- The positive outlook for ETH has sparked discussions about an upcoming altcoin season.

- As BTC struggles below $100K, the sustainability of the current altcoin season trend is being questioned.

Market analysts are suggesting that the long-awaited altcoin season may finally be upon us, attributing this to the strengthening price of Ethereum [ETH] and the momentum in the sector.

ETH’s promising future is seen as a key indicator for the health of the sector and has contributed to the growing calls for an altcoin season.

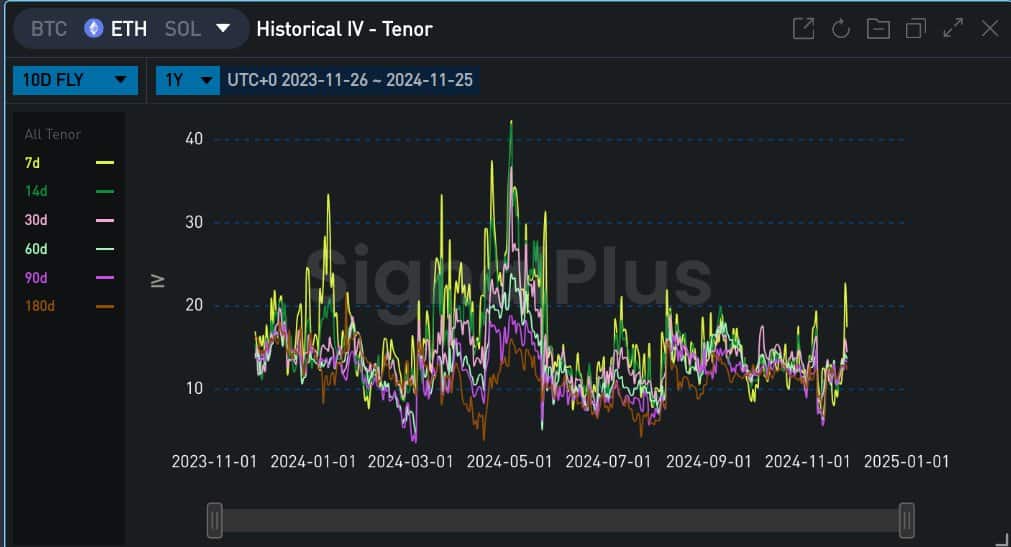

Jake Ostrovskis, an options and OTC trader at market maker Wintermute, highlighted that the positive outlook for ETH is leading to a rotation of capital into altcoins, as evidenced by spikes in volatility and trading activity.

“Is this time different in terms of bullish calls? The market seems to think so. Volatility is rising, skew is at 12-month highs, and there is strong demand for options.”

Source: Signal Plus

The surge in implied volatility indicates that options traders are bullish on ETH’s prospects, which could potentially drive the entire altcoin market higher.

