- Recent research by Galaxy has revealed a significant increase in transactions on Ethereum layer 2s following the Dencun upgrade, potentially due to the involvement of bots.

- Furthermore, the Ethereum mainnet has experienced a noticeable decrease in total revenue and ETH burned.

The Ethereum Dencun upgrade was implemented in March this year, aiming to enhance the scalability and cost-effectiveness of layer 2 solutions. However, it has inadvertently led to some negative consequences.

According to Galaxy’s detailed analysis, the EIP-4844 upgrade significantly reduced costs for Ethereum rollups, resulting in increased usage. This shift in revenue away from the Ethereum mainnet has had repercussions.

Galaxy researcher Christine Kim highlights a decline in revenue and burn rate on the Ethereum network post this upgrade.

Source: X

Data from Ultrasound Money indicates a 0.18% drop in ETH’s burn rate since the Dencun upgrade on March 13.

Are Bots Influencing Transaction Surge?

Ethereum rollups currently have a Total Value Locked (TVL) of $33 billion as per L2Beat data, showing a growth of over 200% in the past year.

In addition, Galaxy’s research highlights a more than doubling of transactions on layer 2s to 6.6 million since the Dencun upgrade. This surge coincides with a significant reduction in transaction costs.

However, the rise in transaction volume has also led to an increase in failure rates, with Base recording the highest at 21%, followed by Arbitrum at 15.4% and Optimism at 10.4%.

The research attributes this failure rate to bot activities, as the low transaction costs have encouraged addresses making over 100 transactions daily, likely indicating bot involvement.

Impact on ETH Price

The decline in revenue and burn rate on Ethereum has hindered ETH price growth, with Ether experiencing a 22% decrease in the last month compared to Bitcoin’s 7.5% drop.

At the time of writing, ETH was trading at $2,668 with a 1.3% increase in 24 hours. The Chaikin Money Flow suggests buying pressure, although the trend is weakening.

While the index remains positive, the CMF line indicates a downward trend, hinting at potential market entry by sellers.

Source: TradingView

Traders should monitor the crucial support level at $2,572, as a failure to hold this support could lead to a potential drop below $2,200.

Additionally, Ether’s upward movement faces resistance at $2,689, a level it has struggled to surpass since August 19.

