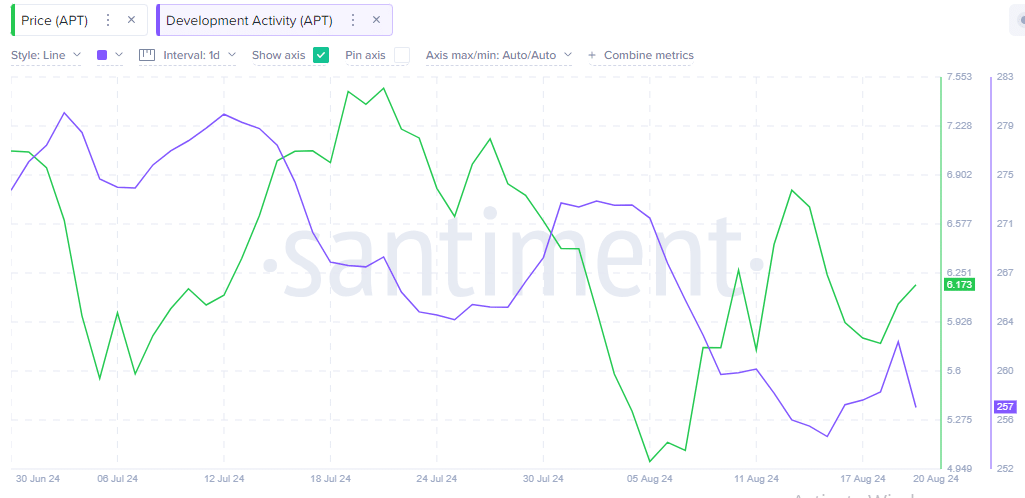

- The development activity surrounding APT has decreased as its price has surged, causing concern in the market.

- Analysis suggests that APT is currently at a critical juncture, awaiting a clear trend to emerge.

Following a notable decline, Aptos [APT] has shown signs of recovery, rising by 5.48% and providing a brief reprieve for market participants.

However, the question remains: Is this upward movement sustainable, or is it just a temporary relief before a potential price decline? AMBCrypto delves deeper into this topic.

The bears are looming

The low level of development activity indicates bearish dominance in the market. When there is a disconnect between an asset’s price and its development activity, it often signals an imbalance that may require correction.

Simply put, this suggests that the price (green line) could soon adjust to match the current level of development activity (blue line), or conversely, development may pick up pace to align with the price movement.

Source: Santiment

However, in this scenario, a price retracement is more likely. A similar divergence on July 16th saw the price initially rise as development activity declined, only for the price to eventually drop, aligning with the reduced development activity.

