- Bitcoin’s progress is hindered by the rising leverage ratio and Open Interest.

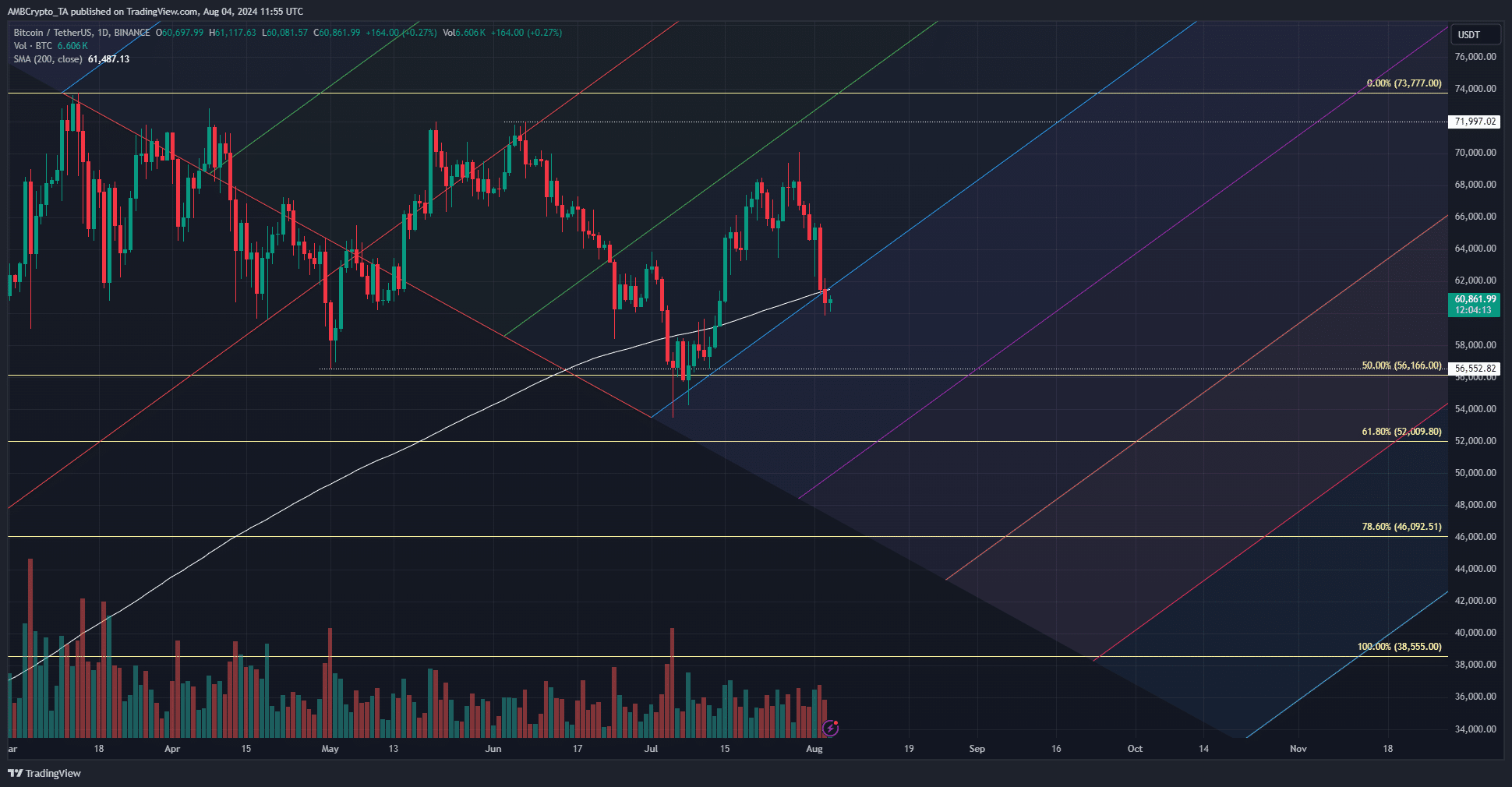

- A potential price drop below $60k was indicated by the failure of the pitchfork and 200 DMA support.

