- BTC has experienced a notable price surge of over 3% in the past 24 hours.

- Various indicators and metrics are signaling positive momentum for the cryptocurrency.

Bitcoin [BTC] has shown signs of recovery by surpassing the $60k mark after a prolonged period. While this uptrend is promising, recent analysis suggests the possibility of BTC reaching new all-time highs by 2024. Let’s delve into BTC’s metrics to assess the likelihood of this scenario.

Bitcoin’s Journey to New Peaks

According to CoinMarketCap’s data, BTC’s price surged by more than 3% in the last 24 hours, pushing it above $60k once again. At the time of writing, BTC was trading at $60,172 with a market cap exceeding $1.17 trillion.

This price surge resulted in over 83% of BTC investors being in a profitable position.

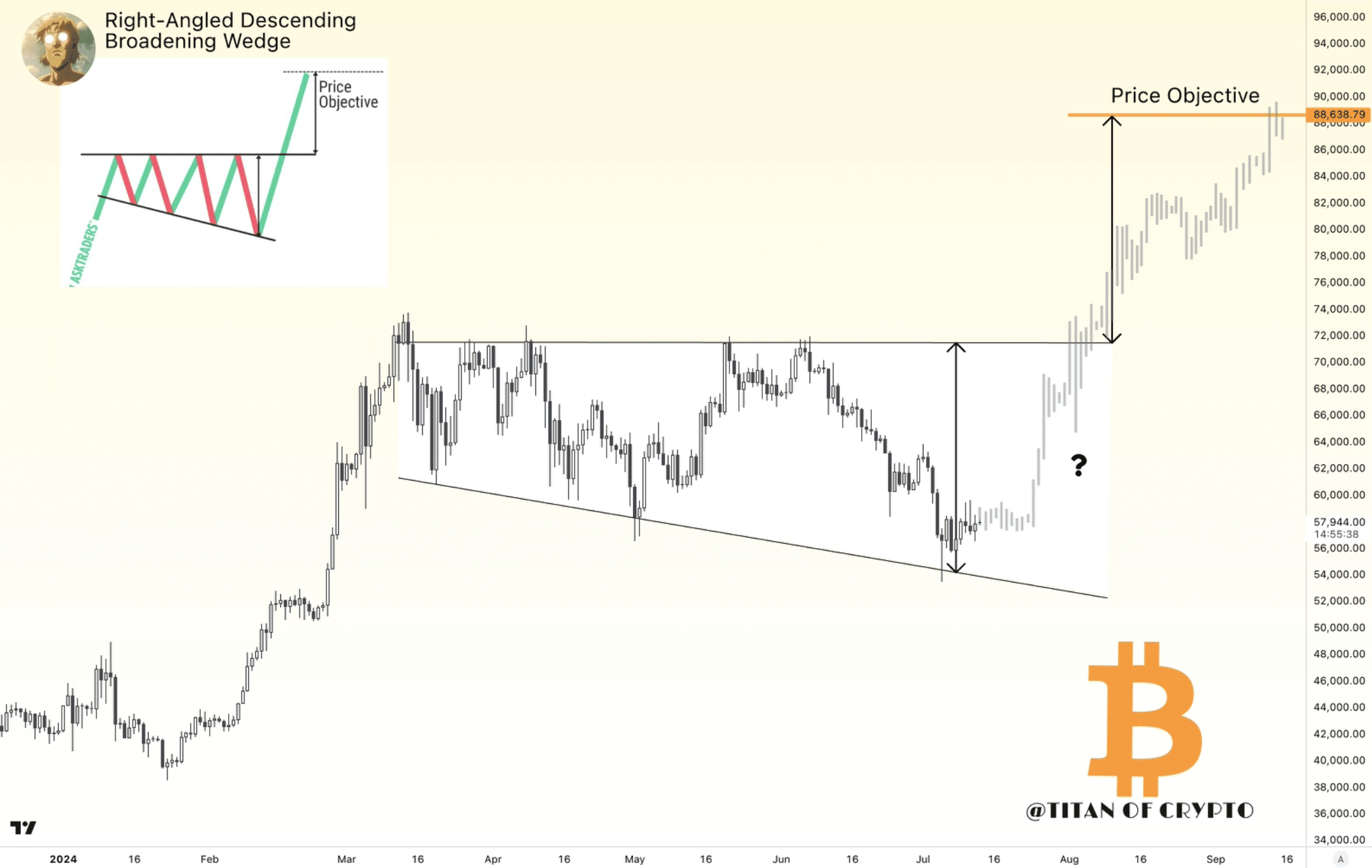

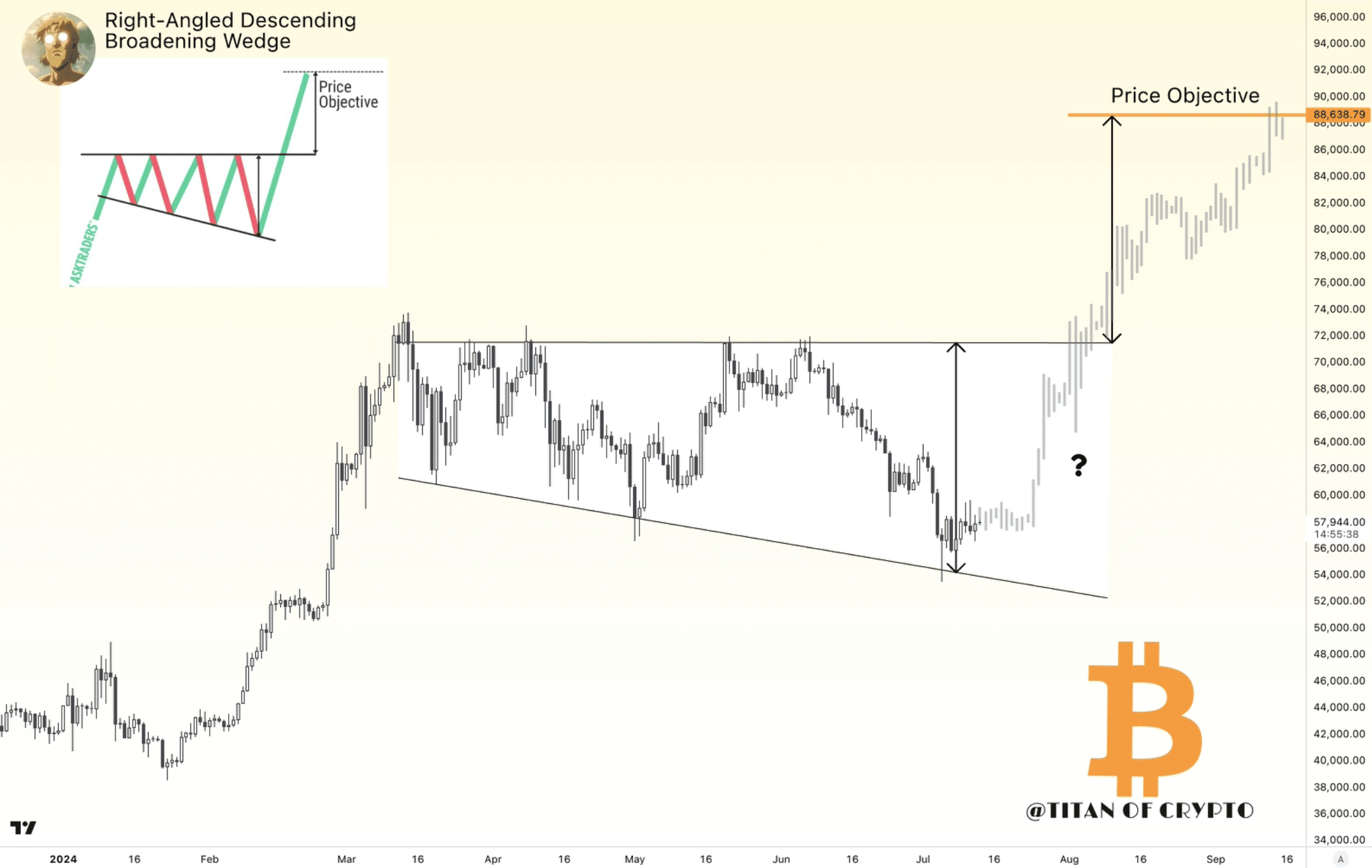

The outlook seems optimistic for the upcoming days as popular crypto analyst, Titan of Cryptos, highlighted an intriguing pattern on BTC’s chart known as a right-angled descending broadening wedge. If BTC follows this pattern, the recent price uptick could be just the beginning of a significant rally. In fact, projections indicate that BTC might reach $88k by September, potentially ensuring all investors are in profit.

