- Both BTC and ETH are currently showing a bearish outlook based on technical analysis

- Recent on-chain metrics indicate more consistent accumulation for ETH compared to BTC

As of now, Bitcoin [BTC] and Ethereum [ETH] are trading below crucial resistance levels of $60k and $2.6k, respectively. The market structures for both cryptocurrencies on the 3-day and weekly timeframes are also displaying bearish signals.

In early August, a rapid sell-off caused panic in the market, but it also provided an opportunity for market participants to accumulate these top crypto assets. A detailed analysis by AMBCrypto revealed interesting trends in market sentiment, with Ethereum having a slight edge.

Price Action and Technical Indicators Suggest Seller Dominance

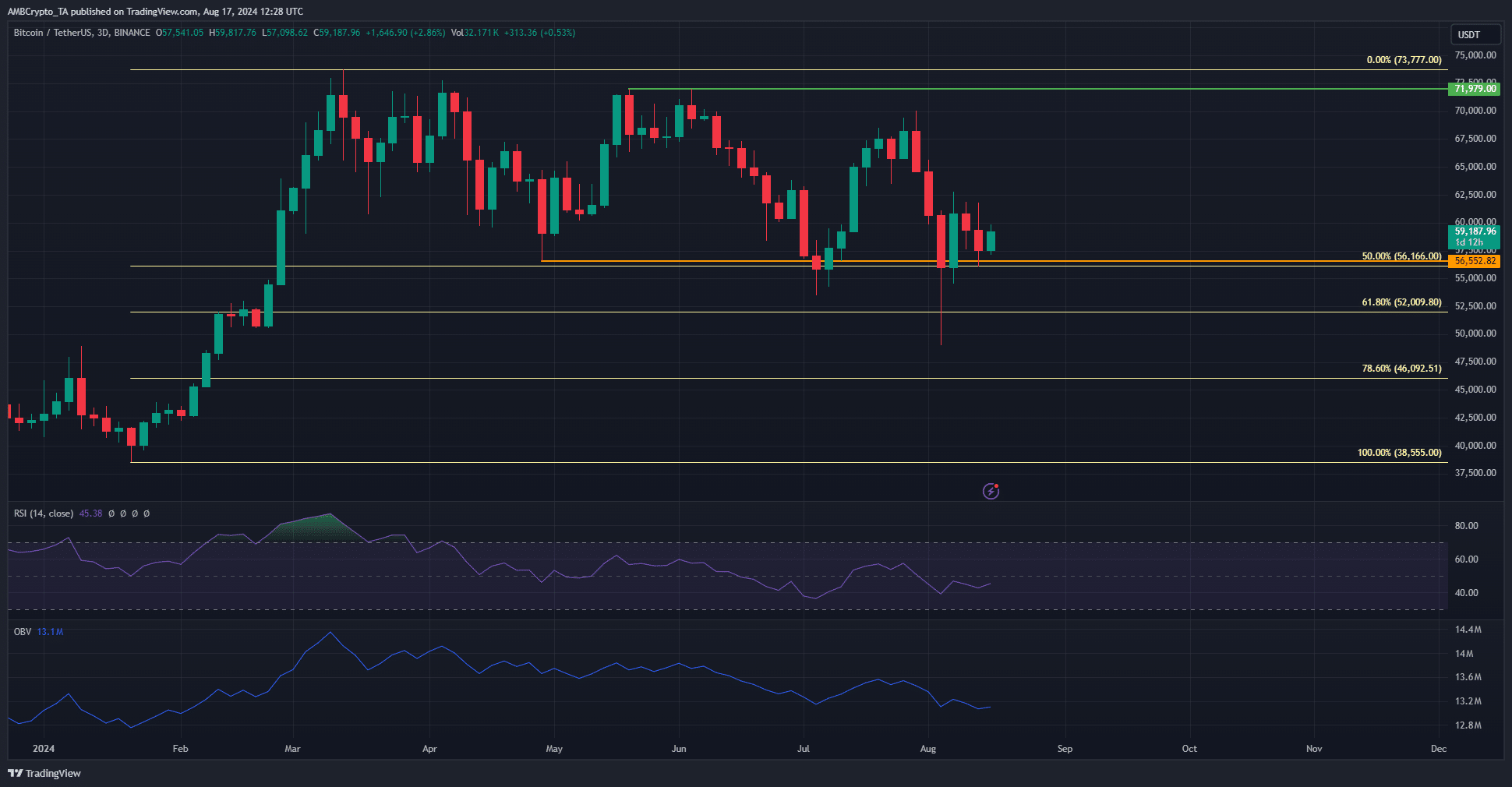

Source: BTC/USDT on TradingView

The chart analysis reveals a bearish structure break indicated by the orange color, with a significant lower high at $72k remaining unbroken. The bearish RSI on the 3-day chart and the downward trend of the OBV suggest that sellers might push BTC below $56.1k again.