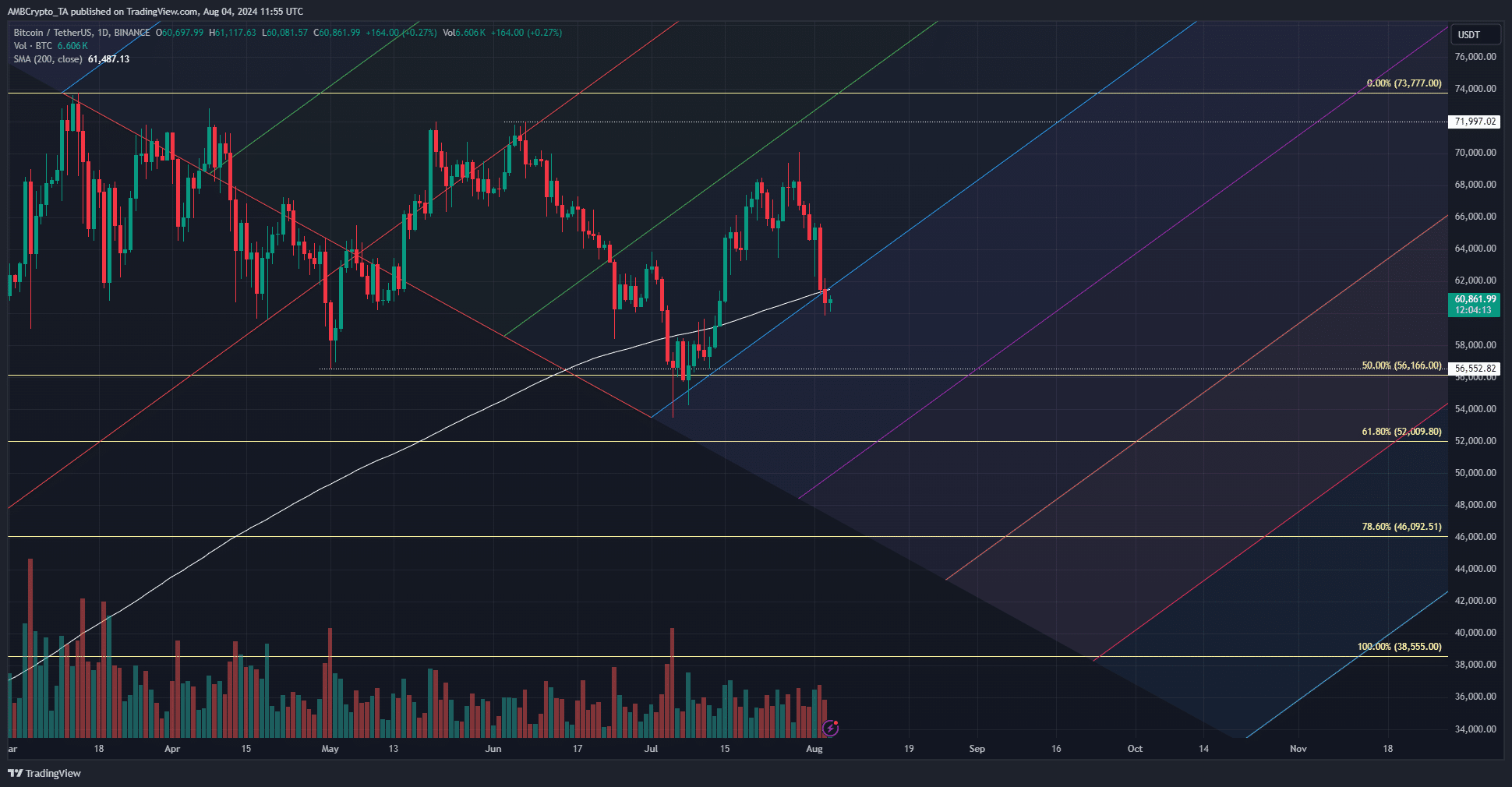

Bitcoin [BTC] has dropped below the 200-day simple moving average and is currently trading within the $60k-$60.5k support range. There is a possibility of it falling to $56k or even lower.