Source: X

Is Bitcoin Poised for a Bull Run?

With indications pointing towards a potential bull rally, AMBCrypto decided to delve into BTC’s metrics for further insights.

Our analysis of CryptoQuant’s data revealed that BTC’s net deposits on exchanges were below the seven-day average, signaling heightened buying pressure on the cryptocurrency.

The binary CDD indicator showed a green signal, indicating that long-term holders were holding onto their coins rather than selling them.

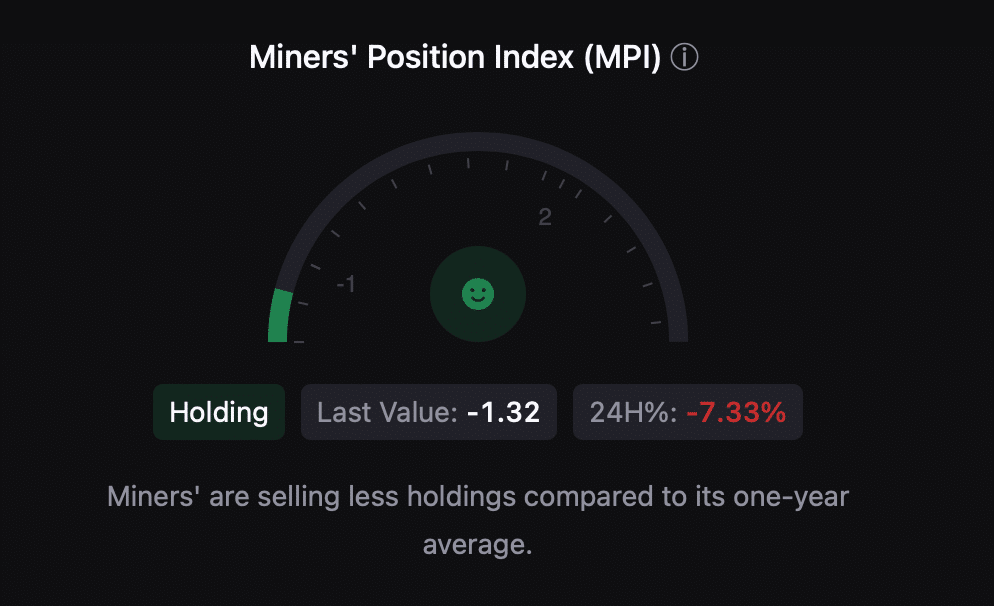

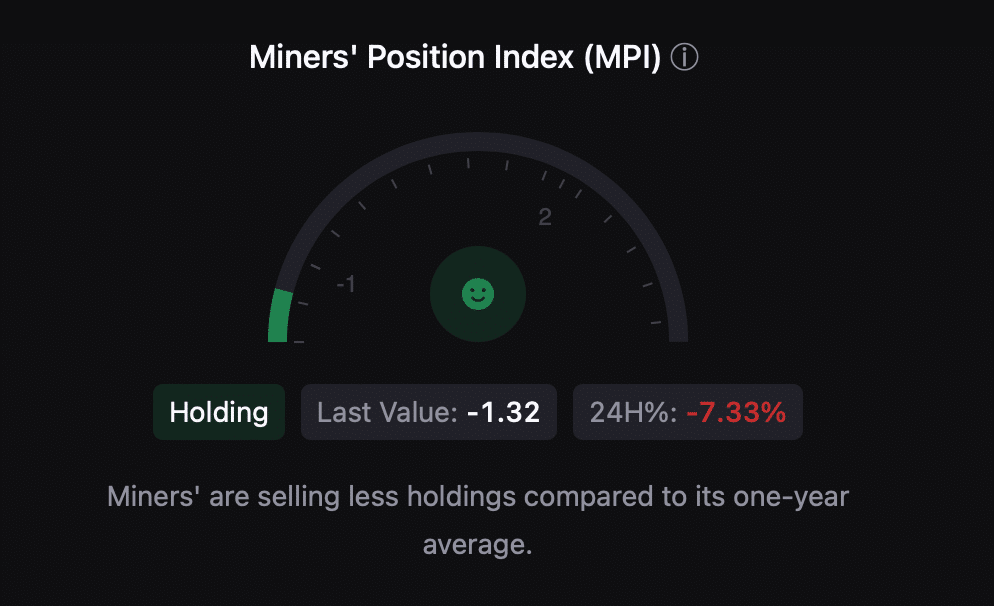

Moreover, miners displayed confidence in BTC as reflected by the green Miners’ Position Index (MPI), suggesting reduced selling of holdings compared to the one-year average.

