Base, a layer-two blockchain developed by Coinbase, has experienced a significant increase in Total Value Locked (TVL) within the last 24 hours following a crucial integration.

This surge comes amidst shifting regulatory dynamics in the US, with President Trump’s favorable stance towards crypto inspiring bold moves within the industry.

Base TVL Surges by 20% After Binance.US Support

DefiLlama data reveals that Base TVL has surged by $557 million, rising from $2.778 billion on Thursday to $3.335 billion currently – marking a 20% increase in just one day.

Base TVL. Source: DefiLlama

The spike in TVL indicates a rise in assets staked, locked, or deposited in the Base blockchain. A higher TVL signals increased user engagement, confidence, and adoption, with users committing funds to the platform.

This surge follows a significant announcement from Binance.US, the US branch of Binance, the world’s largest crypto exchange by trading volume metrics.

Binance.US has officially added support for Base, permitting transfers of Ethereum (ETH) and Circle’s USDC stablecoin on the Layer-2 network.

“We’re thrilled to announce that Binance.US now supports Base! From today, you can deposit and withdraw Ethereum (ETH) and USDC via Base,” a statement in the announcement reads.

The exchange has hinted at adding more assets to its Base network, signaling a commitment to the integration. By utilizing Base’s blockchain, users can directly deposit and withdraw ETH and USDC to and from Binance.US.

This integration could enhance accessibility for the exchange, enabling Binance.US users to engage with Base’s ecosystem without the need to bridge assets via Ethereum’s mainnet, which is known for its slow and expensive transactions.

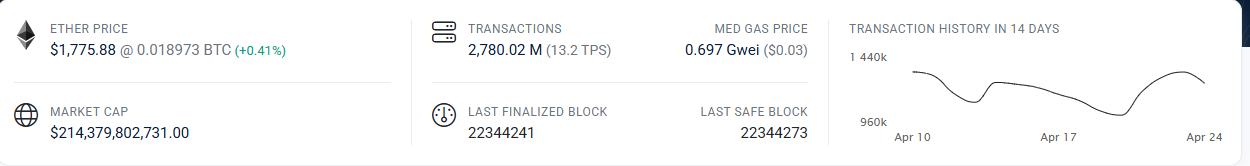

As a Layer-2 scaling solution, Base offers quicker and more cost-effective transactions compared to Ethereum’s mainnet. Data from Etherscan indicates that Ethereum’s transaction throughput is around 13.2 TPS, potentially leading to network congestion and high gas fees during peak times.

Ethereum TPS. Source: Etherscan

Contrarily, Base processes transactions off-chain, bundling them before submitting them to Ethereum, resulting in higher throughput and considerably lower fees, making it more cost-efficient for users.

Therefore, this integration enables Binance.US users to transfer ETH and USDC to Base for DeFi activities at a reduced cost.

This development comes shortly after Binance.US resumed USD deposits and withdrawals via bank transfer after a two-year hiatus.

The exchange had suspended its USD services following a prominent SEC lawsuit and escalating regulatory pressures in 2023. However, in light of the evolving political landscape regarding crypto, exchanges are taking bold strides.

“Now that we’ve weathered the storm, our objective is to promote crypto growth and empower all Americans with the freedom of choice,” stated Binance.US interim CEO Norman Reed recently.

This aligns with a recent move by Kraken exchange, which listed BNB, marking a strategic shift in US crypto exchanges and potentially indicating wider token adoption in the country.