev.

With AKT now directly linked to NVIDIA products, it stands to benefit from the AI industry’s growth.

Akash Network occupies a unique position at the intersection of AI and blockchain technology as a decentralized, blockchain-driven compute network.

Market Sentiment Overview

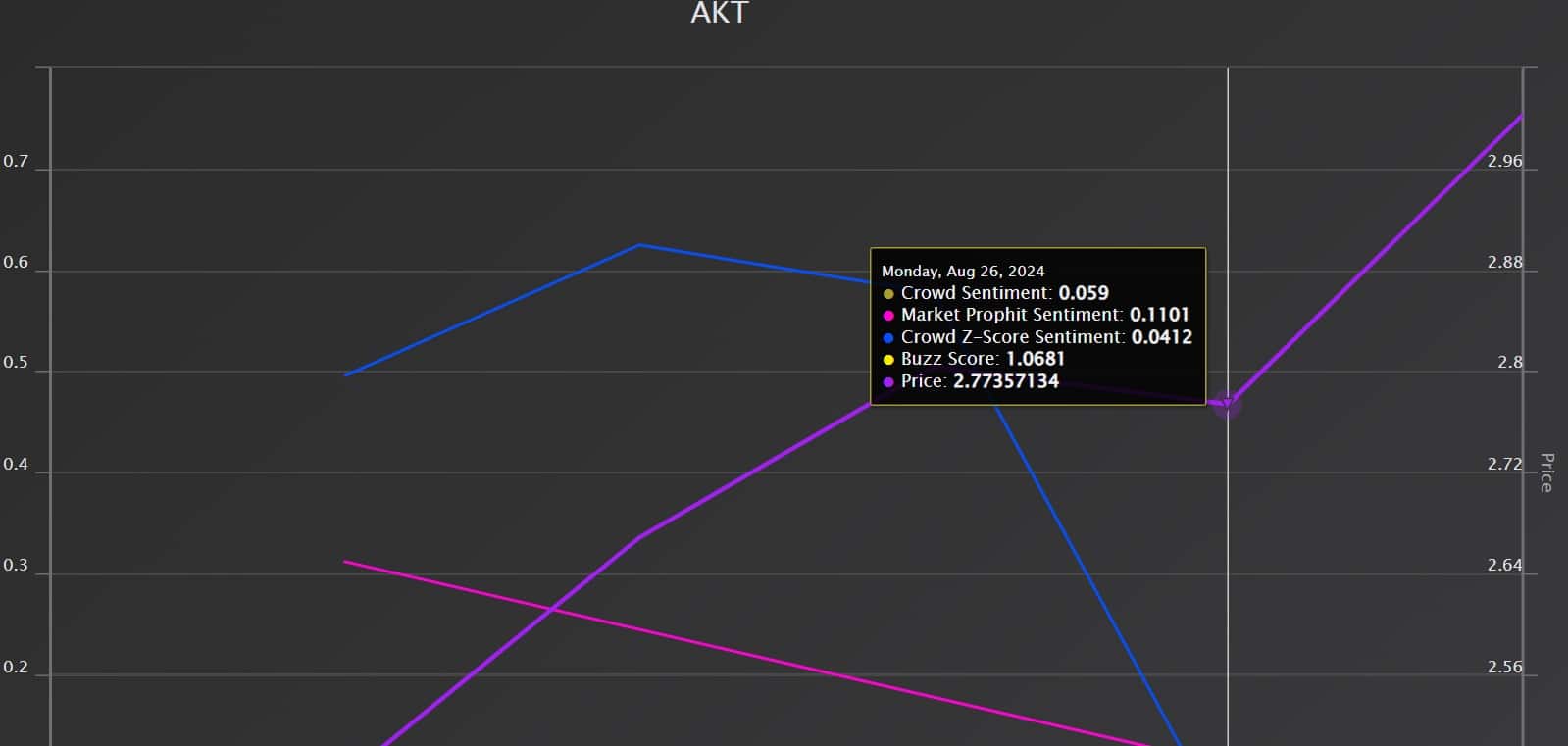

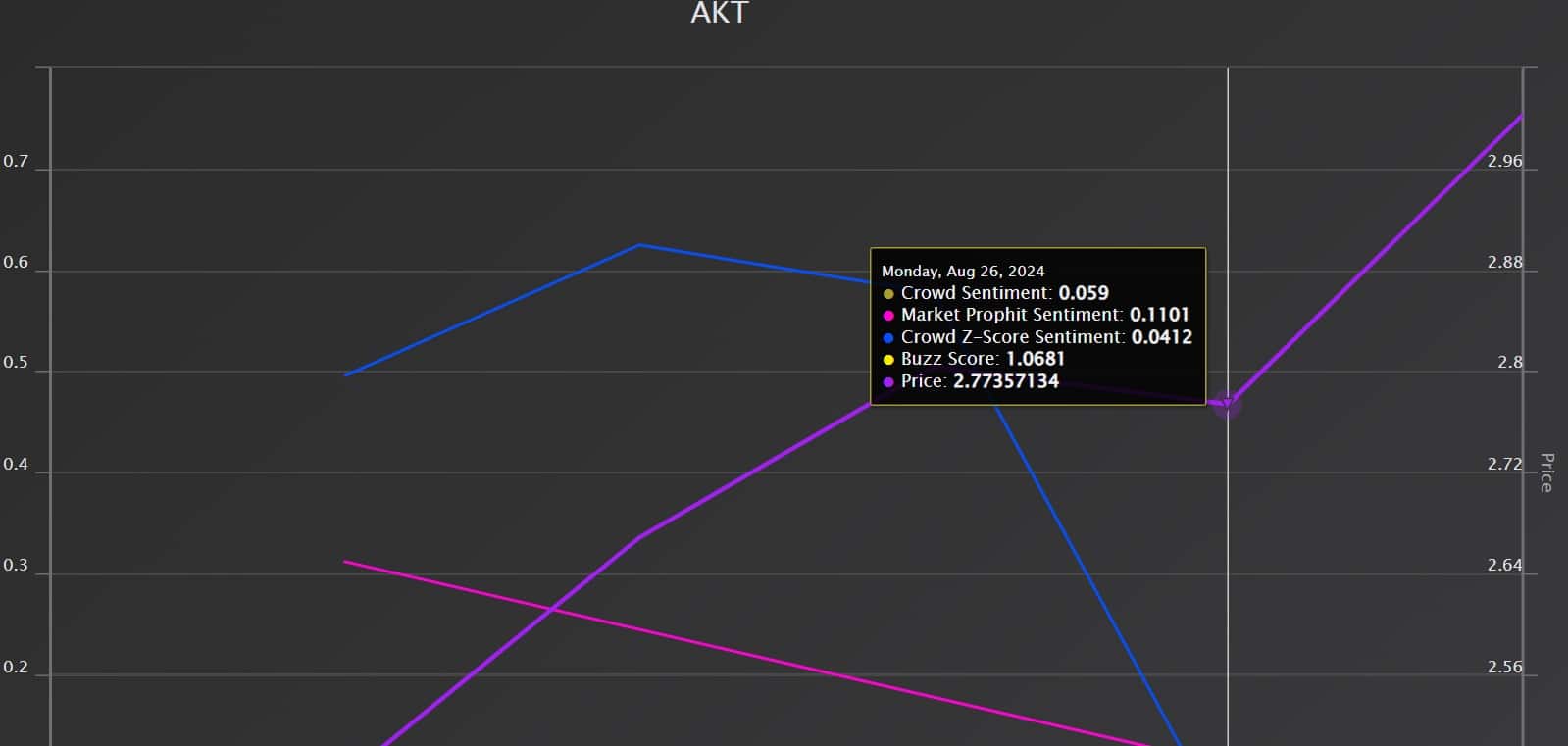

Source: Market Prophit

Aside from the NVIDIA integration, AKT is enjoying significant market favorability, with investors displaying a positive outlook. An analysis by AMBCrypto using Market Prophit indicated positive market sentiment towards the altcoin.

At the time of reporting, AKT had a crowd sentiment of 0.059, a buzz score of 1.06, and a crowd Z score of 0.04, suggesting investor confidence in the altcoin’s trajectory.

Analysis of AKT’s Price Charts

AKT has shown a moderate recovery on price charts, with the AI-focused altcoin trading at $3.03 at the time of writing, reflecting an 11.8% increase in the past 24 hours. Its trading volume surged by 573.17% to $55.5 million within 24 hours.

Prior to these spikes, AKT witnessed sustained price gains over the past week, with a 20.18% increase. Following a low of $1.80 during the market downturn on August 5th, AKT has seen a 68.33% profit.

Despite the recent uptrend, the altcoin’s prices remain relatively below last month’s high of $3.77 and 63.7% down from its all-time high of $8.7.

Therefore, it is crucial to determine whether the recent price surges are sustainable in the long run or merely a market correction.

Source: TradingView

Examining the Directional Movement Index (DMI) for AKT, the positive index stood at 35.75, surpassing the negative index at 16.59, indicating a strong upward trend with recent highs outweighing lows.

This trend is corroborated by the Aroon line, with Aroon Up at 92.86% above Aroon Down at 42.8% at the time of writing.