Altcoin season status

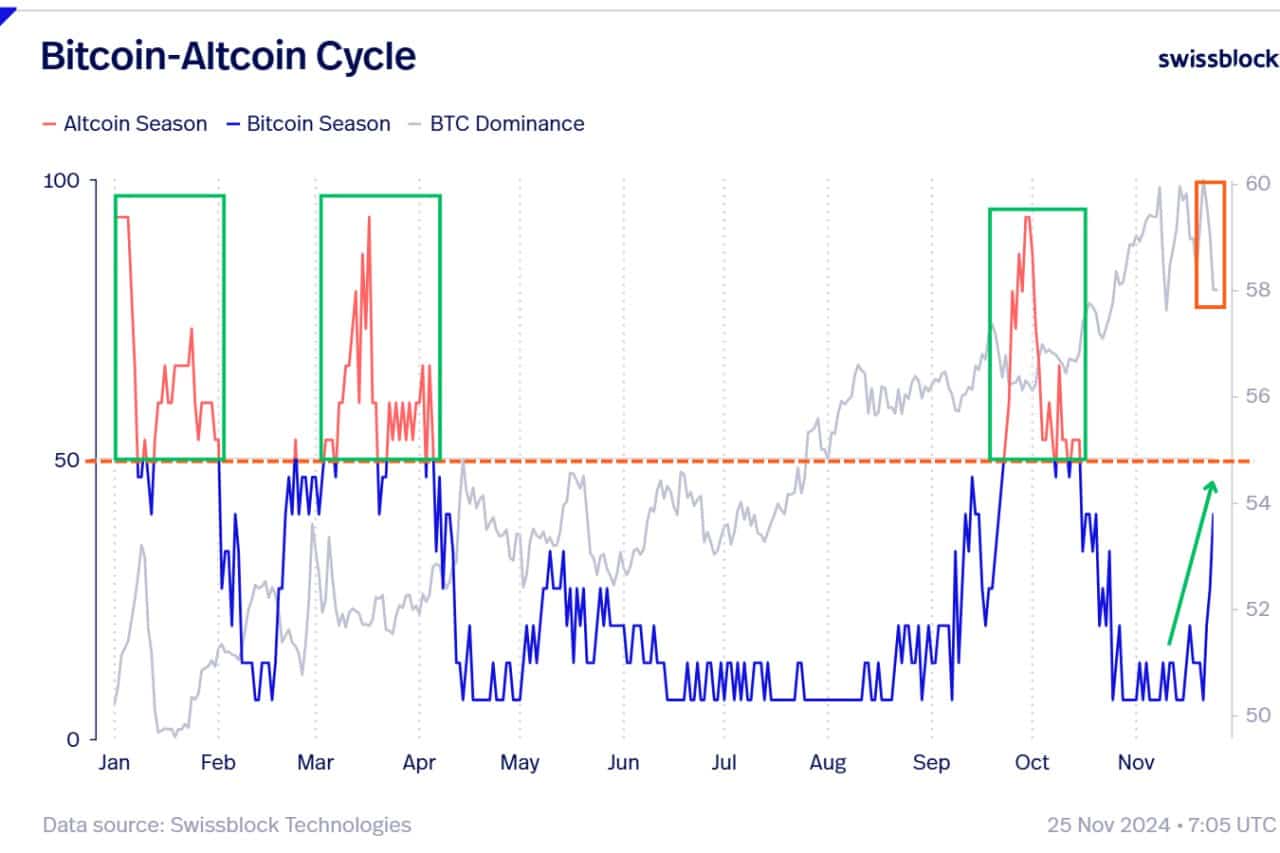

Nicholas Merten from DataDash echoed similar sentiments on YouTube, pointing to the decreasing dominance of Bitcoin (BTC.D) as a sign of an impending altcoin rally.

Merten also noted that the Others index, which tracks the performance of altcoins excluding the top 10 tokens, has been showing strength by reclaiming key levels and staying above the 200-day moving average.

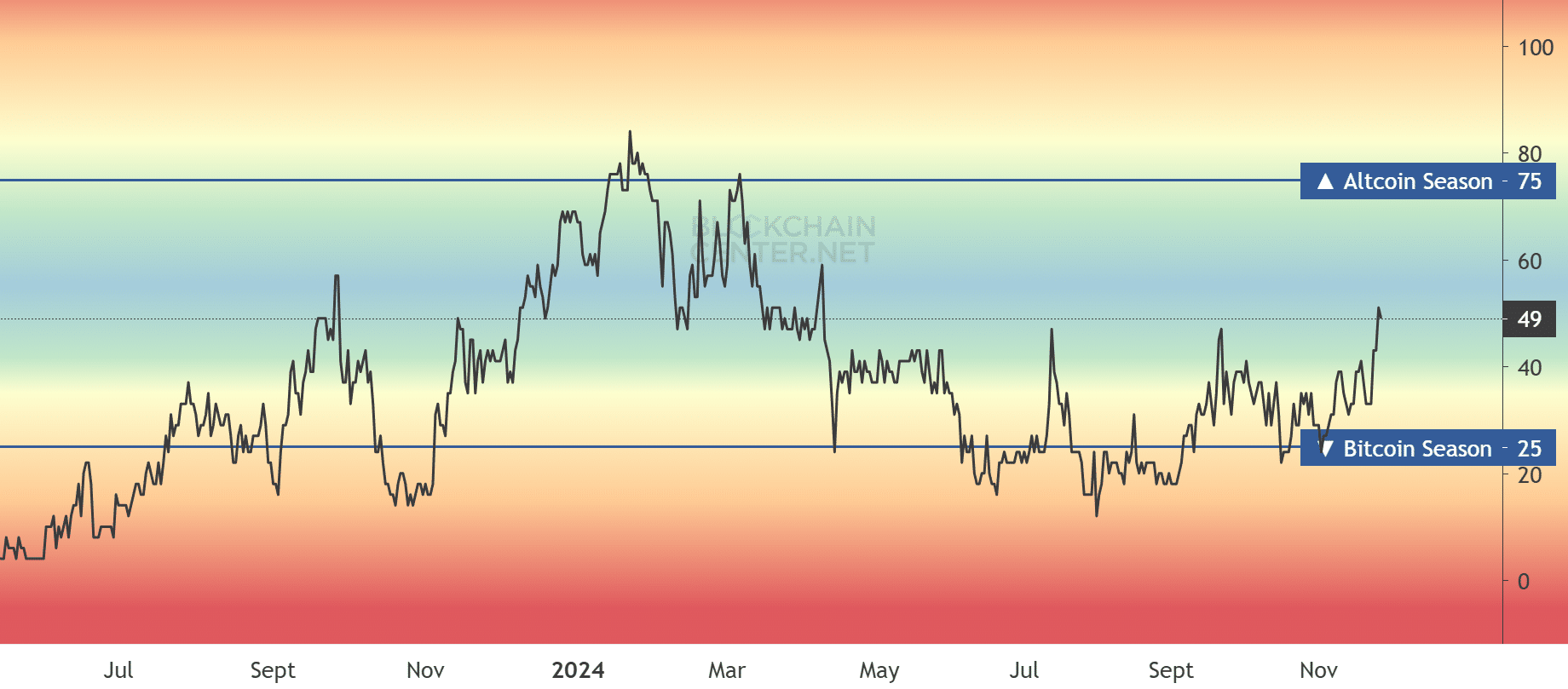

Despite these positive indicators, the Blockchain Center’s Altcoin Season Index suggests that a full-fledged altcoin season has yet to materialize, with only half of the top 50 tokens outperforming BTC in the last three months.

