Key Highlights

- QwQiao points out the lack of lasting competitive advantages in major L1 networks and tokens, making them vulnerable.

- He suggests that the ease of switching between different blockchains for users and developers diminishes the long-term value of tokens.

- His proposed solution advocates for building apps and services directly on blockchain networks.

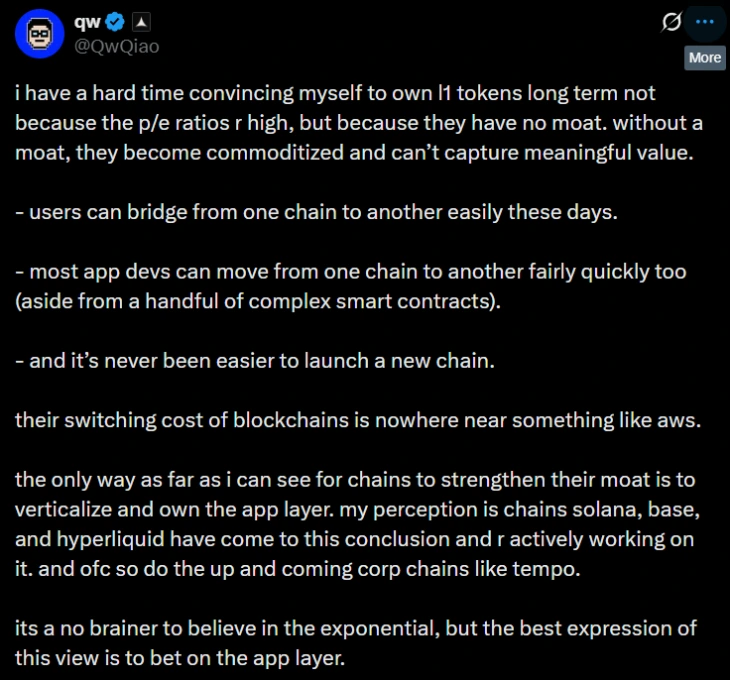

On November 27, QwQiao, a partner at the Alliance DAO, expressed concerns about the long-term viability of L1 tokens in a tweet.

(Source: QwQiao on X)

In a recent post on X, QwQiao questioned the sustainability of holding Layer 1 (L1) blockchain tokens in the long term, emphasizing the absence of a competitive advantage.

He believes that without a protective “moat,” these infrastructure chains risk becoming basic commodities, unable to retain significant value over time.

L1 Tokens Face Lack of Competitive Edge: QwQiao

QwQiao’s argument revolves around the minimal barriers hindering users, developers, and capital from transitioning between different blockchains within the crypto sector.

He highlights the seamless nature of cross-chain asset transfers facilitated by advanced bridge technologies, leading to a substantial volume of transfers exceeding billions of dollars in 2025.

Developers can easily migrate applications across compatible chains, aided by user-friendly development tools and accessible kits for launching new blockchains swiftly.

This ease of blockchain switching contrasts with the complexities of transferring data from cloud service providers, prompting QwQiao to advocate for focusing on the app layer for exponential growth.

Qw, a partner at Alliance DAO, has garnered attention for his accurate warnings on retail ETFs and AI tokens, sparking debates within the crypto community regarding L1 tokens.

QwQiao Proposes Vertical Integration as a Solution

QwQiao suggests that L1 networks must transition from pure infrastructure to owning the application layer to fortify their competitive position.

He cites examples like Base from Coinbase, attracting a growing user base in DeFi, and Hyperliquid, a decentralized exchange (DEX) on a high-performance Layer 1 blockchain.