CoinMarketCap reported that the Crypto Fear and Greed index stood at 48, indicating bearish sentiment in the market. Traders may be tempted to engage in margin trading to recover losses, but this could lead to significant losses.

Is Bitcoin approaching its bottom?

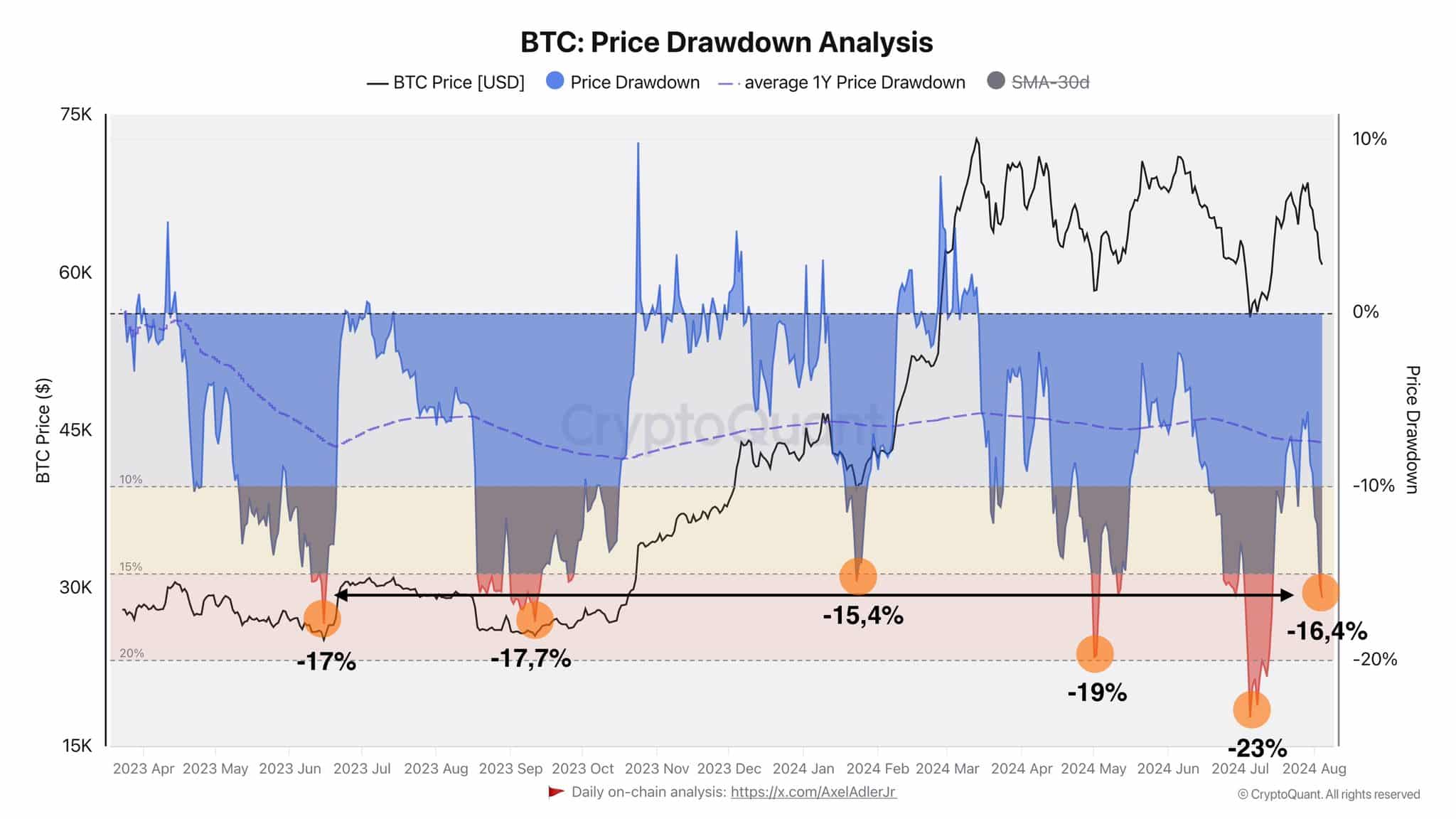

Crypto analyst Axel Adler highlighted that recent price drops have seen drawdowns ranging from 17% to 23%, with the current figure at 16.4%. This suggests that the market may be nearing a bottom compared to the past year.

