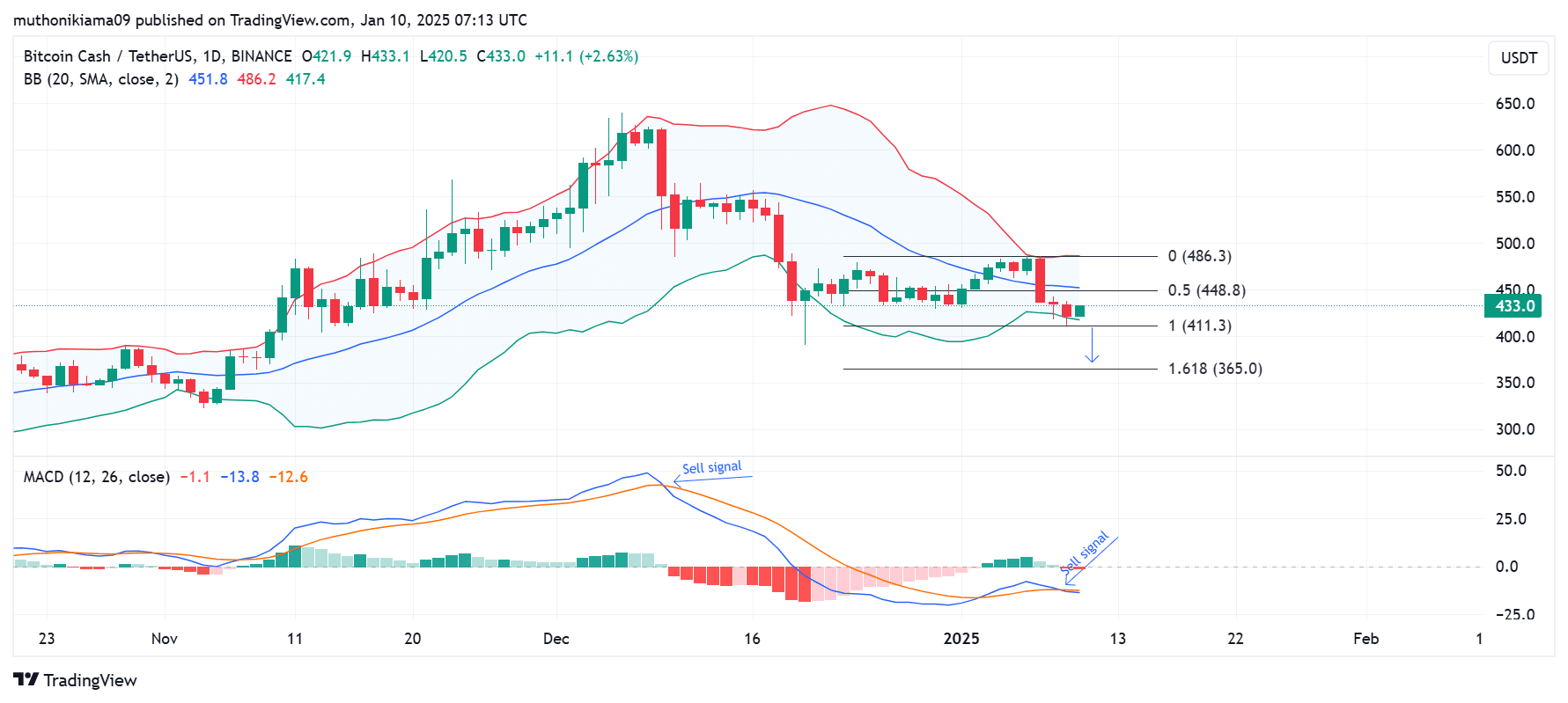

- Bitcoin Cash has recently formed a sell signal on its MACD indicator, suggesting a potential price decline to $365.

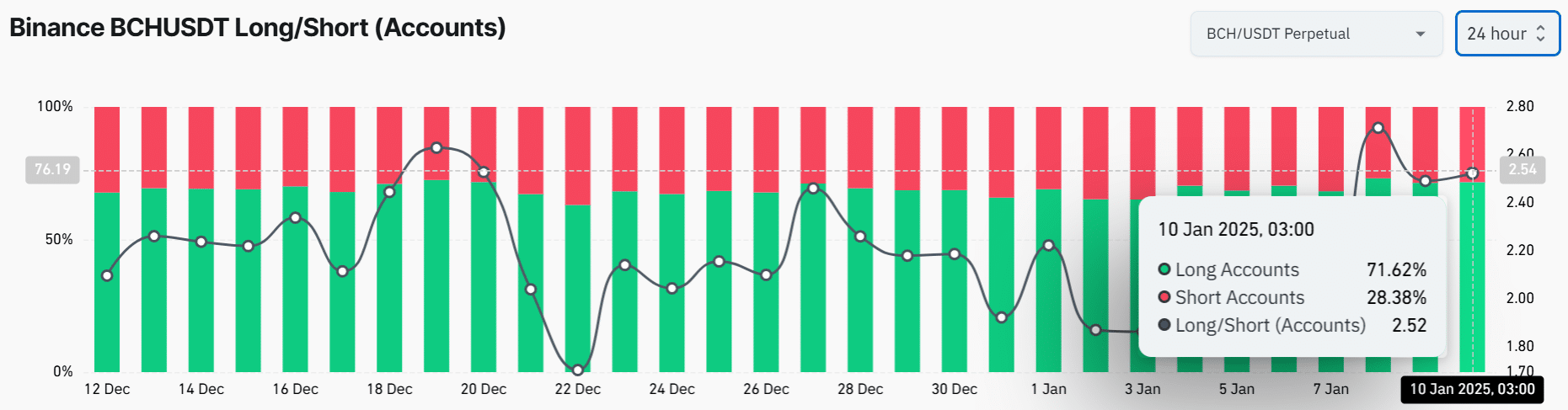

- Despite the bearish trends, traders on Binance remain optimistic about further price increases.

