- Bitcoin whales have been steadily accumulating for six weeks.

- BTC has been hovering around the $60,000 price mark.

Bitcoin [BTC] has seen a strong performance in the past 48 hours, successfully breaking through the crucial $60,000 price barrier at the time of writing.

This milestone, which has been a significant psychological hurdle, witnessed BTC fluctuating around it as the market responded to the renewed bullish momentum.

As Bitcoin faces challenges in maintaining its position above $60,000, some whale addresses have taken advantage of the opportunity to accumulate more BTC.

Accumulation Trend by Whales

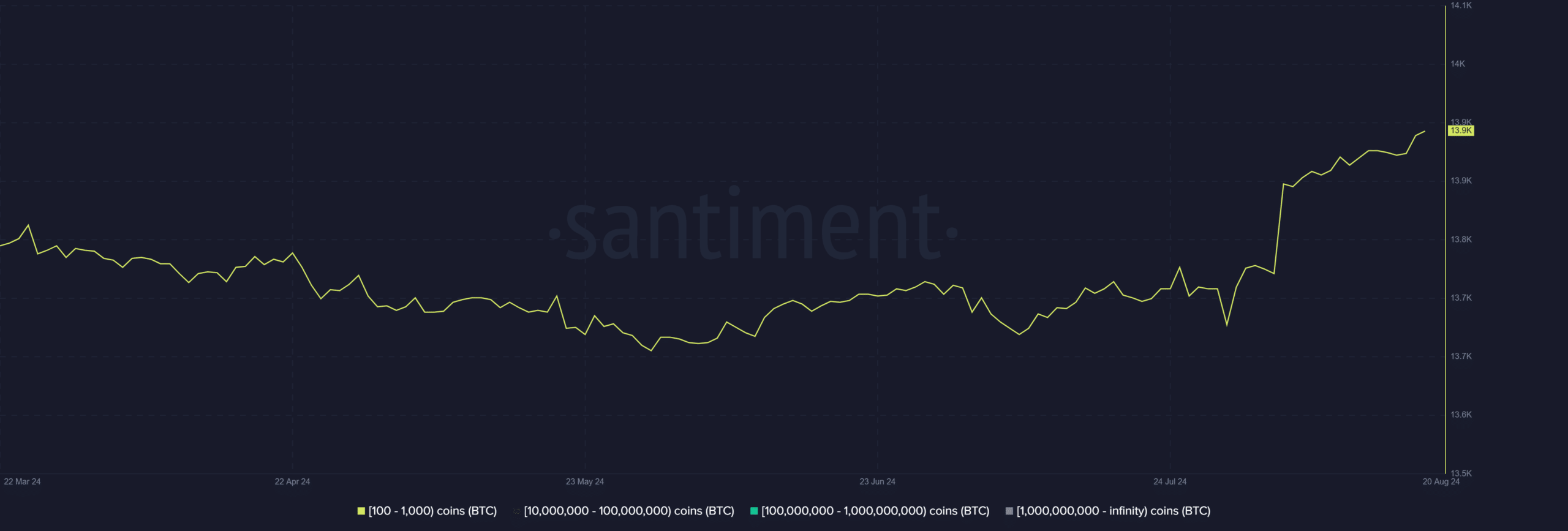

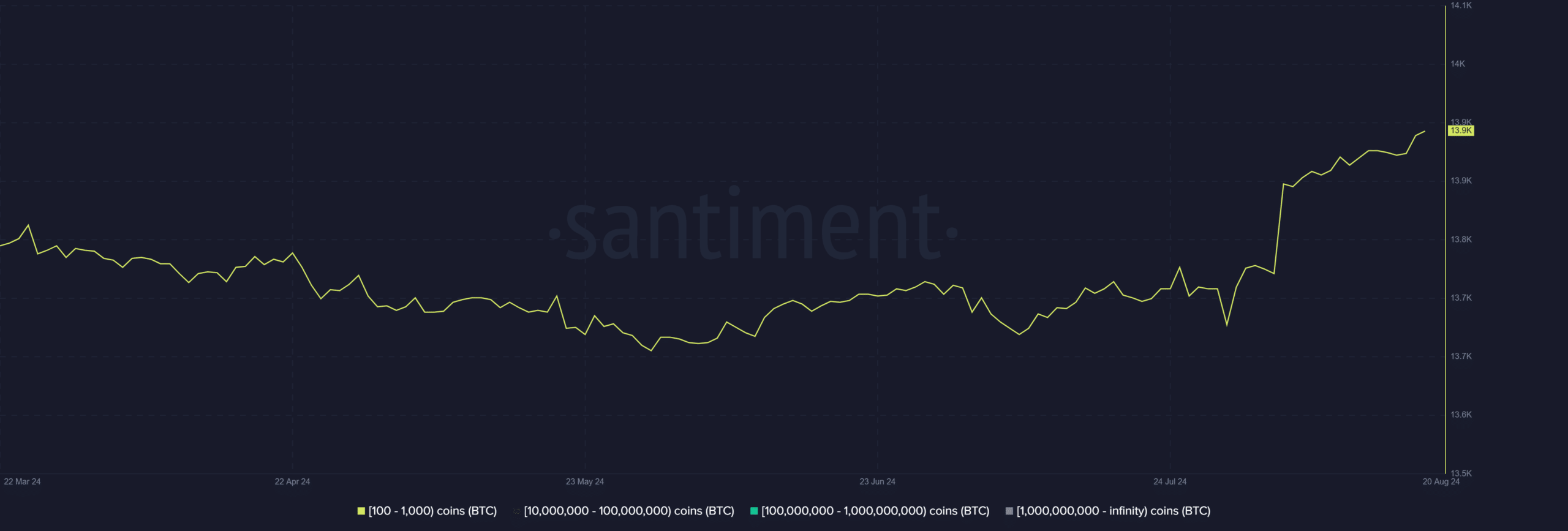

An analysis of Bitcoin whale addresses, specifically those holding between 100 and 1,000 BTC, has revealed a notable uptick in accumulation.

Previously, there was a slight decrease in the number of these addresses, indicating that some holders might have been selling or redistributing their BTC holdings during that period.

However, the trend has reversed, with a clear rise in the number of addresses holding 100-1,000 BTC.

This suggests that mid-sized holders, often seen as influential in the market, have resumed their accumulation of Bitcoin.

Over the past six weeks, these addresses have collectively accumulated around 94,700 more BTC, representing a 2.44% increase in their holdings.

Source: Santiment

The increase in BTC held by these addresses could offer underlying support for Bitcoin’s price, especially as it strives to maintain and build upon the recent breakthrough of the $60,000 level.

Implications of Accumulations

The recent surge in accumulation by mid-sized whale addresses holding 100-1,000 BTC indicates a growing confidence in Bitcoin’s price outlook.

These holders are likely anticipating further gains and are strategically positioning themselves by accumulating more BTC.

If the accumulation trend continues, it could lead to diminished selling pressure in the market. These mid-sized holders, having increased their positions, are expected to hold onto their BTC rather than sell in the short term.

This holding behavior could have a stabilizing effect on Bitcoin’s price, particularly if demand remains steady or increases.

While the current trend suggests accumulation is predominant, a significant price upsurge could eventually result in profit-taking.

Mid-sized whales, who have accumulated at lower levels, might decide to capitalize on higher prices, introducing some selling pressure into the market.

However, this is likely to occur post the accumulation phase, with the current sentiment favoring holding rather than immediate selling.

