- Bitcoin has surged past $60,000 with a rise in OTC desk balances, indicating increased miner selling.

- Analysts are cautiously optimistic, despite mixed signals from network activity and large transactions.

Bitcoin has made a strong recovery, surpassing the $60,000 mark after weeks of consolidation below it.

The leading cryptocurrency has climbed above this crucial level, hitting a 24-hour high of $61,830 and currently trading at $60,798, showing a 2% increase in the last day.

Traders are relieved by this upward movement after being concerned about Bitcoin’s stagnant price recently.

The price increase in Bitcoin aligns with a notable development in one of its key metrics, which could have significant implications for the market.

The Surge in OTC Desk Balances: Impact on BTC

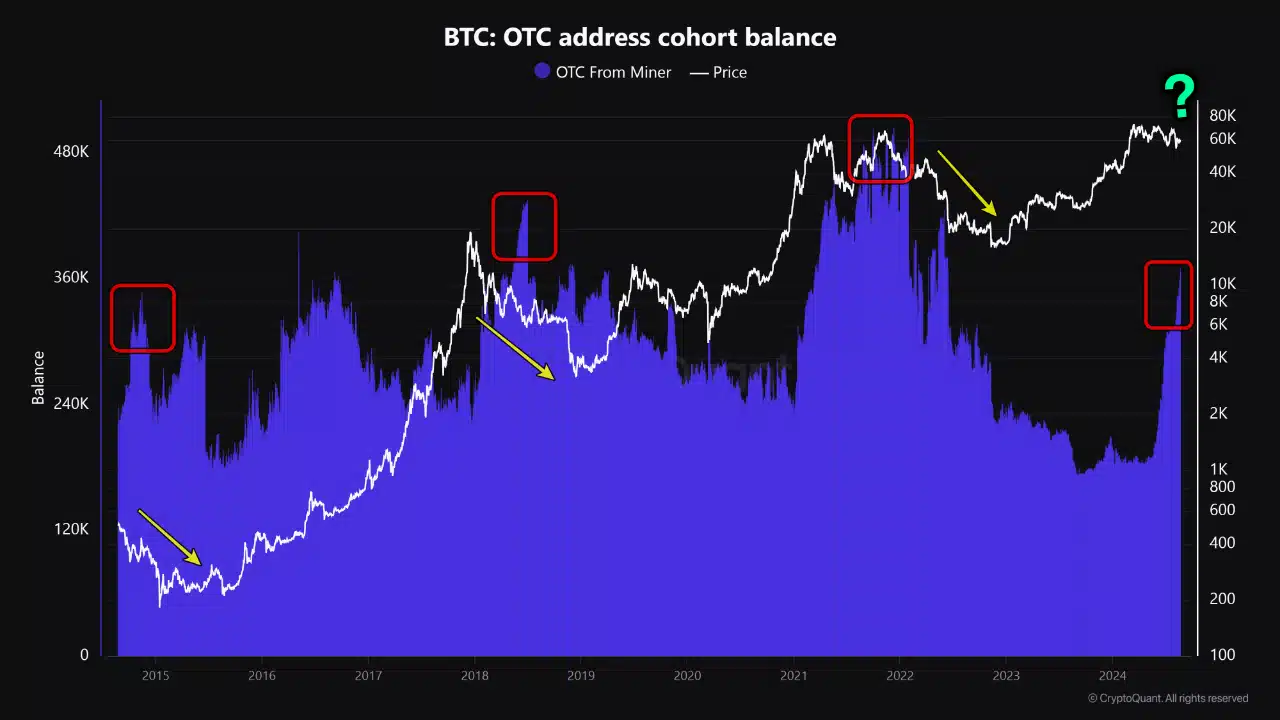

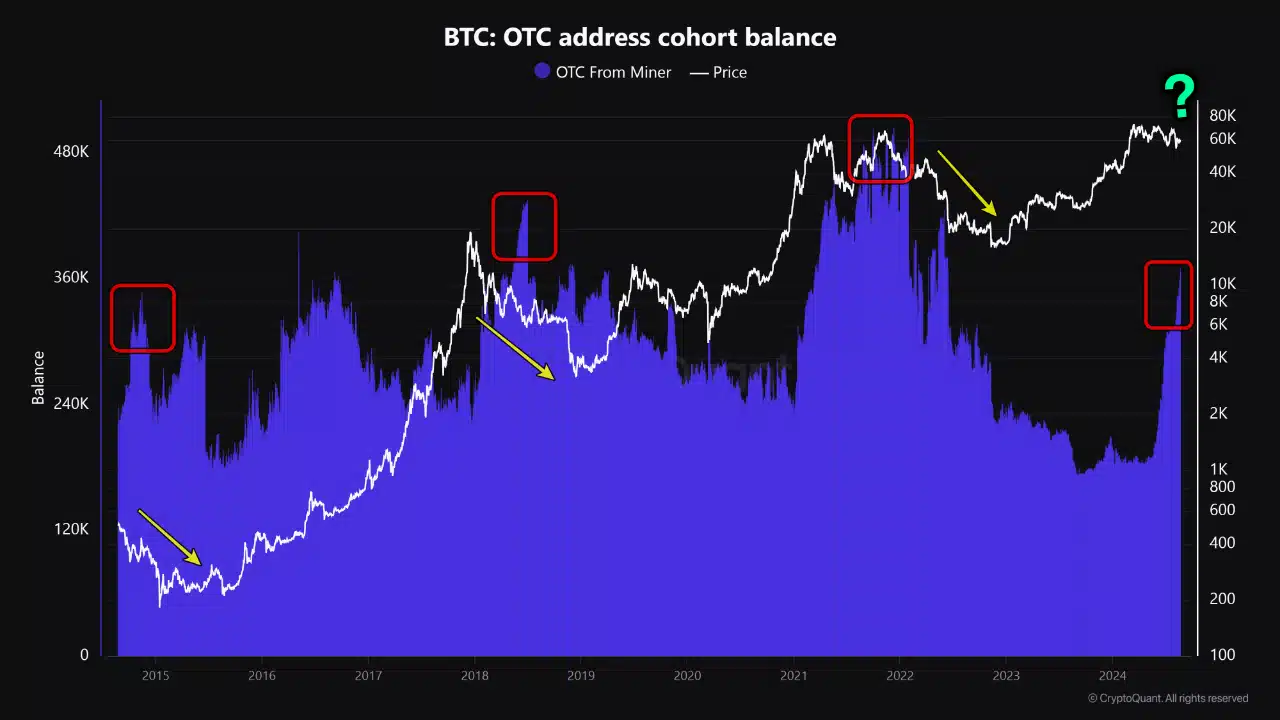

A recent report by CryptoQuant reveals a surge in the balance of Bitcoin held in Over-the-Counter (OTC) desks to a two-year high.

Analyst ‘Ego Hash’ noted a more than 70% increase in these balances over the past three months, representing the Bitcoin that miners sell directly to buyers through OTC deals.

Source: CryptoQuant

Specifically, OTC desk balances have risen from 215,000 BTC in June to 368,000 BTC in August, marking a significant increase of 153,000 BTC.

This level of OTC activity has not been observed since June 2022 and is typically associated with increased selling pressure from miners, historically leading to price declines in Bitcoin.

Despite the potential bearish signs from rising OTC desk balances, many analysts and experts in the crypto space maintain a positive outlook on Bitcoin’s future.

For example, a well-known crypto analyst, Mags, recently shared a bullish prediction for Bitcoin, suggesting a potential significant price surge.