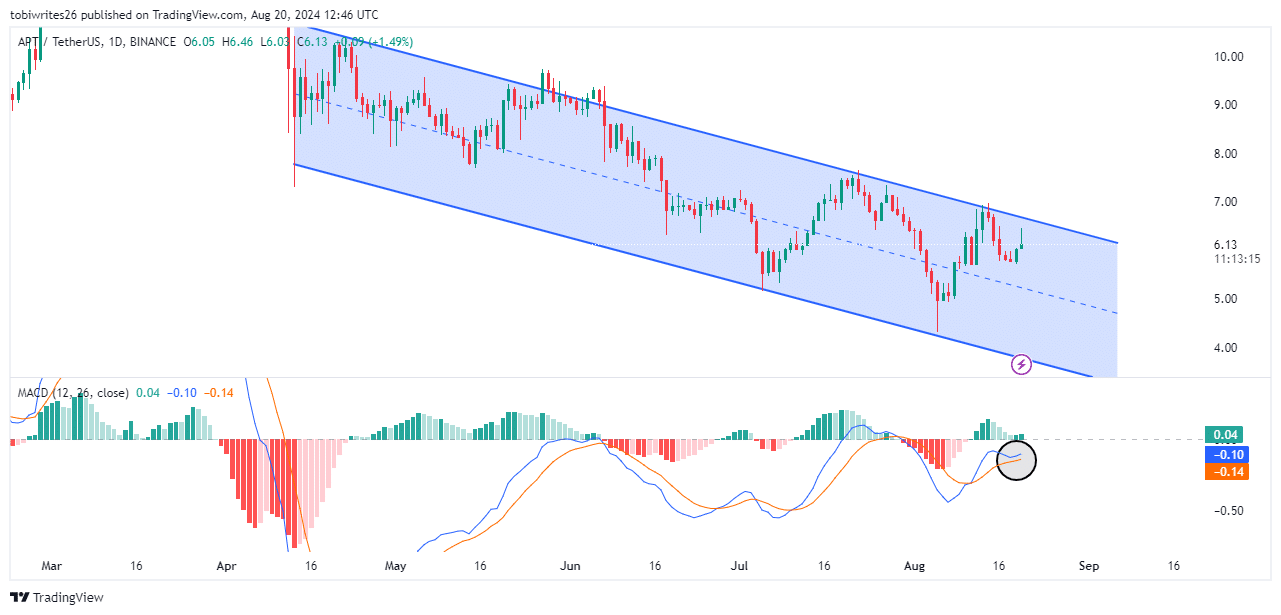

The downward trend intensifies

APT is currently navigating a descending channel that has lasted for a month, presenting conflicting signals on the technical front. Within such a channel, an asset’s price can either break through the upper boundary, signaling an upward breakout, or breach the lower bound, indicating a potential decline.

At present, the upper boundary is acting as resistance; APT has bounced back from this level but has only experienced partial upward momentum, which AMBCrypto’s analysis suggests may not be sustainable.

Source: TradingView

This analysis utilizes the Moving Average Convergence Divergence (MACD), a momentum indicator that shows the relationship between two moving averages of a security’s price.

It generates buy signals when the MACD line (blue) crosses above the signal line (orange) and sell signals when it crosses below.

Currently, the MACD line is in a negative zone with decreasing volume and is on the verge of crossing below the signal line. With APT’s current price at $6.15, further declines are likely.

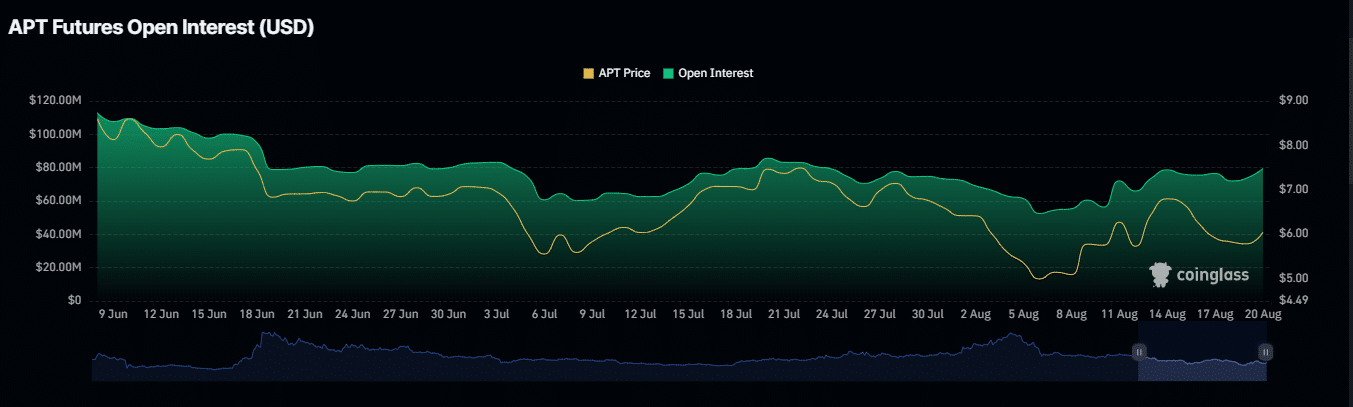

A glimmer of hope: APT remains bullish among retail investors

Open interest, which represents the total number of outstanding derivative contracts like options or futures, has been steadily increasing since August 6, according to Coinglass, indicating high market participation.

As open interest rises, it suggests that new contracts are being opened and existing ones are being closed or fulfilled, signaling a bullish outlook for APT.

Source: Coinglass

Furthermore, the Netflow of APT across exchanges has been negative in both the 24-hour and 7-day timeframes, a typically bullish sign.

Read Aptos’ [APT] Price Prediction 2024-25

This indicates that market participants are opting to store their APT in wallets or offline storage, reflecting confidence in the asset’s growth potential.

In conclusion, despite conflicting signals, it’s crucial to allow the market time to reveal clearer buying or selling indications.

following sentence in a more concise way:

“We need to make sure that all employees attend the training session tomorrow.”

“All employees must attend tomorrow’s training session.”