Following a remarkable surge to an all-time high of approximately $123,000 in the second week of July, the price of Bitcoin has experienced a period of volatility for the remainder of the month. On Friday, July 25, the leading cryptocurrency dropped to just above $115,000, prompting concerns within the market about the potential end of the rally.

Exploring the Significance of the $115,000 Level for Bitcoin’s Price

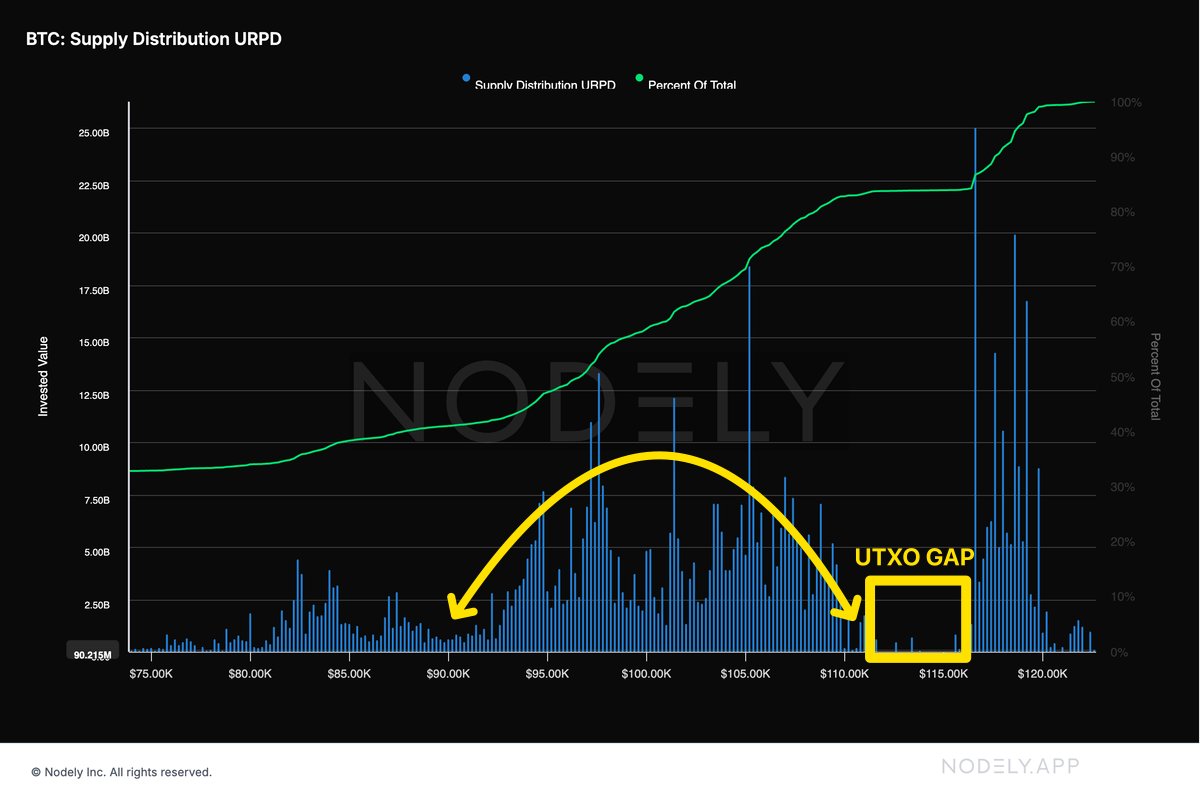

In a recent post on the social media platform X, cryptocurrency expert Burak Tamaç highlighted the importance of the price region just below $115,000 for BTC’s price. Utilizing the BTC Supply Distribution URPD, Tamaç provided insights into how the price of Bitcoin could unfold in the near future.

The Supply Distribution URPD metric monitors the Bitcoin supply that was last moved or transferred at specific price levels, offering valuable data on potential support and resistance zones. Tamaç pointed out on X that there is a notable gap in Bitcoin’s Unspent Transaction Output (UTXO) distribution around the $110,000 to $115,000 range, indicating fewer significant transactions in that price vicinity recently.

However, below this UTXO gap lies a price range of $90,000 to $110,000 with significant investor activity, suggesting a potential support zone within the UTXO gap. The support level is anticipated to be above $110,000, as Bitcoin has maintained above $115,000 despite entering a consolidation phase post reaching its all-time high.

If Bitcoin manages to sustain above the $110,000 to $115,000 range, bullish momentum is likely to persist. Conversely, a breach of this support zone could lead to a substantial sell-off in the flagship cryptocurrency.

Current Bitcoin Price Overview

At present, Bitcoin is valued at approximately $118,050, marking a nearly 2% increase over the past 24 hours.

Featured image from iStock, chart from TradingView