Is your portfolio in the green? Explore the ETH Profit Calculator

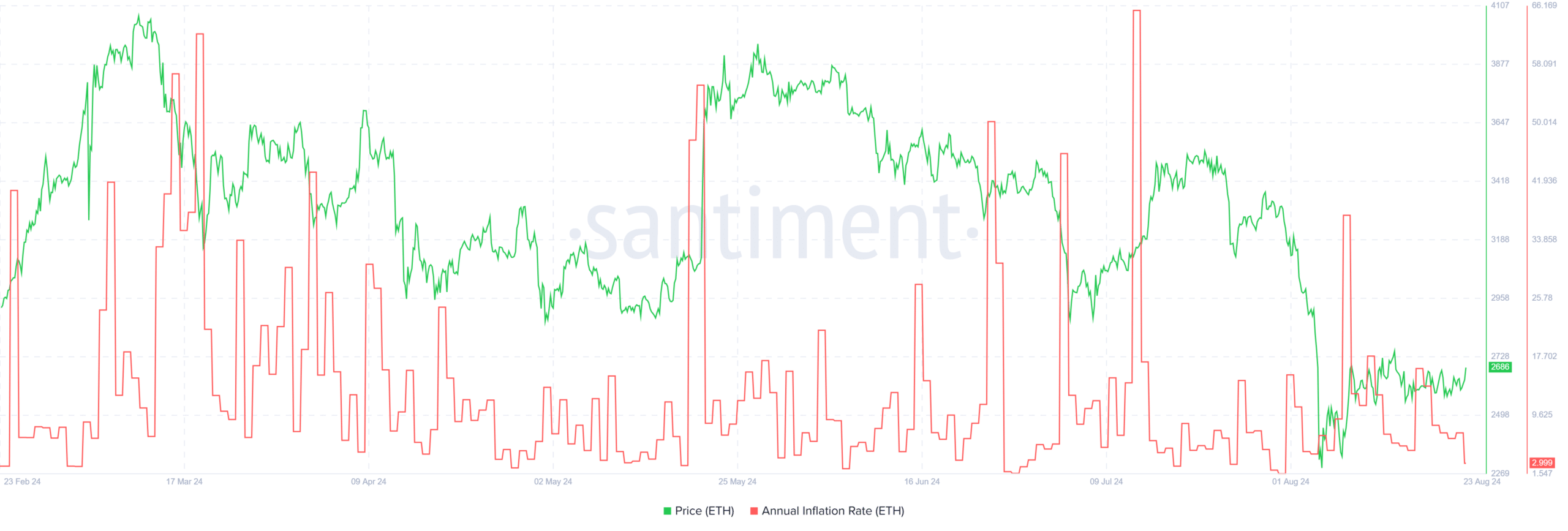

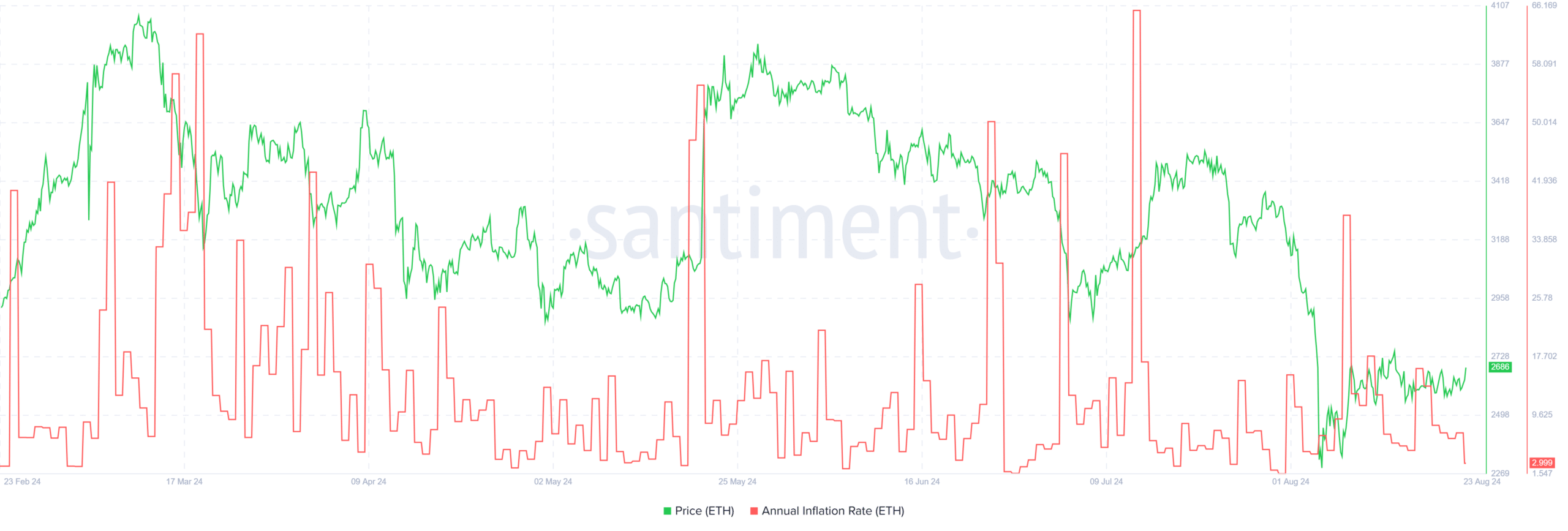

While the implications of increasing supply may be impacting ETH price dynamics, the approaching monthly lows in the annual inflation rate suggest a positive outlook.

Historically, a decrease in this metric tends to boost investor confidence and, consequently, prices.

Source: Santiment

following sentence: The quick brown fox jumps over the lazy dog.

Rewritten sentence: Over the lazy dog jumps the quick brown fox.