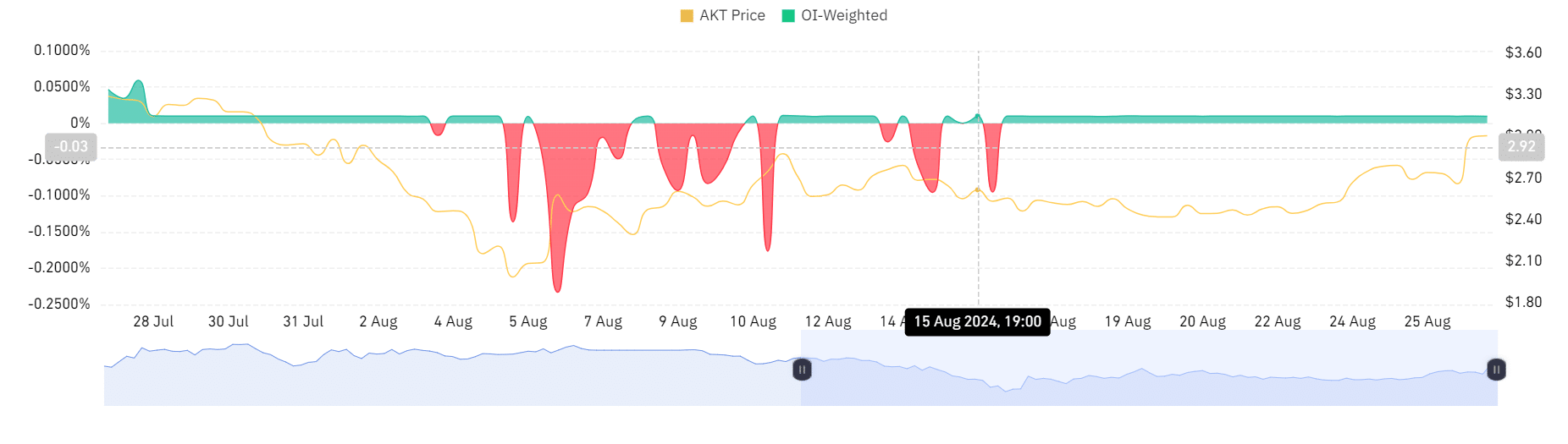

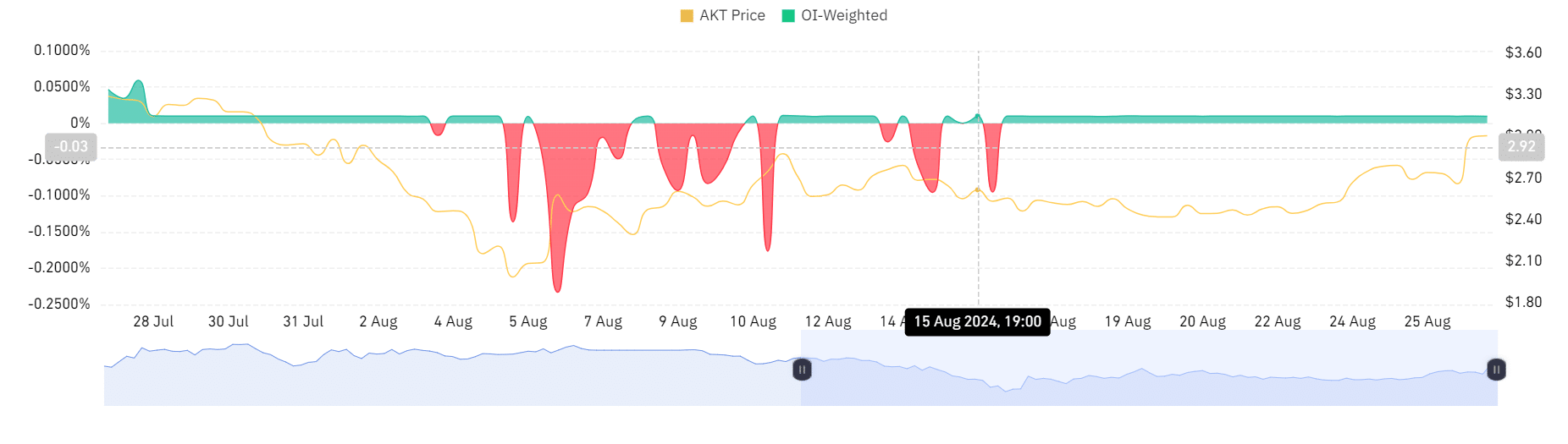

Source: Coinglass

Furthermore, AKT’s OI-Weighted Funding Rate has been positive for the past two weeks, indicating a growing demand for long positions with investors willing to pay a premium for their positions, reflecting a bullish market sentiment.

Source: Santiment

Additionally, the positive Funding Rate aggregated by the exchange signifies a demand for long positions, reflecting investor confidence in AKT’s price appreciation and future potential.

Read Akash Network’s [AKT] Price Prediction 2024–2025

Therefore, following a consolidation just above $2.70, the price of Akash Network’s coin surged past $3. The $2.70 level has proven to be a pivotal support level in recent weeks.

Given the current market sentiment, if sustained, AKT could potentially break through the $3.4 resistance level and target the $3.8 resistance level.

following sentence:

“The dog quickly ran across the field and jumped over the fence.”

The dog sprinted across the field and leaped over the fence.