Source: Mags on X

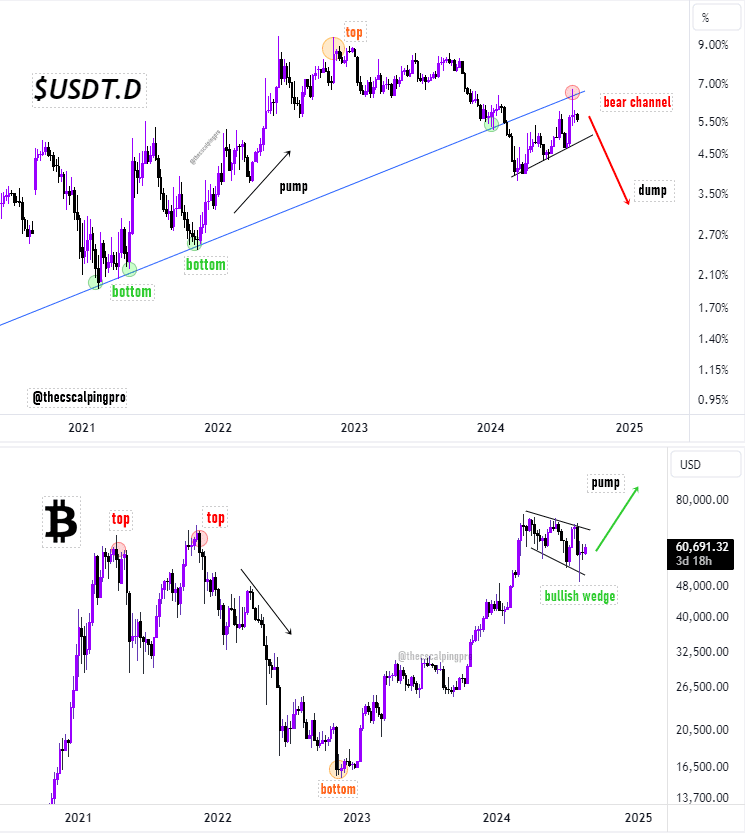

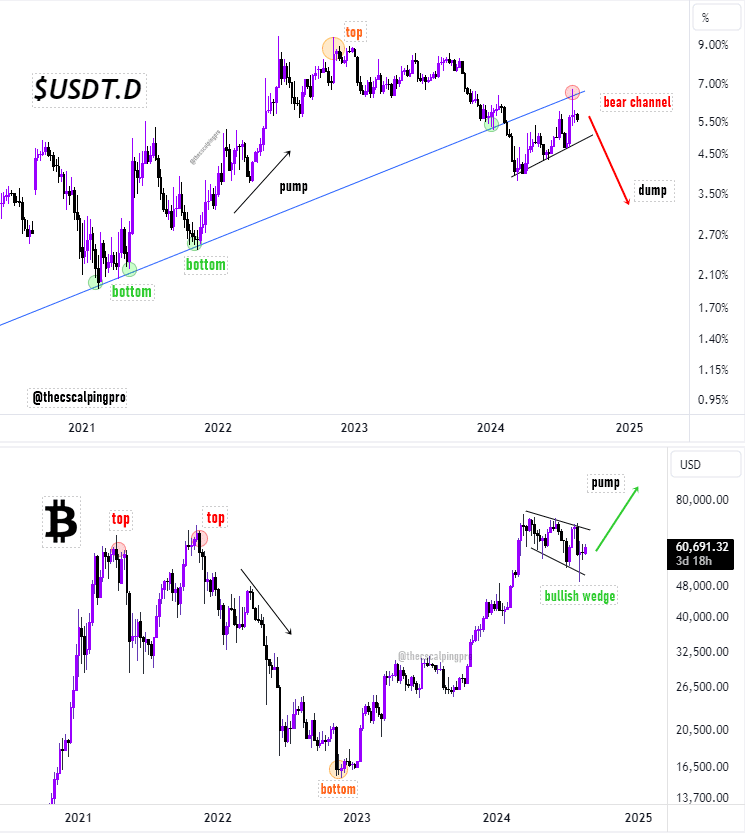

Mags highlighted the inverse relationship between Tether (USDT.D) and Bitcoin (BTC), suggesting a bullish continuation pattern for Bitcoin following a breakdown in USDT.D’s trendline support.

If this scenario unfolds, Mags believes Bitcoin could potentially surge to $72,000 or higher in the near term.

Preparing for Takeoff?

