- DEGEN price action on lower time frames indicates a potential shift in dynamics.

- DEGEN experienced a surge in large on-chain inflows as funding rates stabilized.

DEGEN has seen a 20% decline in the past 7 days but has shown a 6% gain in the last 24 hours, sparking hope among investors.

The asset recently bounced back from a support zone, showing strong buying interest at lower price levels. This recovery has brought DEGEN to a critical point near a known resistance zone.

Analysis suggests that DEGEN is testing a resistance level, and if it breaks through, it could signal a strong uptrend. A clear resistance break at $0.023 indicates the potential for further gains.

The increase in trading volume alongside the price surge is a bullish indicator, supporting the possibility of continued appreciation if momentum above the crucial resistance level is maintained.

Source: Trading View

Market sentiment is optimistic as DEGEN aims for new highs, with targets set above $0.072.

The current setup favors bullish outcomes for DEGEN, as long as it maintains above the key resistance level and turns it into support for future advancements.

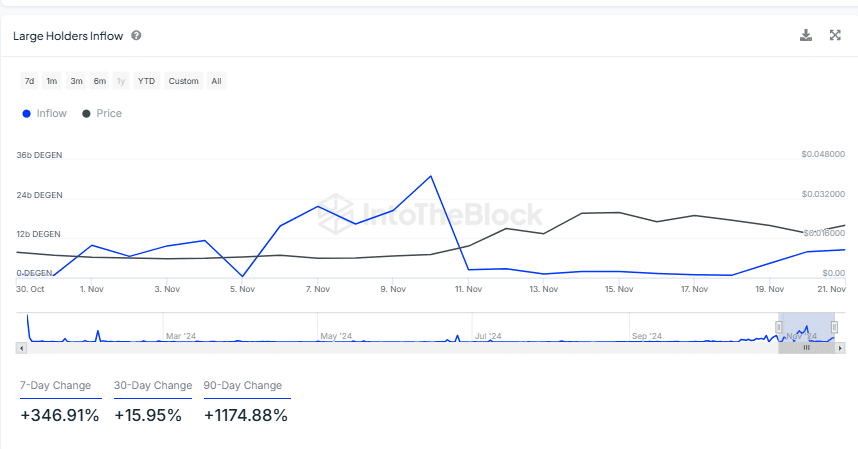

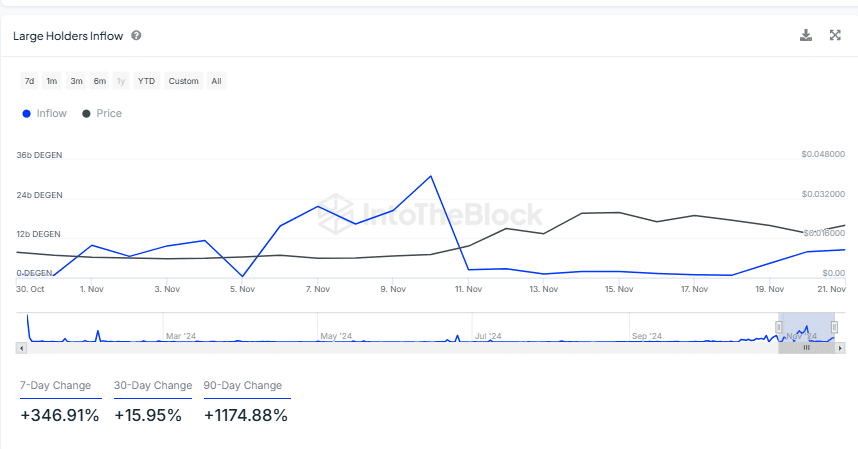

DEGEN’s Large Inflow

DEGEN has seen a significant influx of large holders this month, as shown in on-chain data. In the first half of November, the token’s inflow surged to its peak.

This surge in inflow coincided with a rise in DEGEN’s market price, indicating that large holders were accumulating positions during this period.

The correlation between inflow and price movements suggests the potential for a new all-time high.

Source: IntoTheBlock

Despite continued activity from large holders, the price has gradually declined after the peak, indicating that subsequent investments have not been able to sustain the upward momentum.

This trend emphasizes the impact of significant investments on market dynamics in the crypto space and how they can influence short-term price movements.

The correlation between large holder activities and price changes sheds light on the speculative nature of the DEGEN market during this observed period.

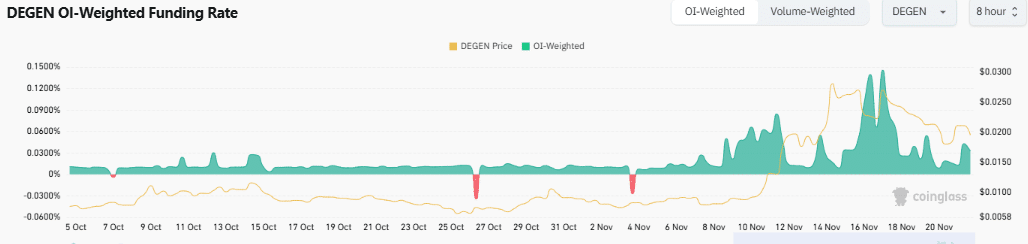

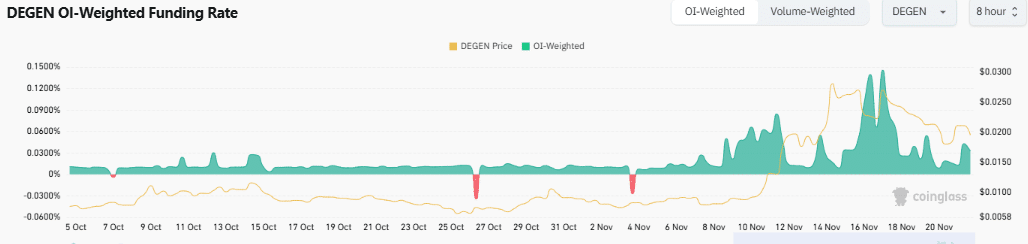

Open Interest and Funding Rates

The correlation between DEGEN’s OI-weighted funding rate and its price movements has been evident, especially from early to mid-November.

During this period, when the funding rate dipped negatively, the price of DEGEN experienced significant spikes, indicating that traders may be positioning themselves in anticipation of price increases.

Source: Coinglass

When the funding rate peaked this month, DEGEN’s price also reached a high of $0.03, increasing the likelihood of a new all-time high.

Is your portfolio in the green? Check out the DEGEN Profit Calculator

This pattern suggests that periods of lower or negative funding rates could be strategic buying opportunities for traders seeking quick gains, indicating bullish sentiments towards DEGEN.

This data offers valuable insights into trader behavior and market sentiment, providing potential strategies for effectively timing market entries and exits.

following sentence:

Original: The cat chased the mouse around the house.

Rewritten: Around the house, the mouse was chased by the cat.