Source: BTC/USDT on TradingView

The $56k level, previously tested as support in July, aligns with the Fibonacci retracement level. The breach of the 200-day simple moving average by the bulls is a strong bearish signal.

Furthermore, the failure of the $61.3k level, where the 200DMA and pitchfork support converge, as depicted in the chart above, is particularly significant.

Was there excessive activity in the derivatives market?

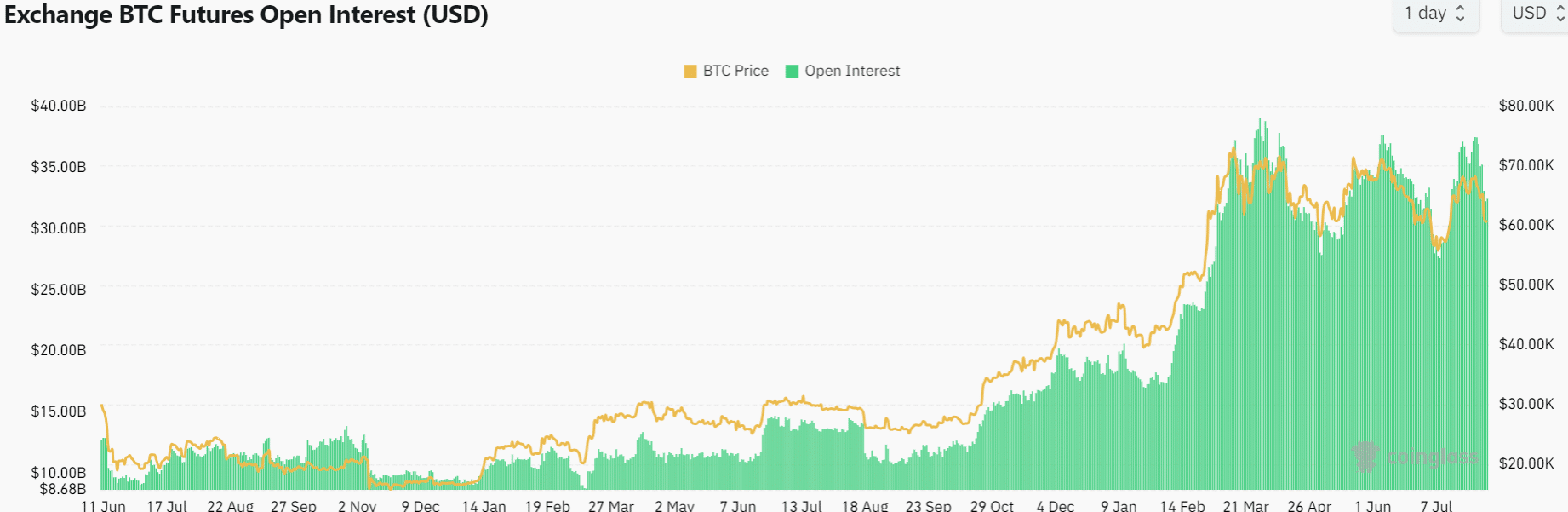

Since March, Bitcoin has struggled to surpass the $70k mark, while Open Interest has remained between $30 billion and $35 billion. In the past week, it has dropped by $4 billion, indicating a bearish sentiment in the short term.

A strong bull market requires significant spot demand, and when the futures market becomes overheated, it often leads to volatile price swings that can reset the upward trend.