Bitcoin Shows Recovery

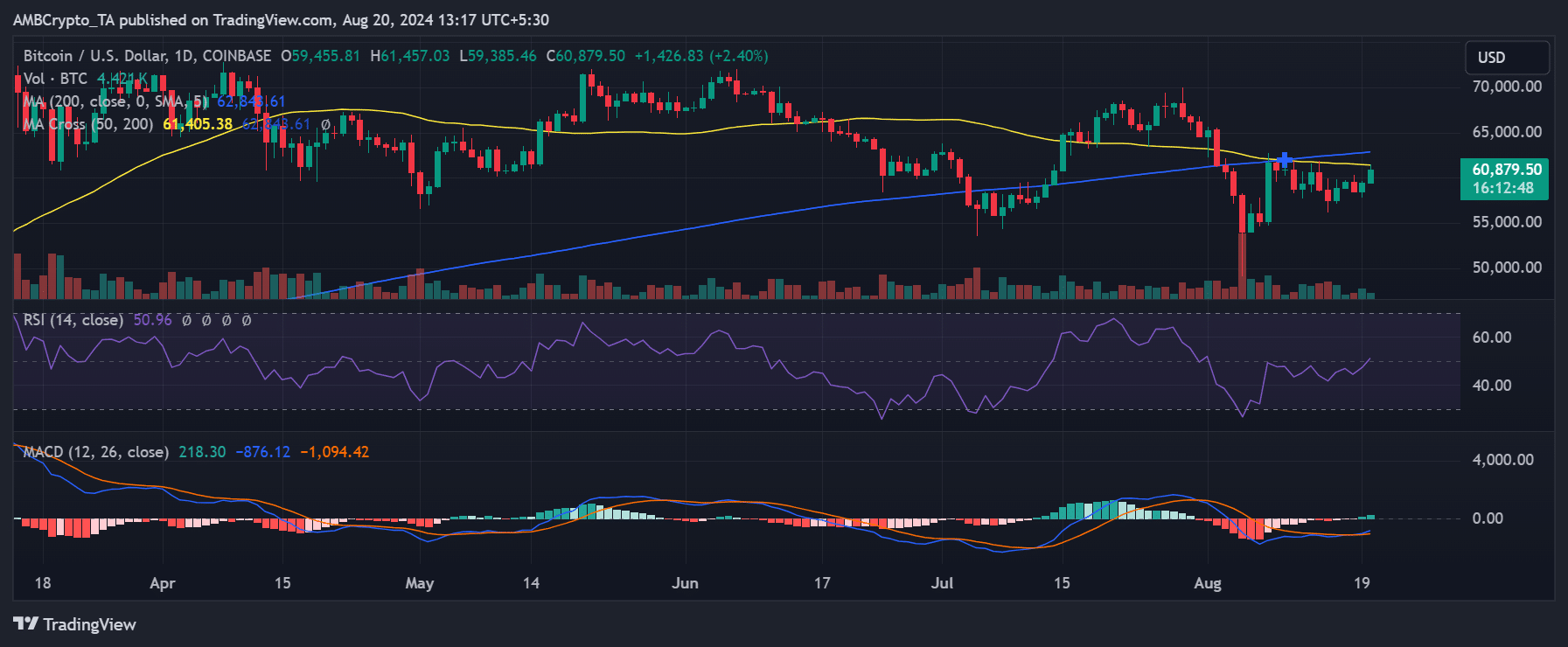

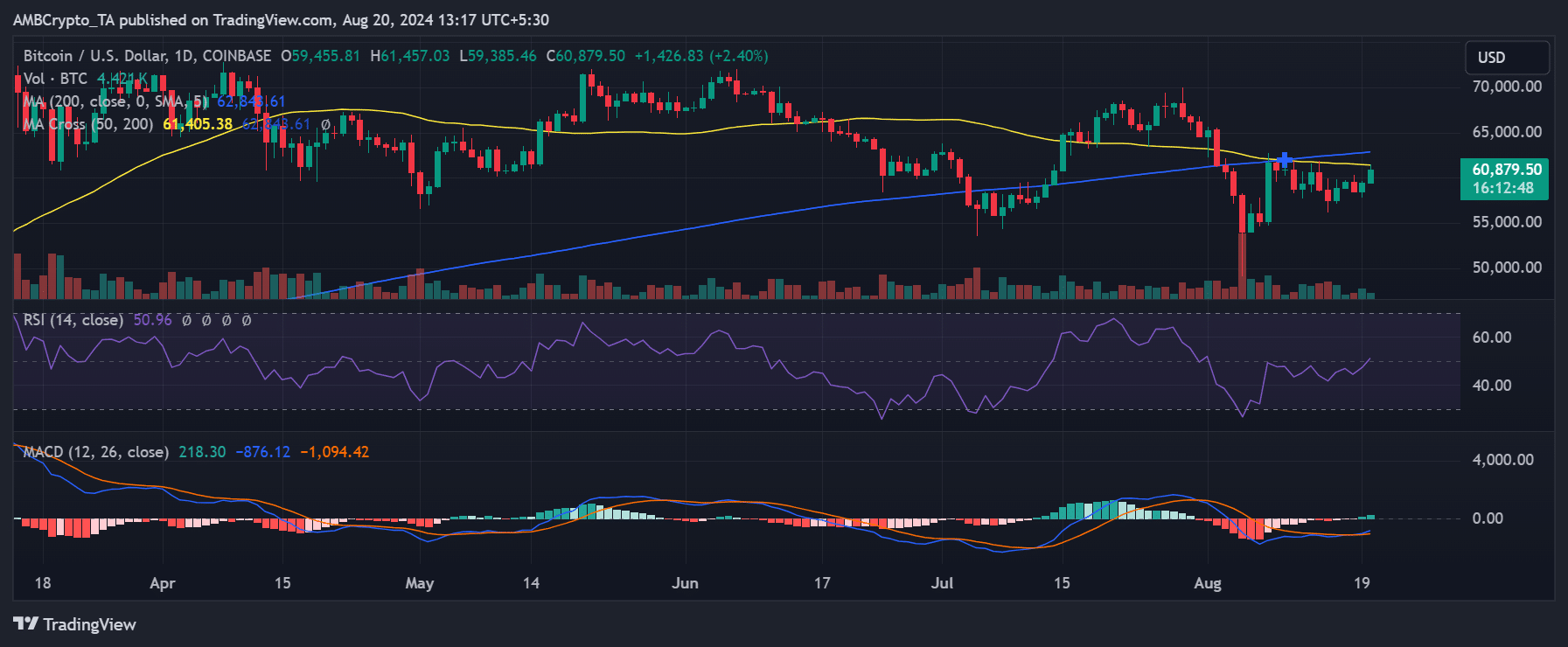

Bitcoin has witnessed positive price movements in the last 24 hours, reflecting a growing market momentum.

Based on AMBCrypto’s analysis, Bitcoin saw a 1.74% increase in the previous trading session, bringing its price to around $59,400.

At present, Bitcoin has continued its upward trend, reaching approximately $60,800 after an additional 2% increase.

Source: TradingView

This recent price action has pushed Bitcoin’s Relative Strength Index (RSI) slightly above the neutral line, indicating a shift towards a more bullish sentiment.

The RSI crossing above the neutral level suggests that buying pressure is starting to outweigh selling pressure, potentially leading to further price appreciation if the trend continues.

Despite the positive price movement, mid-sized whale addresses holding 100-1,000 BTC have not shown significant reactions to this trend yet.

Read Bitcoin’s [BTC] Price Prediction 2024-25

These addresses might still be in an observation phase, monitoring how the market evolves before making any major decisions.

Their ongoing accumulation or potential selling in response to further price increases will be critical aspects to monitor in the days ahead.

sentence: Please rewrite the following sentence for me.

Could you rewrite this sentence, please?