Source: CryptoQuant

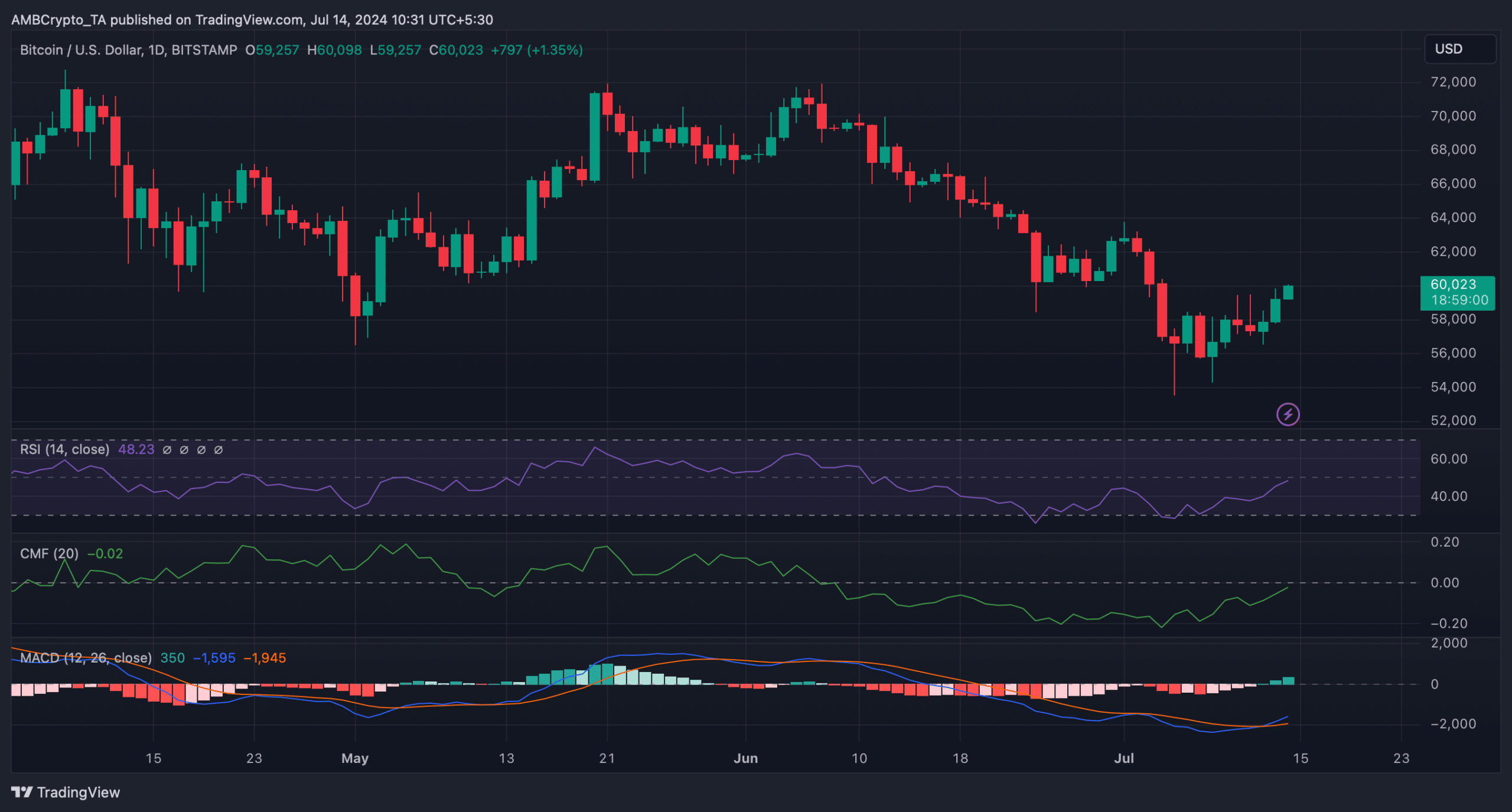

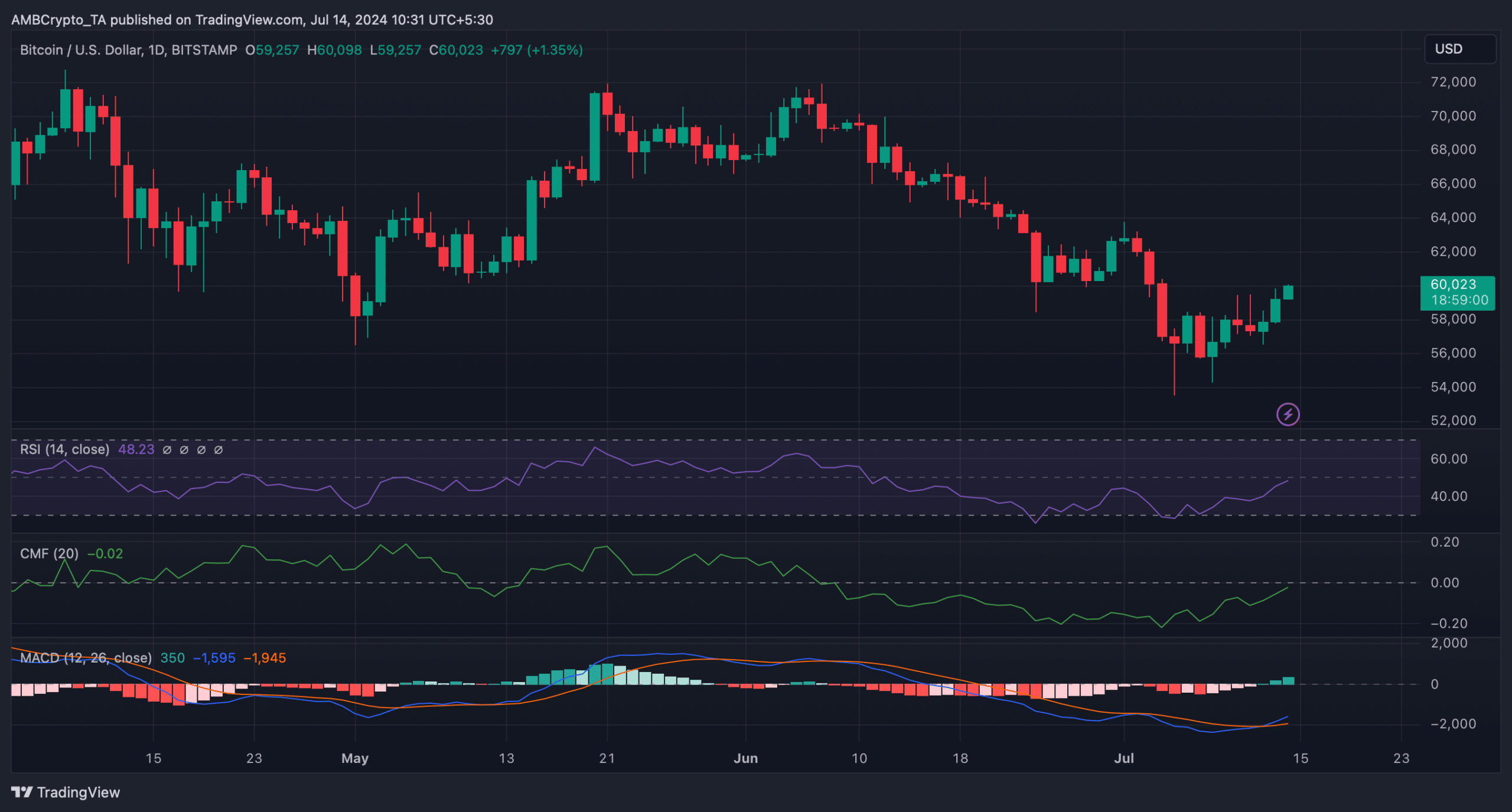

A closer look at the daily chart revealed that most market indicators were favoring the bulls, suggesting a potential continuation of the price uptrend.

Read Bitcoin’s [BTC] Price Prediction 2024-2025

Key metrics such as the MACD, RSI, and CMF all indicated bullish signals, hinting at a possible increase in BTC’s value and the likelihood of reaching new highs by September.

Source: TradingView

following sentence:

The cat sat lazily in the sun, grooming itself with long, slow licks.

The cat lounged in the warmth of the sun, leisurely grooming itself with deliberate strokes of its tongue.