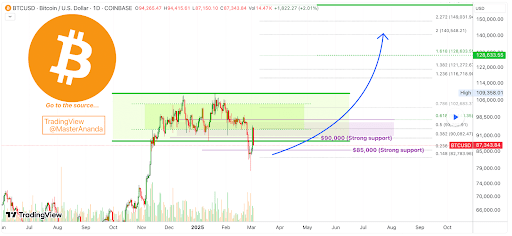

According to crypto analyst Master Ananda, the Bitcoin price has hit rock bottom after experiencing a significant crash below $80,000 last week. The analyst has shared insights on what to expect next from the leading cryptocurrency.

In a recent TradingView post, Master Ananda confidently stated that the bottom is in based on the current price action of Bitcoin. He believes that last week’s drop served as the perfect bottom signal, with $78,300 being identified as the bottom, representing a 28% decline from BTC’s all-time high of $109,000.

Related Reading

Master Ananda emphasized that the recent retracement was a classic move following a strong bullish breakout. He explained that this retracement is beneficial for Bitcoin as it allows the crypto to build up strength gradually. The analyst noted that this growth phase is essential for Bitcoin to achieve higher levels in the long term.

Looking ahead, Master Ananda predicted that daily price increases of $500 or $800 could indicate the timeline for Bitcoin to reach higher price levels in the coming months. He suggested that Bitcoin could potentially hit $200,000 next month. The analyst advised market participants to take advantage of the current opportunity to buy and hold, as Bitcoin is in an accumulation phase and is expected to continue growing in the long run.

BTC Regaining Momentum

Crypto analyst Titan of Crypto also expressed optimism about Bitcoin regaining momentum. He highlighted that BTC has shown a strong reaction to the Kijun acting as support on the weekly chart. A weekly close above the Tenkan at around $94,000 would confirm a shift in momentum and strengthen the bullish case for Bitcoin.

Related Reading

Furthermore, Titan of Crypto stated in another post that the Bitcoin bull market is still intact, with no bear market in sight according to the Supertrend indicator. He believes that Bitcoin could potentially rally above $200,000 before any bearish trend sets in.

As of the latest data, the Bitcoin price is trading around $92,000, showing a more than 5% increase in the last 24 hours according to CoinMarketCap.

Featured image from LinkedIn, chart from Tradingview.com