- Bitcoin’s value decreased by 5.41% in the past week.

- Market indicators suggest a potential uptrend if Bitcoin closes above the 21-week EMA.

October has not been favorable for Bitcoin [BTC] after a strong September performance, traditionally associated with upward trends. In the last week, BTC faced a significant decline.

As of now, Bitcoin is priced at $61980, marking a 5.41% decrease on a weekly basis and extending the bearish trend by 0.34% daily.

Prior to this decline, Bitcoin had shown a positive trend, rising by 9.87% on monthly charts.

The current market conditions raise doubts about the continuation of an uptrend for BTC, especially after the recent downtrend.

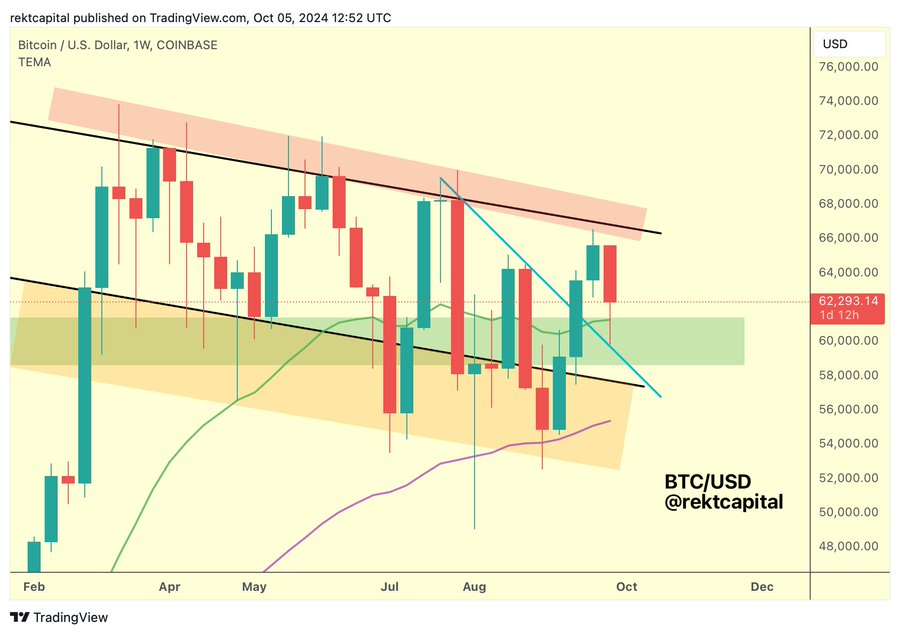

Renowned crypto analyst Rekt Capital has indicated a potential rally, highlighting the importance of the 21-week bull market EMA.

Interpreting Market Sentiment

RektCapital’s analysis suggests that the 21-week EMA has been retested successfully as a support level.

Source: X

Staying above this level indicates a bullish market sentiment, with buyers entering the market and price trends favoring an upward movement.

Breaking above a long-standing downtrend line signals a potential shift in momentum and the end of the downtrend, paving the way for further upward movement.

A strong close above the 21-week EMA and a confirmed breakout from the downtrend could signal additional upward momentum, especially after a bullish weekly close above $62k-$63k.

Chart Analysis for Bitcoin

RektCapital’s analysis presents a positive outlook for BTC, but it’s crucial to consider other market indicators as well.

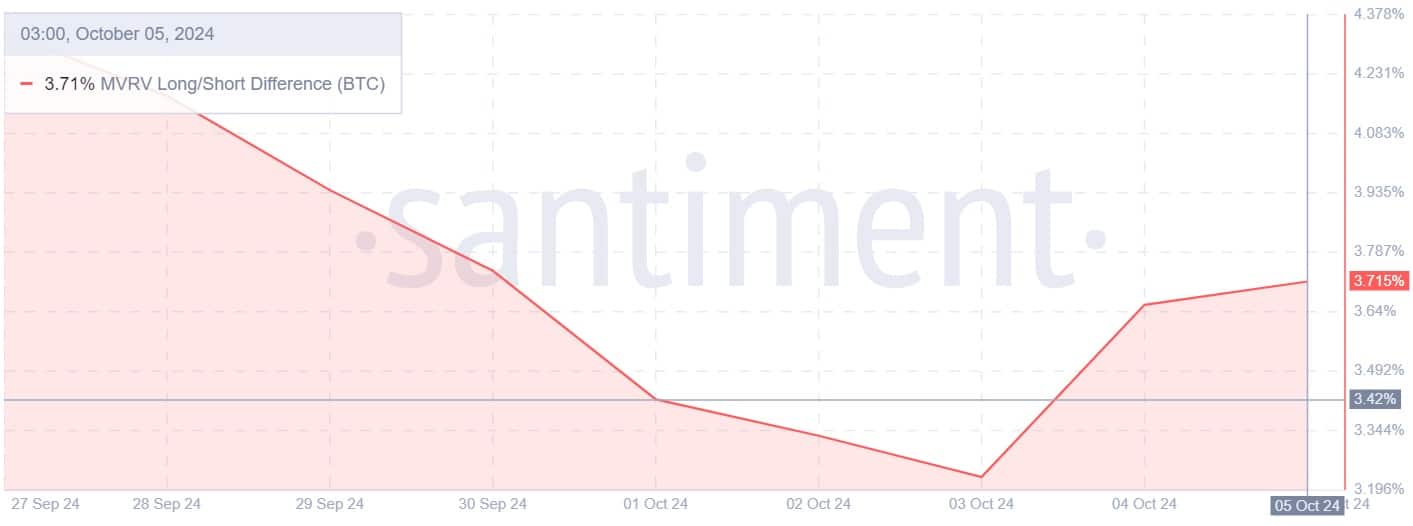

Source: Santiment

One key indicator to consider is Bitcoin’s MVRV long/short difference, which has transitioned from a downtrend to an uptrend.