A sustained push above $60k would signal a potential reversal, but current market conditions do not indicate strong demand for such a move.

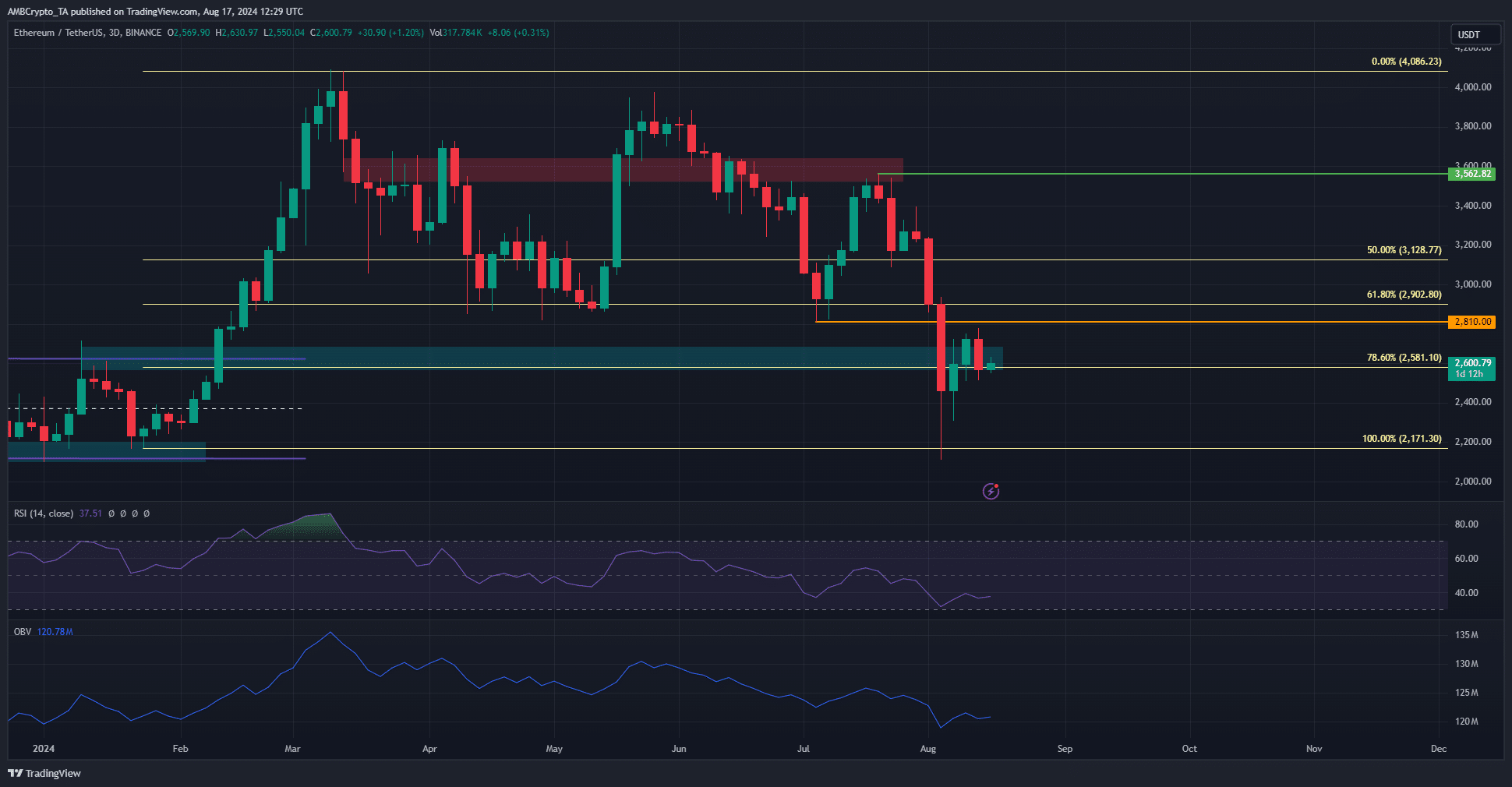

Source: ETH/USDT on TradingView

The technical analysis for ETH paints an even bleaker picture, with a fair value around $2.8k and a looming Fibonacci level at $2.9k. This poses significant challenges for Ethereum bulls.

