Authored by Martin Young via CoinTelegraph.com,

Experts have noted that a significant Bitcoin correction in the first month following a halving event is a common occurrence, drawing comparisons from past cycles.

“Bitcoin historically undergoes a dip in January in post-halving years,” noted crypto analyst Axel Bitblaze to his 123,000 followers on Jan. 12.

“The aftermath of the dumps in 2017 and 2021 is well-documented.”

Bitcoin has seen a 10% decline this month, dropping from its peak of $102,300 on Jan. 7 to just under $92,000 before experiencing a slight recovery to stabilize around $94,000.

In January 2021, following the most recent halving, Bitcoin plummeted over 25% from above $40,000 to slightly over $30,000 by the month’s end. It then surged by 130% to reach a new all-time high of $69,000 by November.

Similarly, in January 2017, after the 2016 halving, Bitcoin saw a 30% drop from $1,130 to $784. It then skyrocketed by 2,400% that year, hitting an all-time high of $20,000 by December.

Bitcoin post-halving year January slumps. Source: Axel Bitblaze

Furthermore, Crypto Rover, a YouTuber and analyst, pointed out that Bitcoin has consistently seen a decline in the first half of January over the past year.

“This current dip is minor compared to previous patterns,” he remarked.

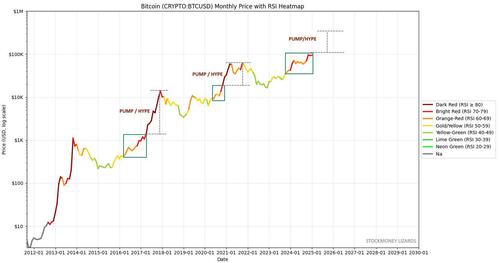

“Bitcoin has yet to reach its peak hype/pump phase,” stated the finance analysis account Stockmoney Lizards X on Jan. 12. “The cycle ahead holds more potential over the next 12 months.”

Bitcoin monthly chart with RSI color coding. Source: Stockmoney Lizards

The analyst acknowledged that each cycle has its unique features but added, “With increasing adoption, supportive pro-crypto governments worldwide, and the introduction of ETFs, our predictions are reinforced.”

A 130% surge similar to previous peak cycles could potentially drive BTC prices above $200,000 by the end of 2025.

Conversely, a retracement akin to the January declines in the past two cycles could push prices below $70,000.

Loading…