Long-term holders’ confidence in their positions is reflected in the rising MVRV long/short difference, indicating a belief in future gains.

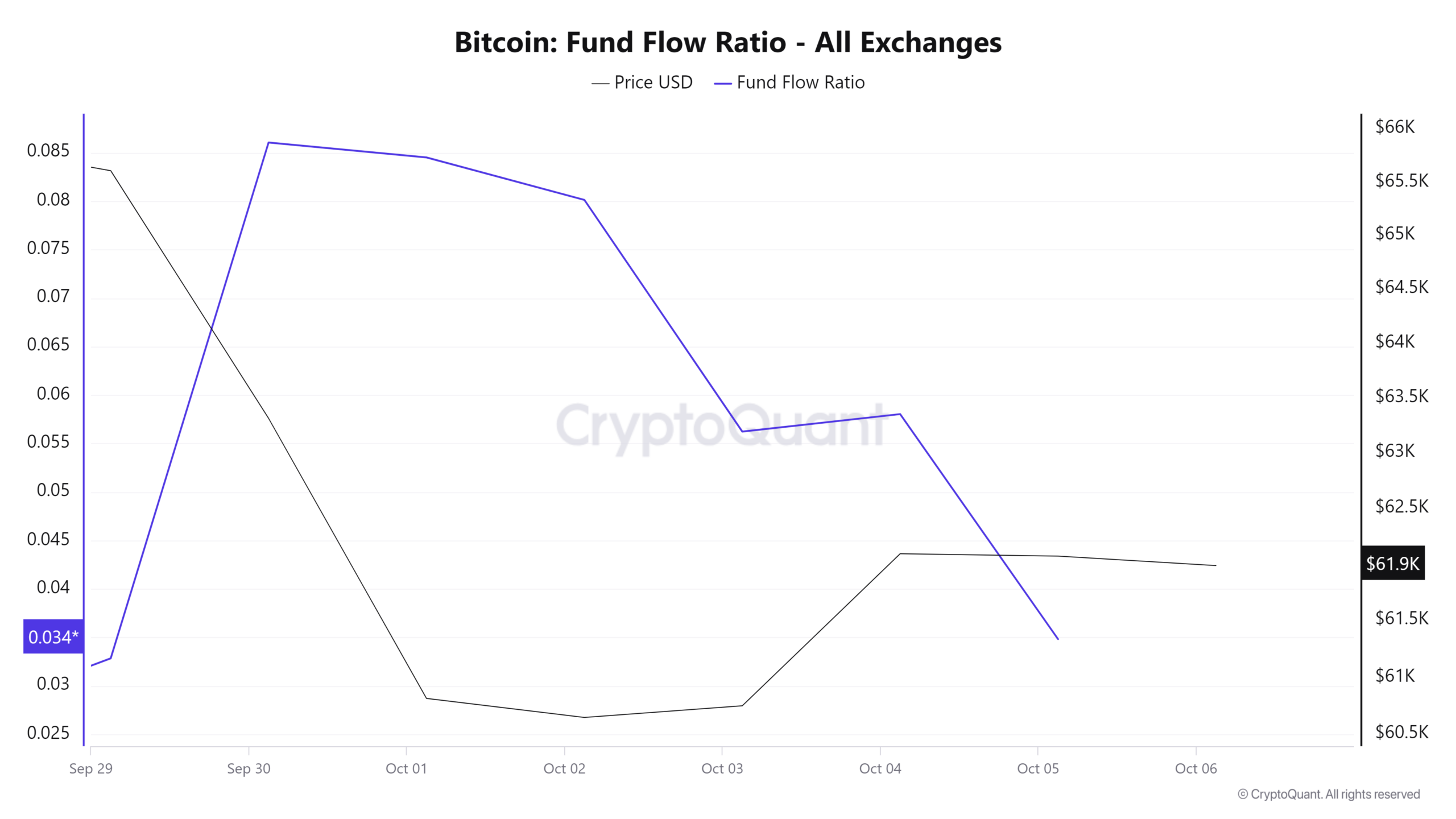

Source: CryptoQuant

Furthermore, the Fund flow ratio has been declining, indicating accumulation as investors anticipate future gains.

Source: Santiment

Bitcoin’s Funding Rate Aggregated by Exchange has remained positive, indicating investor confidence in long positions for potential price gains.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

Overall, Bitcoin has been trading sideways recently, with accumulation and long positions indicating a favorable market setup for future gains.

If the current market sentiment persists, BTC may target the $62785 resistance level in the near future.

following sentence in a different way:

The cat slept peacefully on the windowsill in the warm sunlight.

The cat peacefully slept on the windowsill, basking in the warm sunlight.