- Bitcoin Dominance exhibited bearish divergence as the market pivots towards alternative assets.

- Does this indicate a shift of investor interest away from BTC?

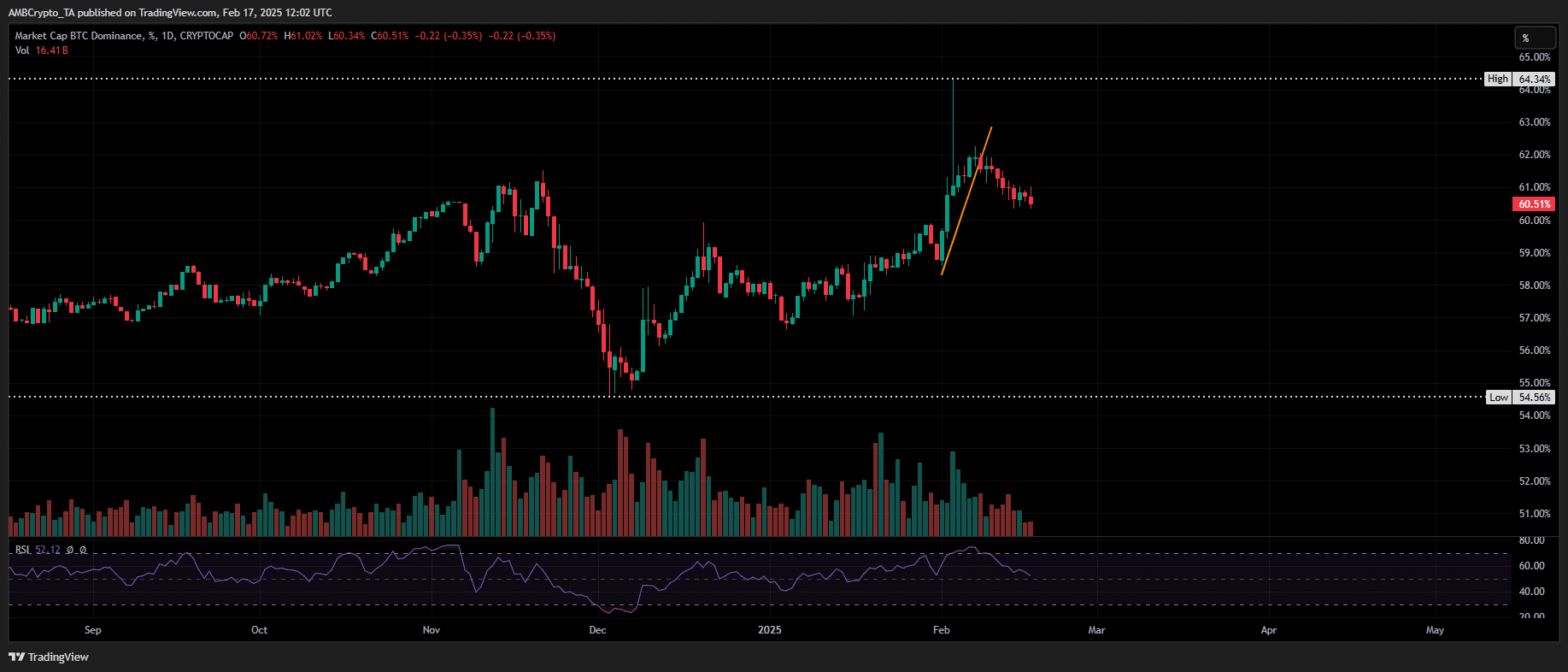

Bitcoin [BTC] Dominance (BTC.D) displayed a bearish divergence, implying a weakening market share relative to the overall crypto market cap.

Nevertheless, the Relative Strength Index (RSI) has not yet issued a sell signal, suggesting that the momentum has not completely turned bearish at this point.

Is Bitcoin gearing up for a retreat, or is this just a temporary cooling-off phase?

A pivotal week ahead for Bitcoin

BTC.D surged by 5% in early February following a market-wide upheaval triggered by Trump’s tariff stance, erasing over $420 billion in crypto market cap.

Source: TradingView (BTC.D)

Amidst the panic, Bitcoin remained resilient while altcoins faltered, with many high-cap altcoins hitting new lows against BTC.

Historically, Bitcoin’s consolidation often triggers rallies in altcoins. In Q2 of last year, when BTC fluctuated between $60K and $70K, Ethereum [ETH] saw a significant surge, posting a 19% daily gain with its longest green candlestick.

With high-cap altcoins already showing weekly gains, this pattern might repeat. Bitcoin futures traders need to remain cautious. Sentiment is bullish, with more long positions accumulating.

However, with a bearish divergence present, there is a risk of billions being liquidated in the upcoming days, potentially leading to a long squeeze.

Is this turmoil just a temporary cooldown?

This month, Bitcoin has shed over $1 trillion in market cap, dropping from a peak of $2.10 trillion at the end of January.

With sentiment veering towards fear, a rebound for BTC seems distant.

If its dominance continues to slide, we may witness the fear index plummet into ‘extreme’ levels, paving the way for potential panic selling. This is a crucial development to monitor in the days ahead.

Source: CoinMarketCap

However, there is a slight uptick in the index, with momentum now neutral. The RSI has not completely turned bearish yet, leaving room for a potential reversal.

Altcoins are experiencing a 5% correction in daily price action, indicating that the recent surge might be merely a cooldown phase rather than the beginning of a full-fledged altcoin season.

To prevent the RSI from hitting a low, closely monitoring the futures market is crucial, as it could pose the biggest threat to Bitcoin’s dominance.