Bitcoin Cash (BCH) saw a slight gain of 0.1% to reach $430 at the time of writing. However, the altcoin has experienced a 6.5% decline over the past seven days, reflecting a bearish sentiment in the broader cryptocurrency market.

The Moving Average Convergence Divergence (MACD) indicator indicates that bears are currently controlling BCH’s price action. The negative histogram bars and MACD line suggest a bearish momentum.

A sell signal has been triggered by the crossover of the MACD line below the signal line, historically leading to a significant decline in BCH’s price.

Source: TradingView

A strong support level for Bitcoin Cash is located at the lower Bollinger band at $417. A breach of this support could lead to a decline to the 1.618 Fibonacci level at $365.

Key resistance level to watch

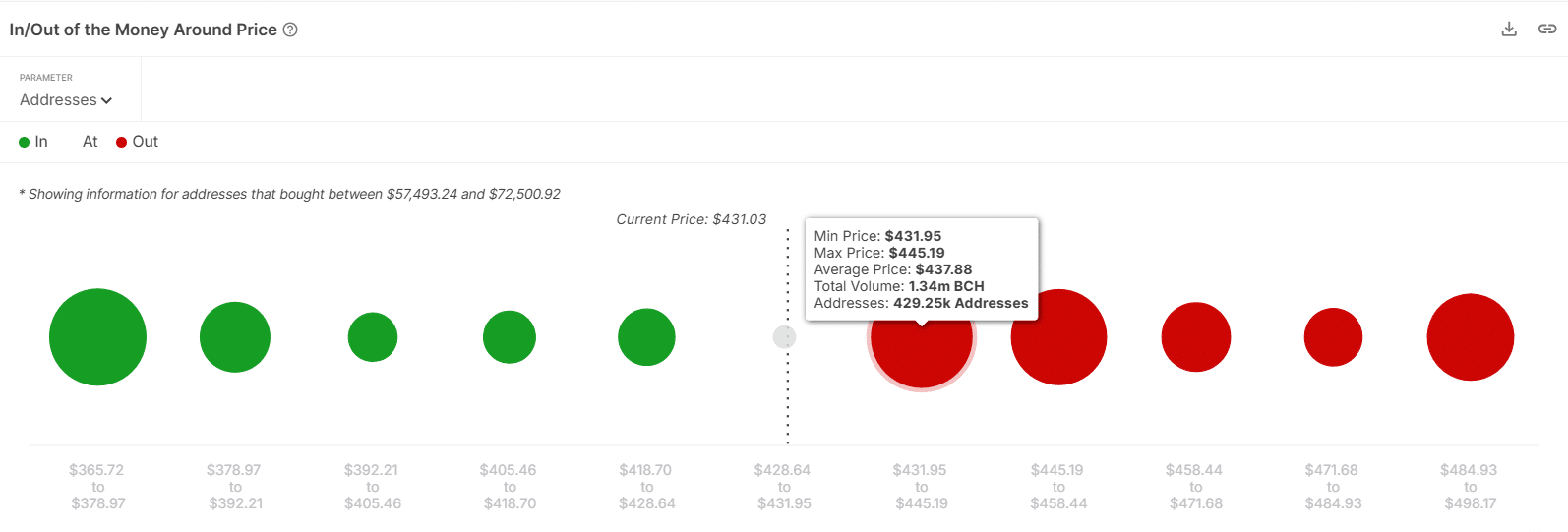

The In/Out of the Money Around Price (IOMAP) indicator highlights a crucial resistance level for BCH between $432 and $445, where over 429,000 addresses purchased the token. If these holders decide to sell, it could create additional selling pressure.

Source: IntoTheBlock

Due to the significant losses at this supply zone, buyers may hesitate to enter the market, potentially stalling any upward momentum.

Traders increase bullish bets

Despite the negative one-day chart outlook, traders on Binance are increasingly bullish on Bitcoin Cash, with 71% taking long positions and 28% short positions.

Source: Coinglass

The high number of traders with long positions suggests optimism about potential gains. However, these positions could face liquidation in the event of a price drop, adding to selling pressure.

A decrease in funding rates to 0.0076% per Coinglass has contributed to the demand for long positions, indicating that traders are paying less to maintain their positions.

Read Bitcoin Cash’s [BCH] Price Prediction 2024–2025

The one-day chart for Bitcoin Cash continues to show bearish trends, with a MACD sell signal potentially driving further downward pressure on the price.

The Long/Short Ratio’s bullish bias reflects positive market sentiment, but forced long liquidations resulting from a drop could lead to increased selling activity.

information provided so that it is more concise and easier to understand.

Rewrite: Make the information more concise and easier to understand.