Beyond these optimistic forecasts, Bitcoin’s underlying fundamentals present a complex picture that can offer a deeper insight into the current market situation.

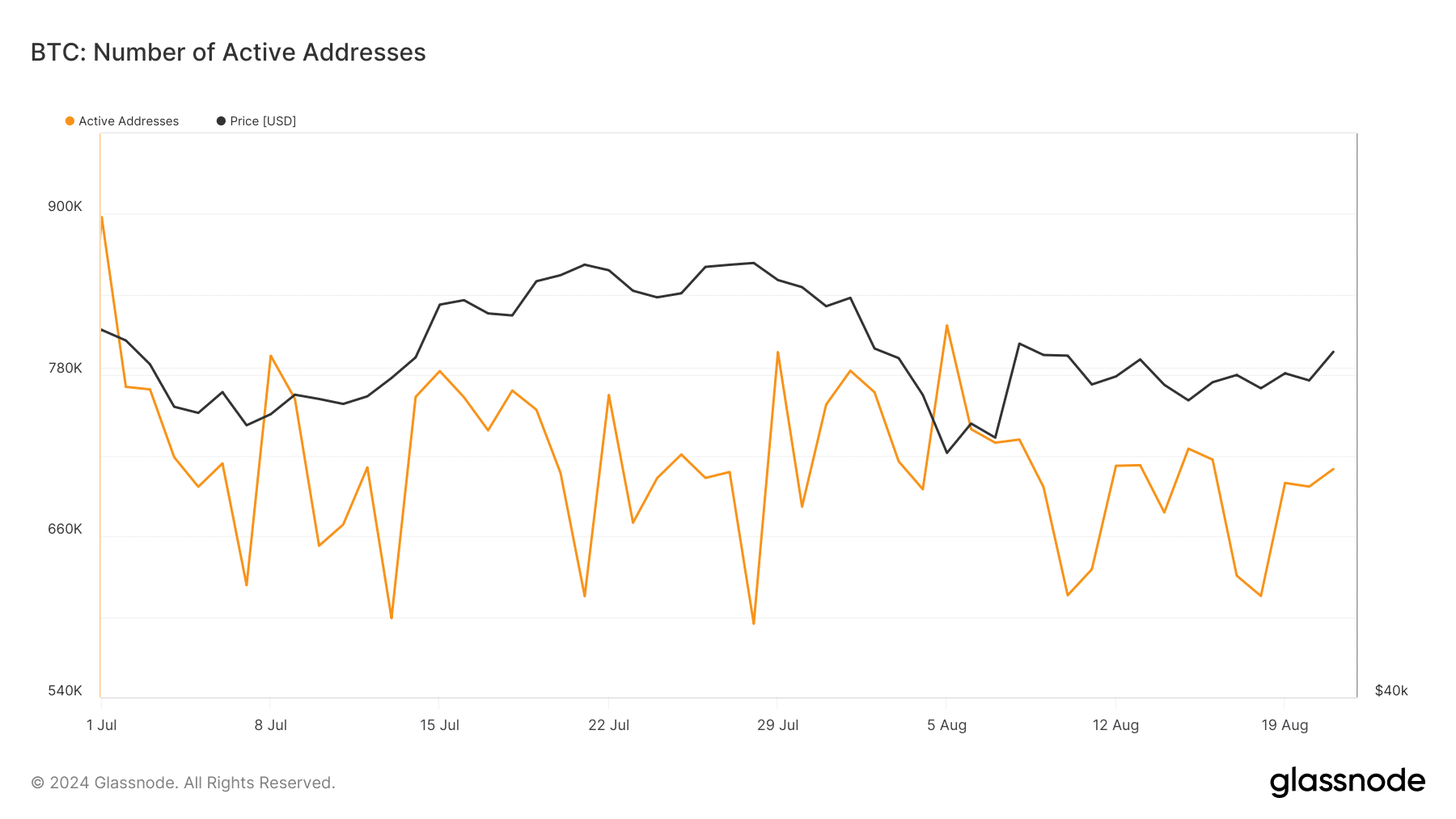

