Bitcoin experienced a significant sell-off on October 9, dropping to $102,000 before recovering most of its losses. On-chain data now indicates a noticeable decrease in Bitcoin network activity throughout 2025.

Is Bitcoin’s On-Chain Activity Weakening?

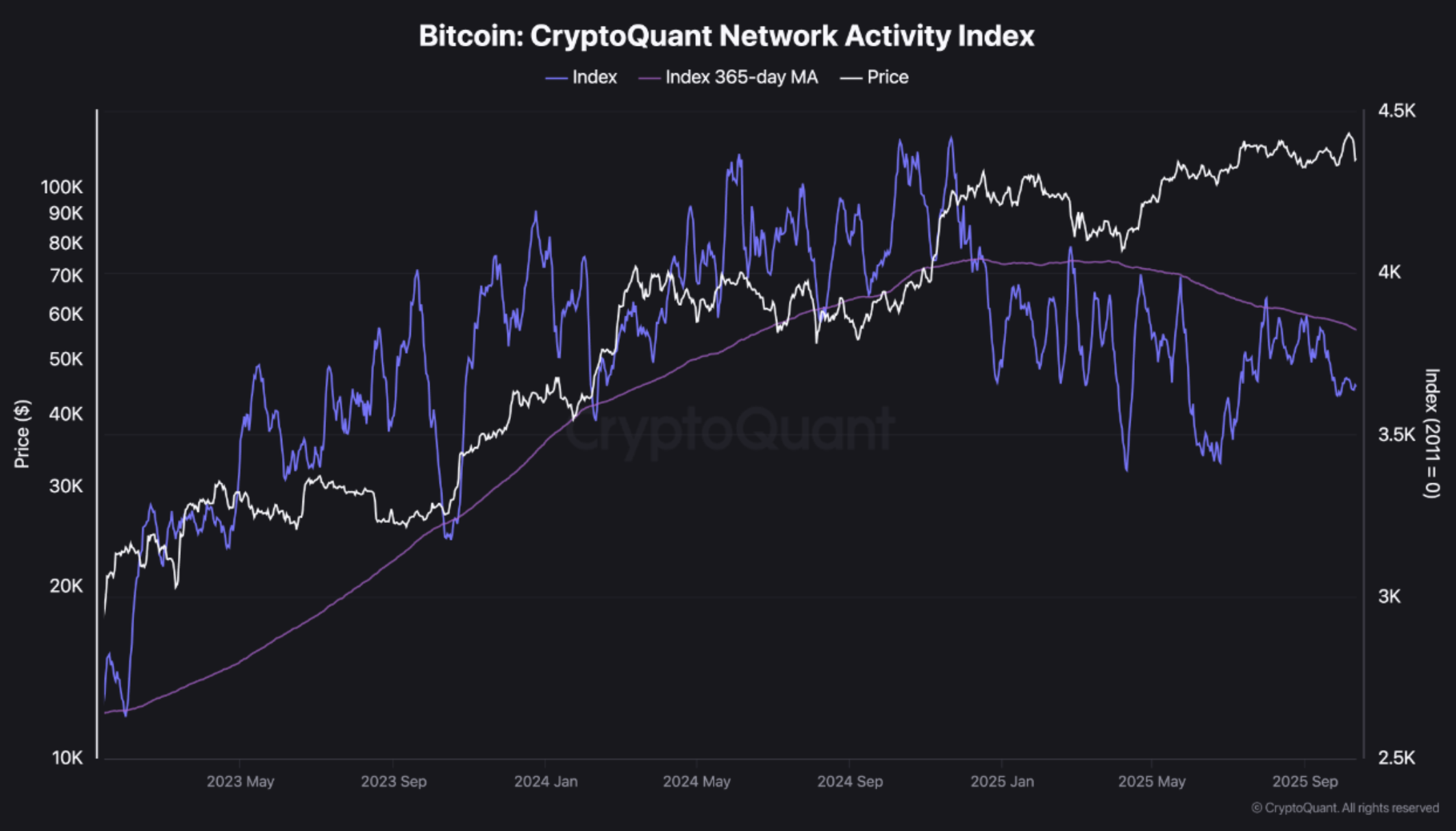

A recent CryptoQant report by TeddyVision highlights that Bitcoin’s Network Activity Index has consistently fallen below its 365-day moving average this year, signaling a slowdown in on-chain usage.

The Network Activity Index measures user interactions on the Bitcoin blockchain, such as transaction counts and active addresses. A declining index suggests reduced network engagement, contrasting the surge in on-chain activity seen in 2023-24 when Bitcoin’s price rose organically.

Despite Bitcoin’s price holding steady between $100,000 to $120,000, the divergence between valuation and network fundamentals is widening. The analyst noted that capital flows predominantly occur off-chain, while on-chain demand remains subdued, leading to stagnation in network usage.

The recent capital rotation in the Bitcoin market may just be momentum running on fumes, rather than a sign of strength.

While Bitcoin’s network activity decline raises concerns about its fundamentals, some analysts believe the bull market is not over yet. According to an X post by crypto analyst Titan of Crypto, Bitcoin would enter a bear market only if it drops below the 50-day Simple Moving Average on the weekly chart.

Will Q4 2025 be Bullish for Bitcoin?

Despite the recent market volatility, industry experts remain optimistic about Bitcoin’s potential in the last quarter of 2025. Ash Crypto predicts a price target of $180,000 for BTC, while data from Binance suggests a possible surge to $130,000.

Egrag, another crypto analyst, believes that Bitcoin could reach $175,000 with a minor catalyst. At the time of writing, Bitcoin is trading at $114,076, showing a 0.8% increase in the past 24 hours.

Image source: Unsplash, charts from CryptoQuant, X, and TradingView.com