- Bitcoin experienced a price increase of more than 4% in the past 24 hours

- Various metrics suggested that BTC was showing signs of being overbought

Bitcoin [BTC], being the top cryptocurrency in the market, led the bullish trend last week with a significant price surge. However, recent data has surfaced indicating a potential further increase in price.

Despite the positive indicators, there is still uncertainty as another signal suggested a different outcome at the current moment.

Bitcoin’s Market Situation

The price of the leading cryptocurrency rose by over 14% in the last seven days, with a 4% surge in the past 24 hours. At the time of writing, BTC was trading at $66,616.52 with a market cap exceeding $1.3 trillion.

Renowned crypto analyst Ali recently shared a tweet highlighting a bullish development. According to the tweet, BTC has broken above a crucial resistance level, indicating a possible further uptrend in the near future.

However, there are conflicting signals as well. The TD sequential indicator on BTC’s daily chart flashed a sell signal, as mentioned in another tweet by Ali.

If the sell signal holds true, BTC’s rally could soon come to a halt. However, the tweet also mentioned that if BTC manages to sustain its upward momentum and surpasses $67.5k, the sell signal would be invalidated.

Future of BTC

Given the mixed signals, AMBCrypto delved deeper into BTC’s metrics to gain a better understanding of its potential trajectory.

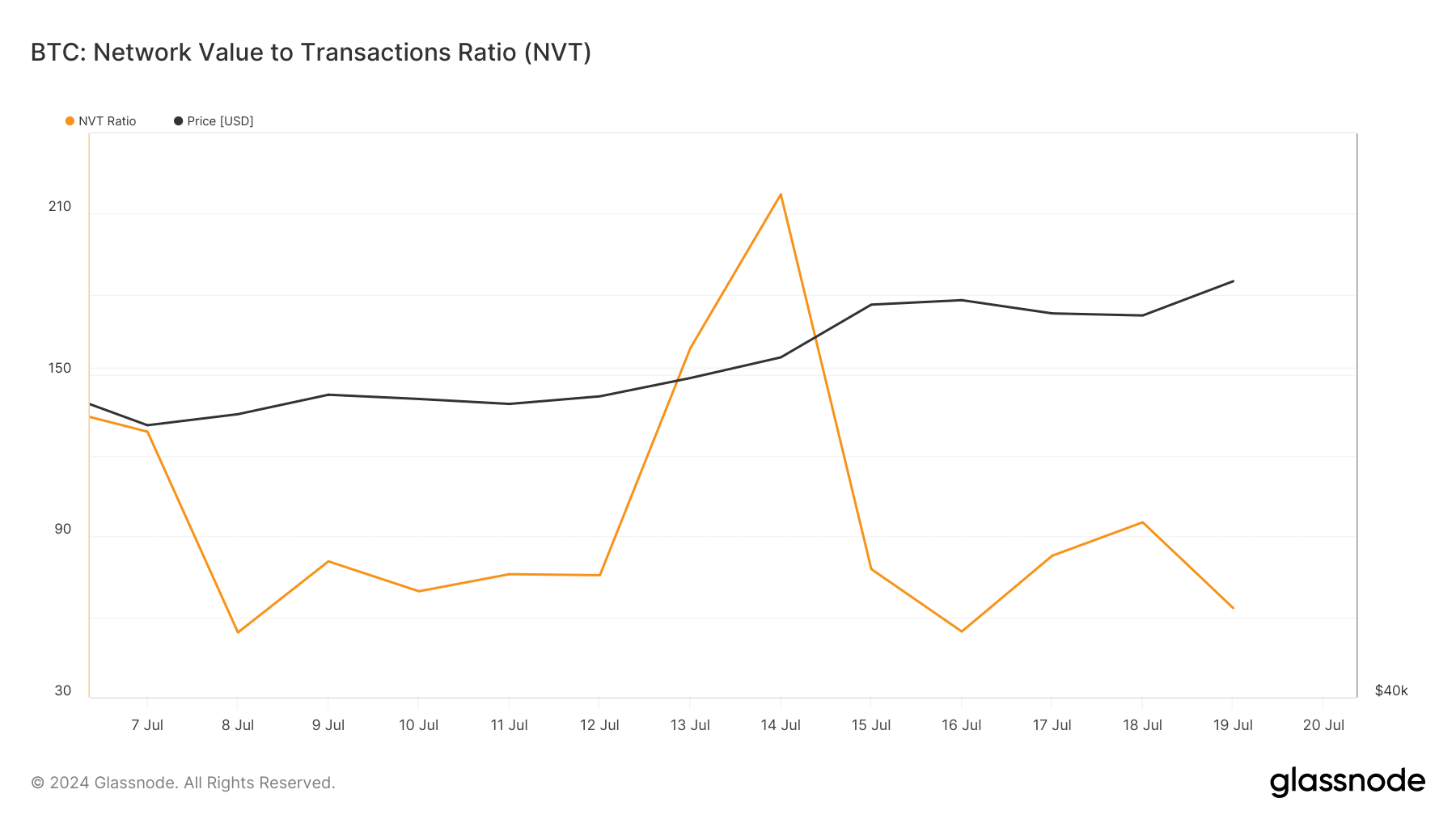

According to Glassnode’s data, BTC’s NVT ratio decreased, indicating a possible undervaluation that often leads to price increases later on.