A true altcoin season is typically declared when more than 75% of the top tokens outperform BTC.

Source: Blockchain Center

Recent spikes in altcoin momentum have been observed in July and September, but these rallies were short-lived due to a resurgence in BTC dominance. The key question now is whether the current trend will be sustainable.

On November 25th, Ethereum, L2s, GameFi, and DeFi segments saw double-digit gains as BTC dropped below $95K.

However, Glassnode founders caution that a significant altcoin rally may only occur if BTC surpasses $100K and its dominance decreases. They emphasized the importance of monitoring these key levels for future market movements.

Source: Swissblock Technologies

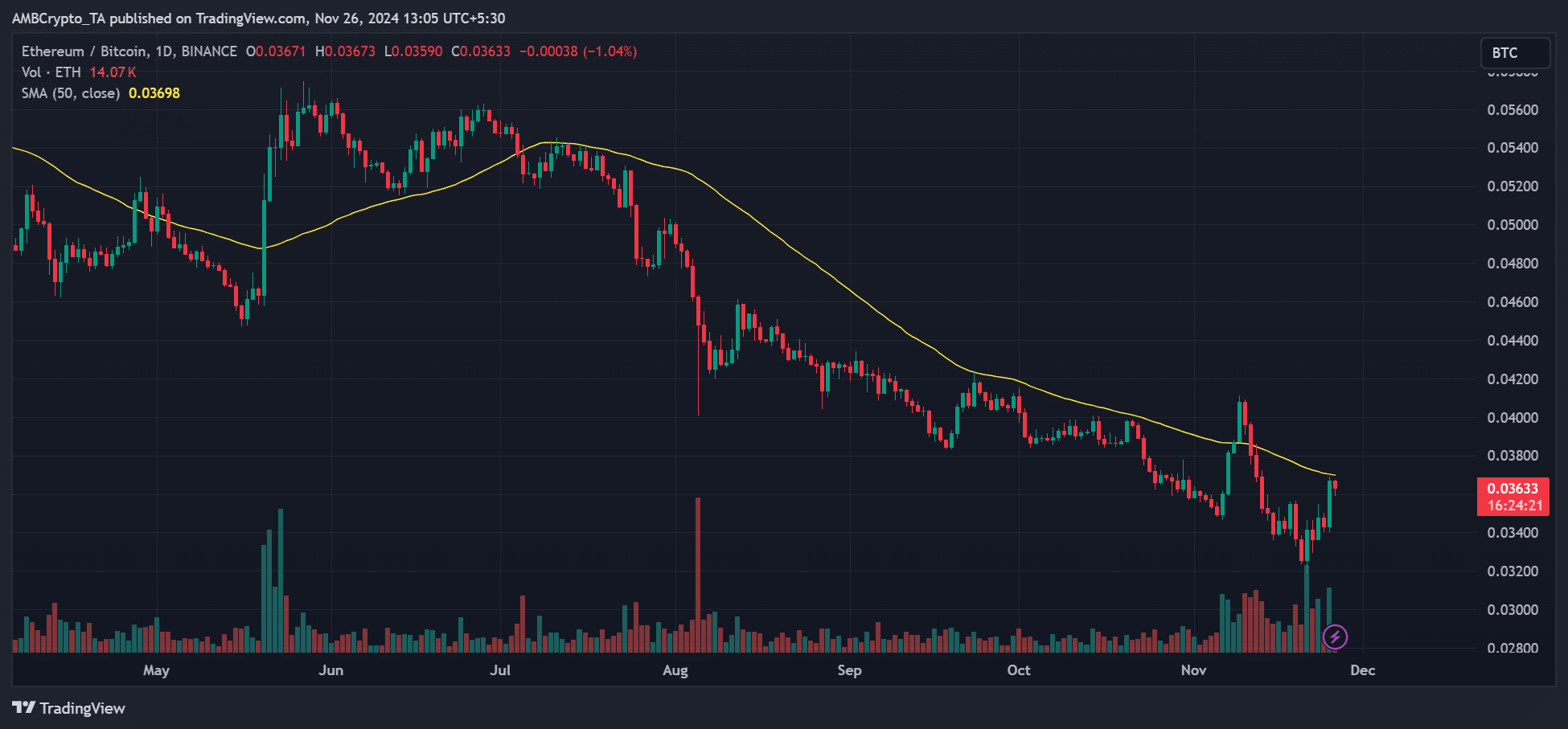

Looking at the ETH/BTC ratio, there is cautious optimism about the future. A strong rally in this ratio would indicate ETH outperforming BTC, which is generally a positive sign for altcoins as a whole.

However, Ostrovskis from Wintermute believes that the ETHBTC trend is not yet strong enough to sustain a full-blown altcoin season. He emphasized the need for sustained strength in this ratio for the trend to continue into the end of the year.

Source: ETH/BTC, TradingView

text in a simpler way:

Rewrite the text to make it easier to understand.