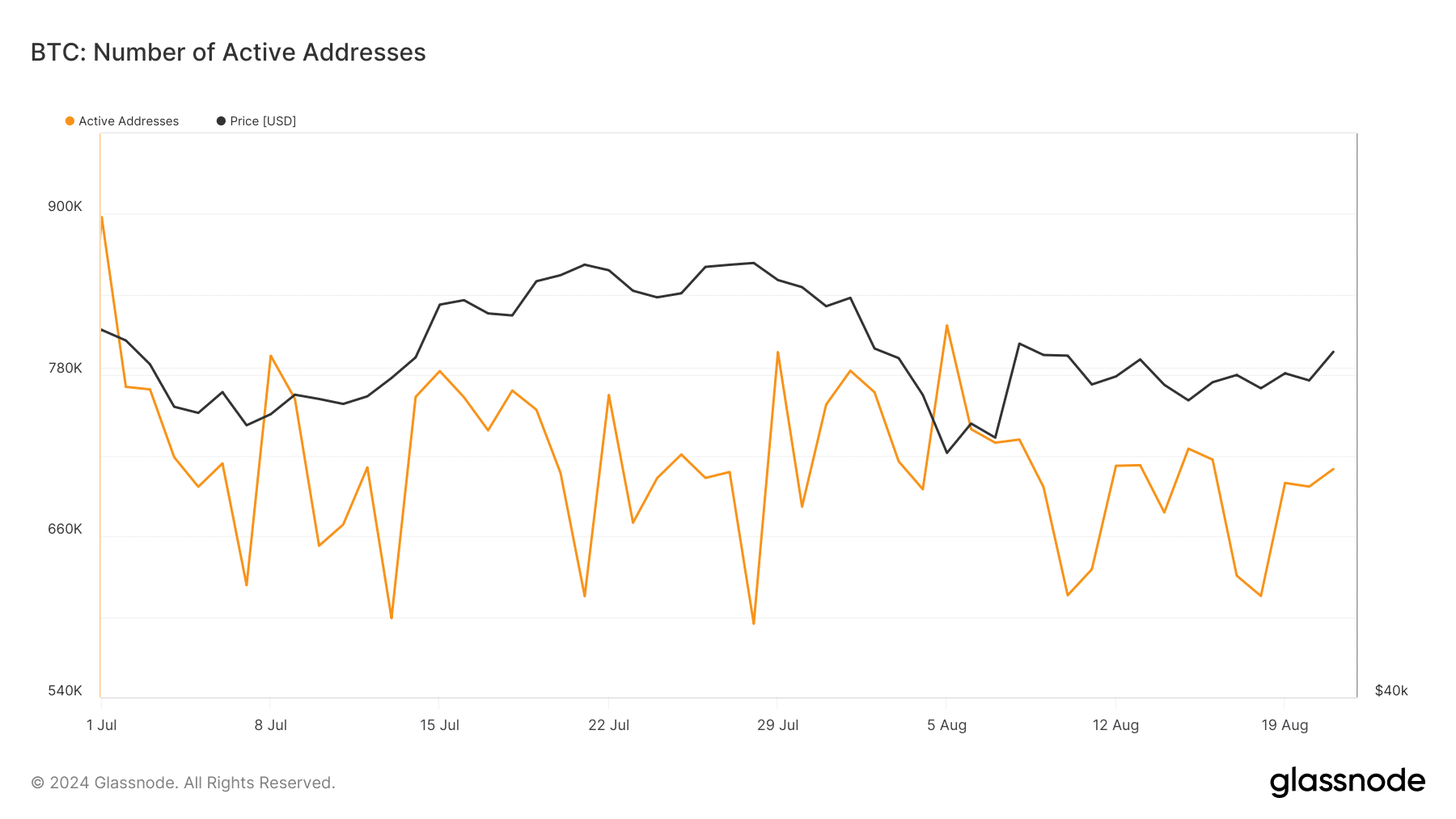

Data from Glassnode shows a significant drop in Bitcoin’s number of active addresses, a key metric for network activity, in the past month.