Source: Glassnode

Further analysis of CryptoQuant’s data revealed more positive metrics. The net deposit of BTC on exchanges was low compared to the average of the last seven days, indicating high buying pressure. The binary CDD showed that movements of long-term holders in the past week were below average, suggesting a motivation to hold onto their coins.

However, some indicators raised concerns. Bitcoin’s Relative Strength Index (RSI) and Stochastic were in overbought territories, signaling a potential increase in selling pressure that could halt the rally.

Source: CryptoQuant

Currently, the fear and greed index for BTC is at 69%, indicating a state of “greed” in the market. This level usually precedes a price correction.

Read Bitcoin’s [BTC] Price Prediction 2024-25

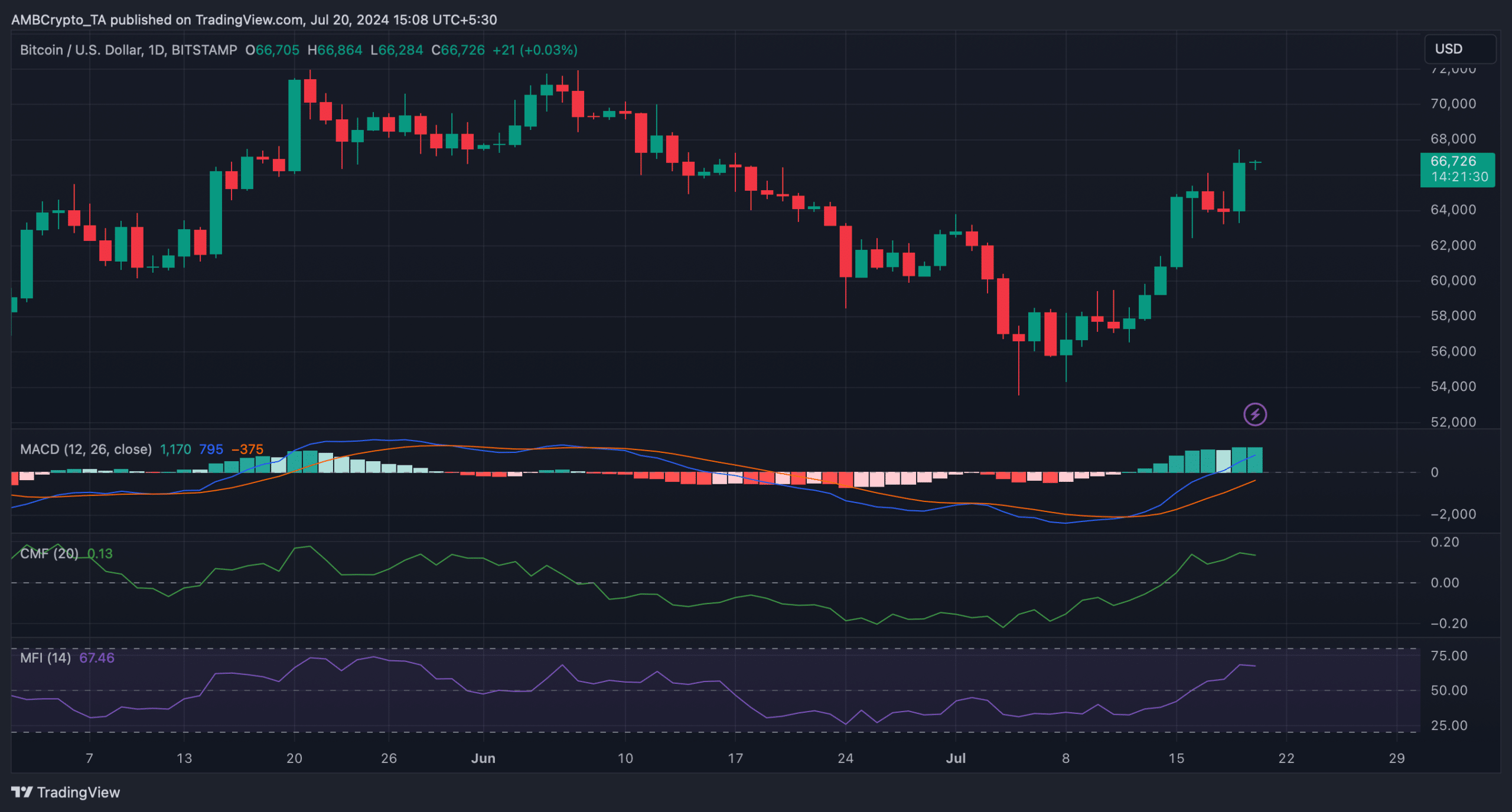

Therefore, a closer examination of BTC’s daily chart revealed downticks in both the Money Flow Index (MFI) and Chaikin Money Flow (CMF), suggesting a potential price correction on the horizon.

On the other hand, the MACD indicator favored the buyers, showing a bullish momentum.

Source: TradingView

sentence: “The cat chased the mouse around the house.”

Rewritten sentence: “Around the house, the mouse was chased by the cat.”