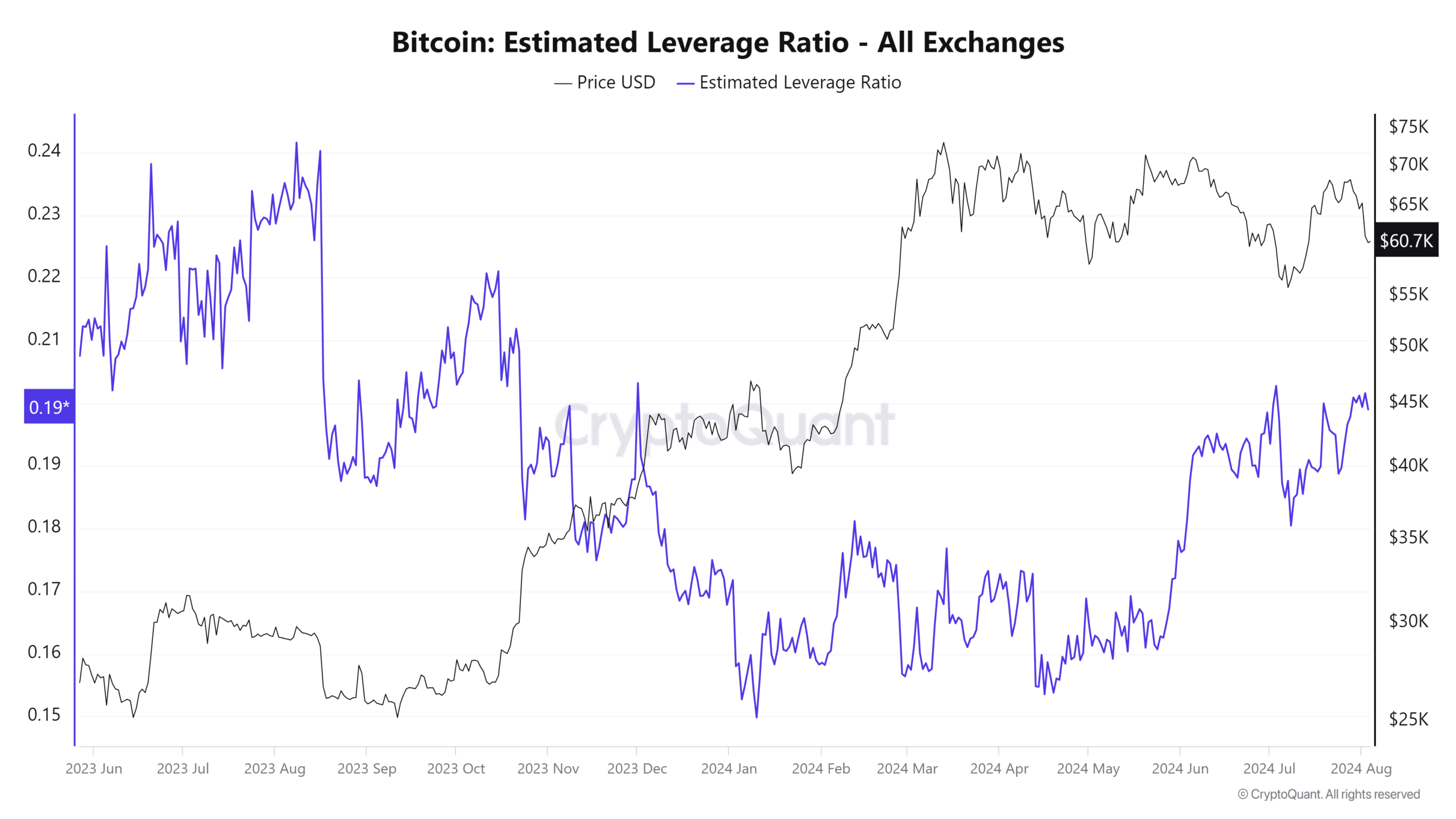

The estimated leverage ratio has been on the rise since June, suggesting that investors are taking on more risk in leveraged trading in anticipation of a bullish breakout.

Check out Bitcoin’s [BTC] Price Prediction 2024-25

This increased risk in leveraged trading can hinder a breakout as the price tends to gravitate towards levels where long positions are liquidated.

Recent data indicated a decrease in selling pressure from long-term holders, hinting that $60k could be a temporary bottom. However, given the current macro environment and market uncertainty, a deeper retracement cannot be discounted.

following sentence:

“The cat sat lazily in the sun, soaking up its warmth.”

The cat lounged in the sun, enjoying its comforting rays.