Source: Glassnode

The number of active addresses fell from nearly 900,000 on July 1 to a low of 594,000 on July 24 but has since rebounded to over 700,000.

This recovery in network activity indicates a resurgence in user engagement with Bitcoin after a period of decline.

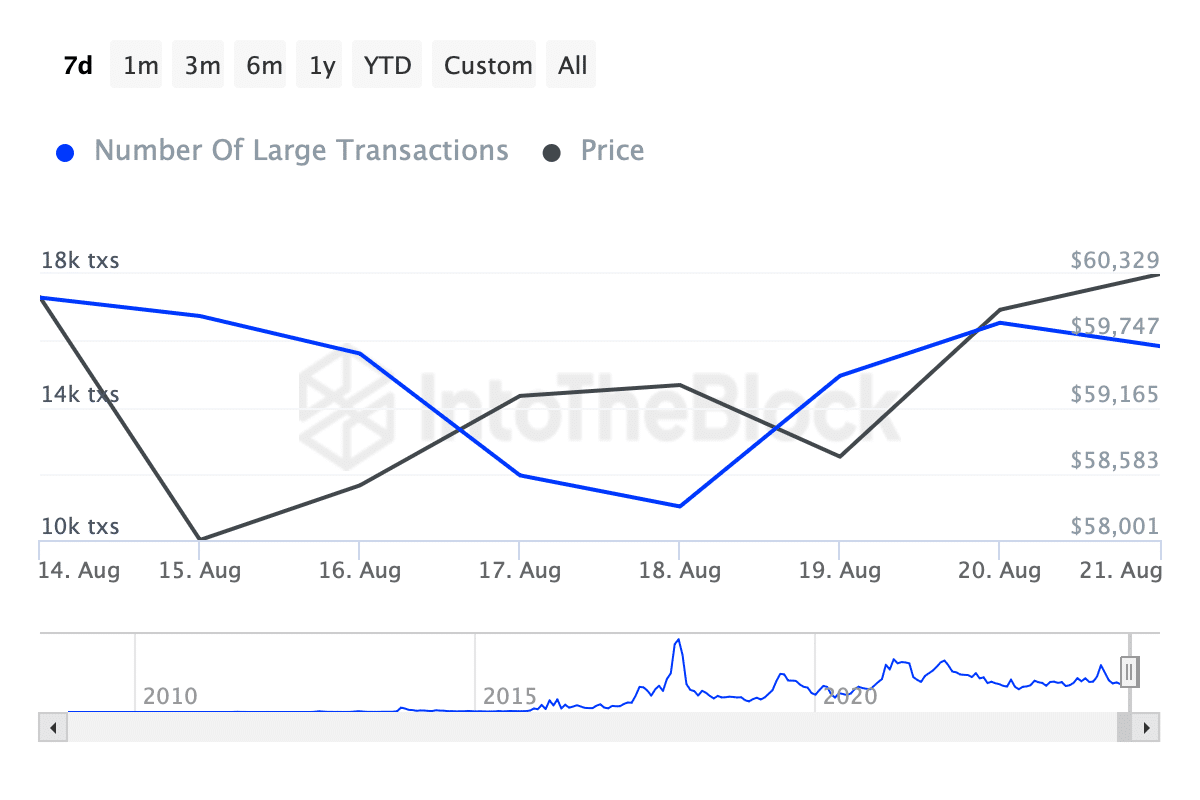

In addition to network activity, whale transactions—Bitcoin transactions exceeding $100,000—have shown some fluctuations.

Read Bitcoin’s [BTC] Price Prediction 2024-25

According to data from IntoTheBlock, the number of these large transactions has slightly decreased in the past week, from over 17,000 to just under 16,000.

Source: IntoTheBlock

While this decline may indicate caution among large investors, the overall market sentiment remains cautiously optimistic.

paragraph in a different way:

The students were excited to hear that they would be going on a field trip to the museum next week. They eagerly began researching the exhibits they would see and making plans for the day.