Goldilocks it wasn’t… as surprise inflation data and disappointing growth data caused a stir in the macroeconomic landscape (we love the smell of stagflation in the morning)…

Source: Bloomberg

Despite this, stocks continued their upward trajectory for the fifth consecutive week, with Small Caps making a significant leap today (rebounding into positive territory for the week)…

…as “most shorted” stocks experienced a significant rally today…

Source: Bloomberg

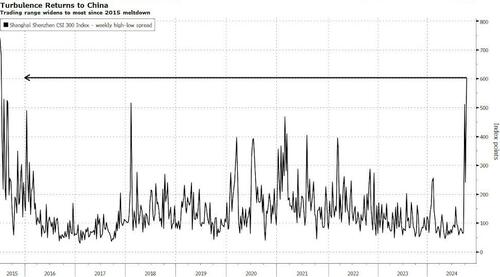

Meanwhile, the turmoil in Shanghai dominated headlines as Chinese markets experienced their highest level of volatility since the 2015 meltdown, resulting in nearly $500 billion in combined losses across mainland and Hong Kong markets, prompting calls for additional stimulus beyond what Beijing has already promised.

The CSI 300 Index’s weekly trading range – the difference between high and low prices – reached over 600 index points this week for the first time since July 2015.

Source: Bloomberg

During the previous crisis, foreign investors fled Chinese markets due to growing economic worries and a government crackdown on traders, exacerbating the panic.

Source: Bloomberg

This time, the market turbulence is driven by weak consumer demand, which poses a threat to the country’s scaled-down growth targets. The index’s 10-day and 20-day realized volatility also reached a nine-year high.

Interestingly, the uptick in surprise macro data coincides with the loosest financial conditions since November 2021…

Source: Bloomberg

Today marked the 45th all-time high of the year, but unlike previous highs, this one coincided with elevated volatility; this week is the first of the year where the VIX closed above 20 every day, suggesting continued high risk as October progresses…

Source: Bloomberg

The volatility term structure is showing an upward slope leading into the upcoming election (and the coinciding FOMC meeting)…

Source: Bloomberg

Treasury yields displayed mixed movements today, with short-term yields significantly outperforming on the week while the long end experienced a notable increase…

Source: Bloomberg

Following a significant flattening last week, the yield curve experienced its most notable steepening since the beginning of August this week, with 2s10s briefly inverting at the start of the week and then steepening to erase the post-payrolls dip by week’s end…

Source: Bloomberg

Expectations for rate cuts saw a modest increase this week (with focus shifting to 2025 as 2024 is now priced for less than 2 full rate cuts)…

Source: Bloomberg

The dollar saw a second consecutive week of gains, testing August’s highs before slowing down today…

Source: Bloomberg

Despite the dollar’s strength, Gold continued its rebound from yesterday, ending the week higher and finding support at $2600 once again…

Source: Bloomberg

Oil remained stable today, holding onto gains for the week (with WTI back above $75)…

Source: Bloomberg

Bitcoin surged back today (rising from $59,000 to $63,000), ending the week with solid gains after testing near one-month lows…

Source: Bloomberg

Could this be the beginning of a Bitcoin rally fueled by increasing liquidity…

Source: Bloomberg

Lastly, this weekend marks the two-year anniversary of the bear market lows. The S&P has risen 66% from the lows in October 2021, thanks to the continuous injection of liquidity by global central banks…]

HOWEVER… liquidity has started to contract in the last week or two (even as stocks reached new record highs)…

Will central banks ramp up their money-printing efforts… or will stocks face a downturn leading up to the election (where Trump is currently favored in prediction markets but not in polls)?

Source: Bloomberg

There’s no bears left…

Source: Bloomberg

…well maybe some…

Loading…