This article is also available in Spanish.

Crypto analyst Ali Martinez has raised concerns that the Bitcoin crash may not be over despite the recent relief rally to $61,000. Martinez emphasized the significance of the $60,365 price level in avoiding a potential crash to as low as $57,000.

Bitcoin Must Hold Above This Price Level to Prevent a Crash

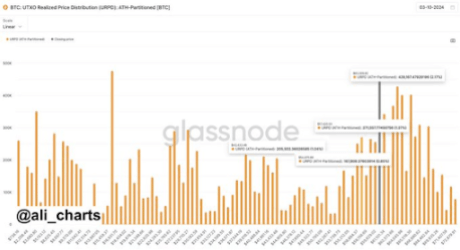

Martinez, in a recent post, pointed out that $60,365 is a critical price level to monitor for Bitcoin. He stated that a break below this level could lead to a drop to $57,420. However, if Bitcoin maintains above this level, Martinez suggested a potential rebound to $63,300. Therefore, Bitcoin’s future direction hinges on the vital support at $60,000.

Related Reading

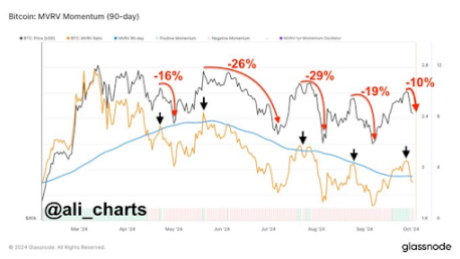

Another analysis by Martinez suggested that Bitcoin could face further downward pressure in the short term rather than a recovery. He noted that every correction of the market value to realized value (MVRV) ratio from its 90-day average since May has resulted in a significant Bitcoin correction.

Martinez also mentioned that the recent rejection has triggered a 10% decline, indicating the possibility of further price drops for Bitcoin. Analyst Justin Bennett echoed similar sentiments, predicting a potential drop to $57,000 and emphasizing the importance of clearing $63,200 in short positions.

Furthermore, the upcoming US jobs report on October 4 could introduce significant volatility, particularly with inflation data. A weak job report might trigger a Bitcoin crash, similar to the events in August, potentially pushing Bitcoin down to $54,000. The inflation data will also provide insights into the likelihood of further rate cuts by the Federal Reserve this year.

Veteran trader Peter Brandt also expressed bearish sentiments towards Bitcoin, highlighting a ‘Three Blind Mice’ pattern that suggests a bearish reversal following the recent uptrend in October.

Why a Price Crash Could Have Benefits

The on-chain analytics platform Santiment suggested that a Bitcoin price crash might be necessary for the cryptocurrency to make significant gains. Santiment noted a decrease in market enthusiasm towards crypto since Bitcoin retraced over 9% from its recent high of $66,400 on September 27.

Related Reading

Santiment suggested that this cooling off period is a positive sign, as markets often move in the opposite direction of crowd expectations. Therefore, Bitcoin could potentially experience an unexpected rally, given the prevailing bearish sentiment among market participants.

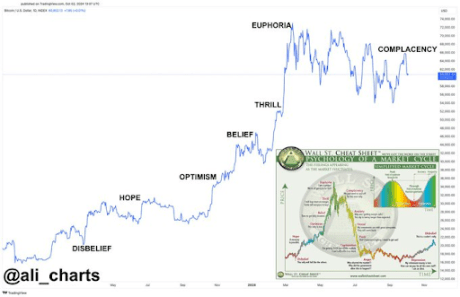

Ali Martinez suggested that Bitcoin is currently in a phase of complacency and may just need a cooling off period before embarking on its next bull run.

Featured image created with Dall.E, chart from Tradingview.com