The recent Amazon Web Services (AWS) outage that disrupted major crypto and fintech platforms, including Coinbase, Robinhood, MetaMask, and Venmo, has sparked a renewed discussion on the level of decentralization in Web3.

While blockchains continued to function without interruption, numerous users were unable to access wallets, exchanges, and decentralized applications (DApps) due to their reliance on centralized servers for interfaces and APIs.

“Decentralization has been successful at the ledger layer but has yet to fully extend to the infrastructure layer,” stated Jamie Elkaleh, chief marketing officer at Bitget Wallet. “True resilience relies on diversifying beyond hyperscalers to incorporate community-driven and distributed networks.”

Elkaleh emphasized that achieving complete decentralization at scale is currently unfeasible, as many teams depend on hyperscalers like AWS, Google Cloud, and Azure for compliance, speed, and uptime. The focus, he suggested, should be on establishing a “credible multi-home” infrastructure that distributes workloads across both cloud and decentralized networks to mitigate single points of failure.

Cloud providers offer scalability and security but come with the downside of concentration risk, Elkaleh argued. He proposed hybrid systems that combine cloud services with decentralized storage and community-operated nodes as the logical next step.

X user poking fun at so-called decentralized platforms. Source: Kunal Gandhi

Related: Amazon AWS Outage Hits Coinbase Mobile App, Robinhood

Users were locked out of working blockchains

Anthurine Xiang, co-founder of EthStorage and QuarkChain, remarked that the outage highlighted the heavy reliance of many Web3 services on centralized infrastructure.

Xiang explained that achieving true decentralization necessitates a redesign of every layer, from storage to access, to prevent any single provider from disrupting the system. She likened the situation to a functional house with a jammed door, illustrating how users were locked out of operational blockchains.

The outage, which lasted approximately 15 hours starting on Monday, resulted in crashes for Coinbase’s app and Base network, hindering users from accessing their accounts or conducting transactions. Robinhood traders experienced delays and API failures.

MetaMask was also impacted, with users reporting zero balances in their wallets. Xiang clarified that although users’ assets were secure, the service responsible for retrieving balance data had gone offline, indicating a service failure rather than a blockchain issue.

Jawad Ashraf, CEO of Vanar Blockchain, criticized the crypto industry for predominantly relying on the same server providers. He estimated that around 70% of Ethereum nodes are hosted by AWS, Google, or Microsoft, likening the situation to paying multiple landlords instead of just one.

Ashraf acknowledged that building fully decentralized systems is feasible but emphasized that most teams are unlikely to pursue this approach in the near term due to the complexity and slower pace compared to using AWS.

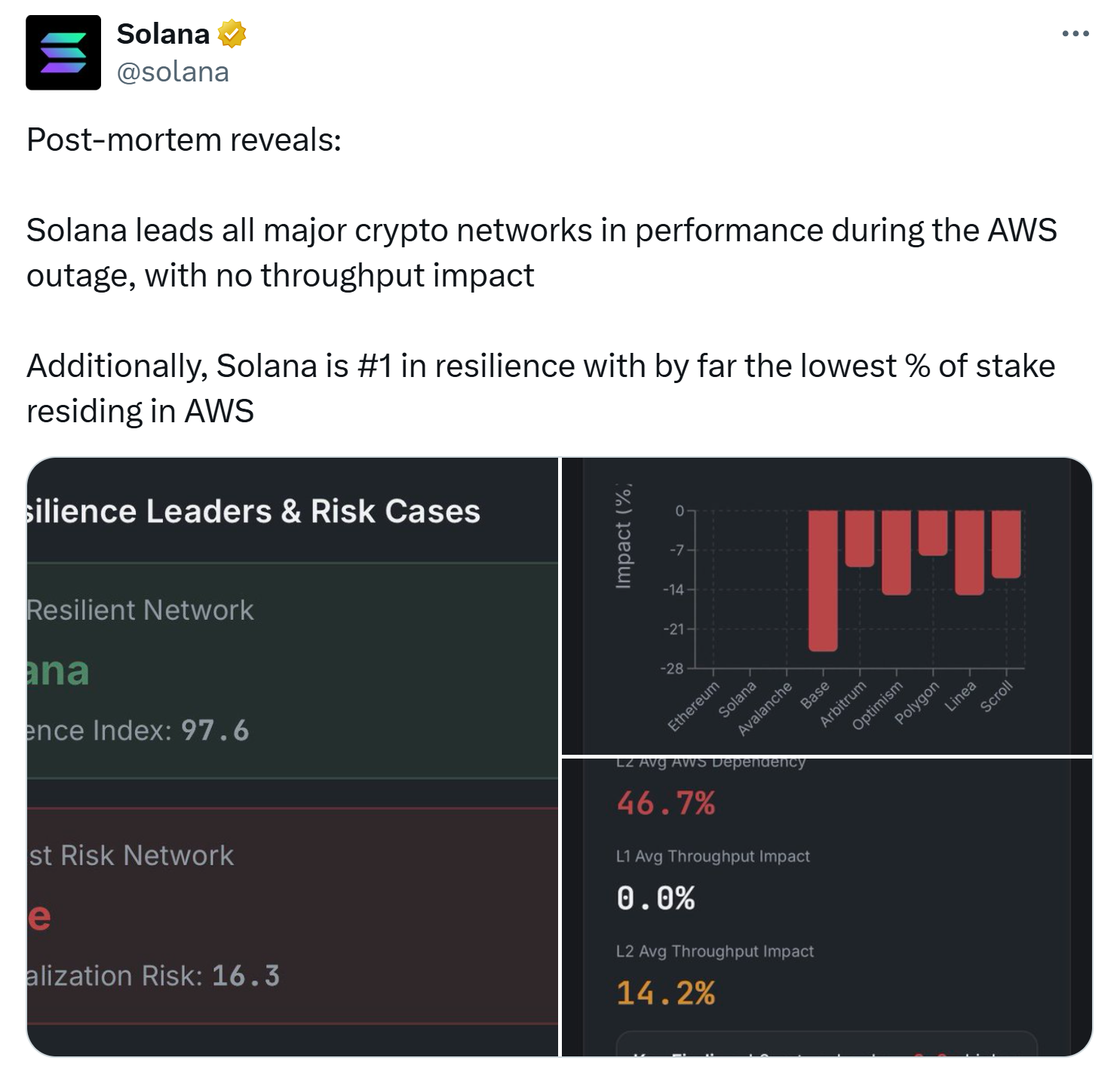

Solana claims no throughput impact from the outage. Source: Solana

A wake-up call

Elkaleh asserted that the outage should prompt increased investment in decentralized cloud, storage, and compute networks such as Akash, Filecoin, and Arweave. He advocated for Web3 developers to adopt hybrid models that blend traditional reliability with distributed redundancy.

“Every significant outage serves as a wake-up call,” Elkaleh stated. “The future of Web3 will not be determined solely by the decentralization of tokens but by the extent of true distribution in the infrastructure.”

Magazine: Back to Ethereum — How Synthetix, Ronin, and Celo saw the light