Both the RSI and OBV indicators suggest bearish pressure that could potentially drive ETH towards $2.2k.

Accumulation Trends Favor Ethereum

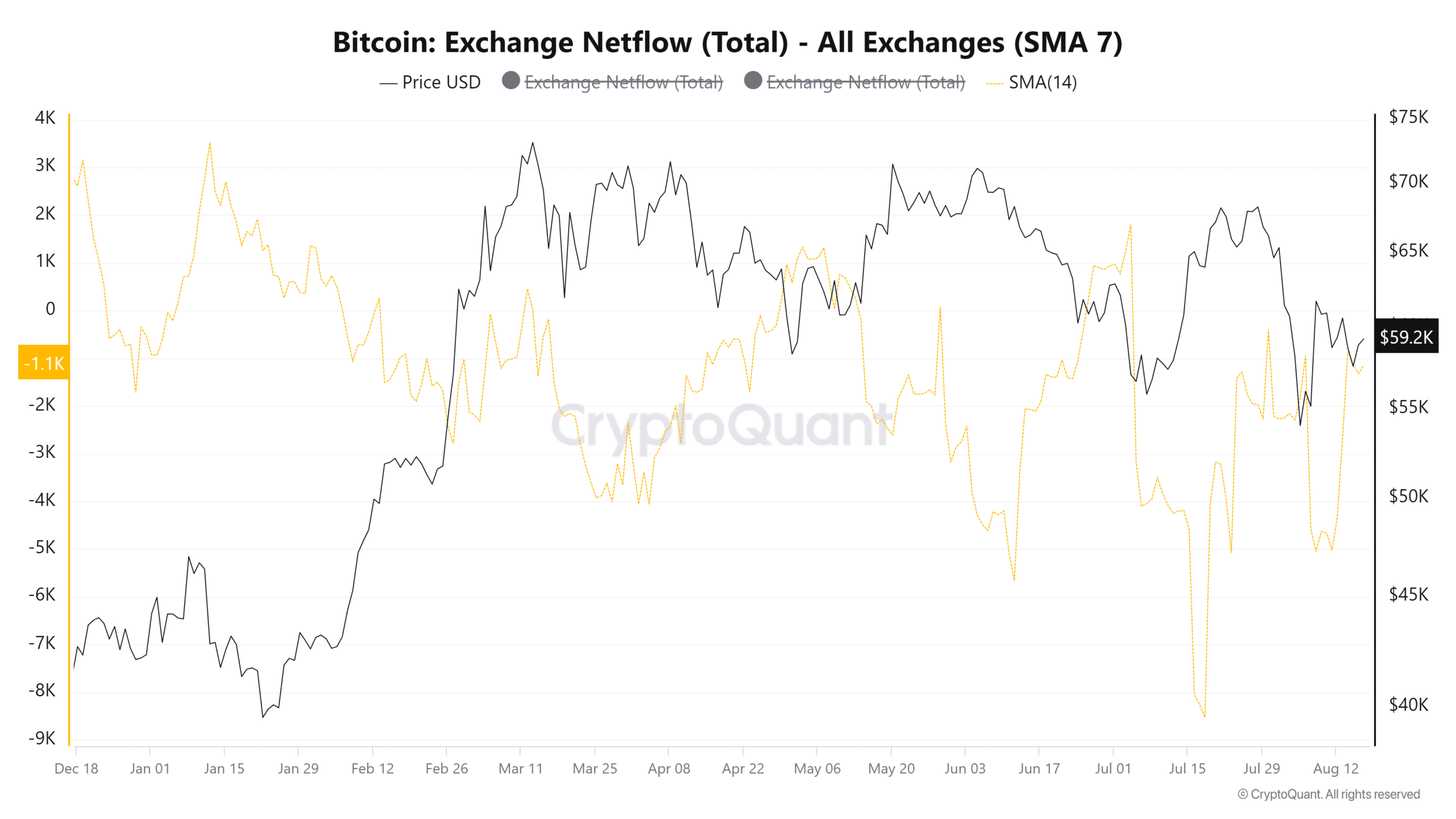

Source: CryptoQuant

Stablecoin reserves have been on the rise, indicating increasing buying power in the crypto market. Following the sharp price drop on August 5th, BTC netflows turned negative, suggesting accumulation as coins moved off exchanges.

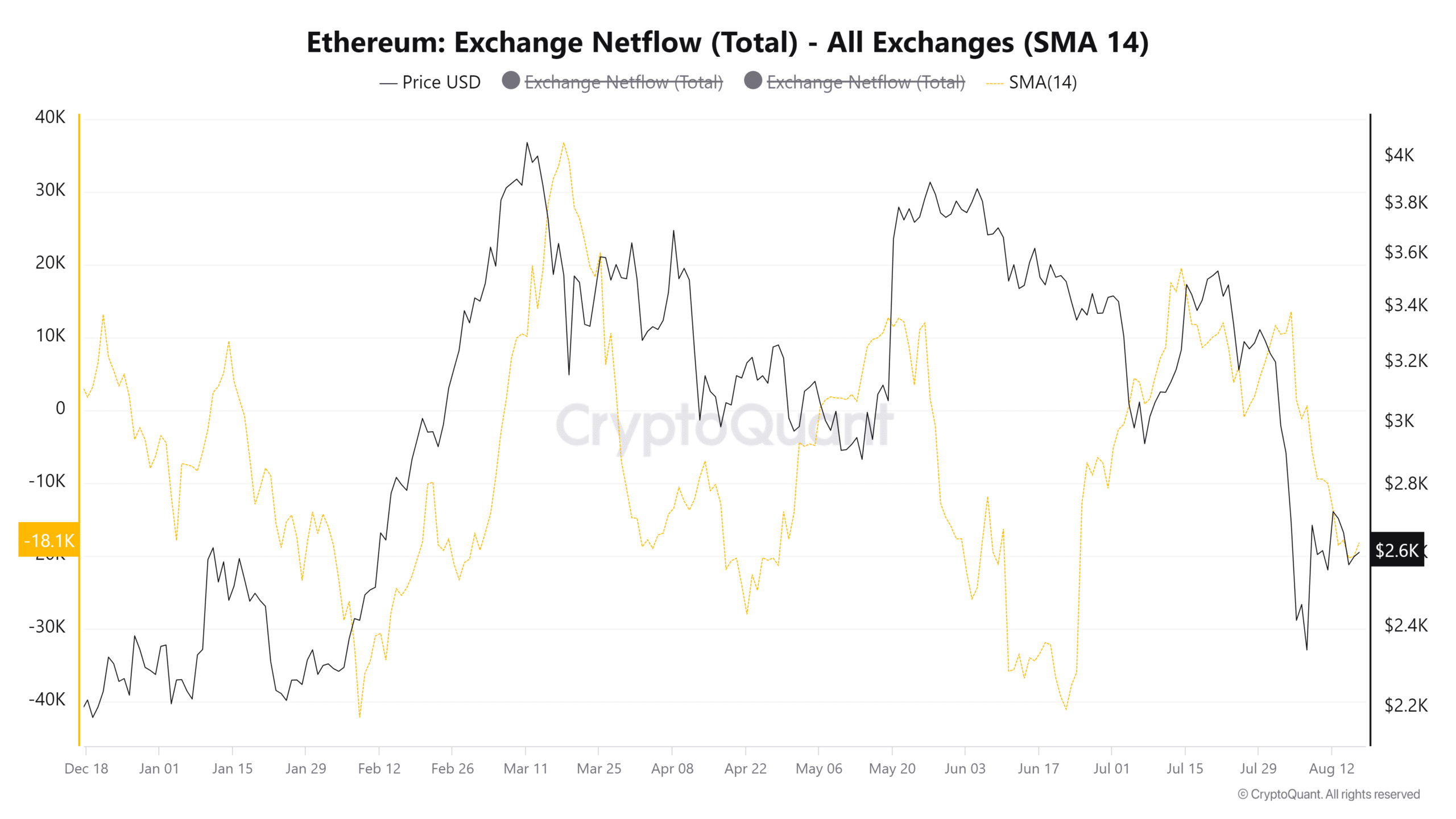

Source: CryptoQuant

ETH has also witnessed consistent accumulation since late July, with its netflow trend showing more stability than that of BTC.

This suggests that Ethereum’s accumulation has been more consistent compared to BTC, indicating a stronger investor sentiment towards ETH.

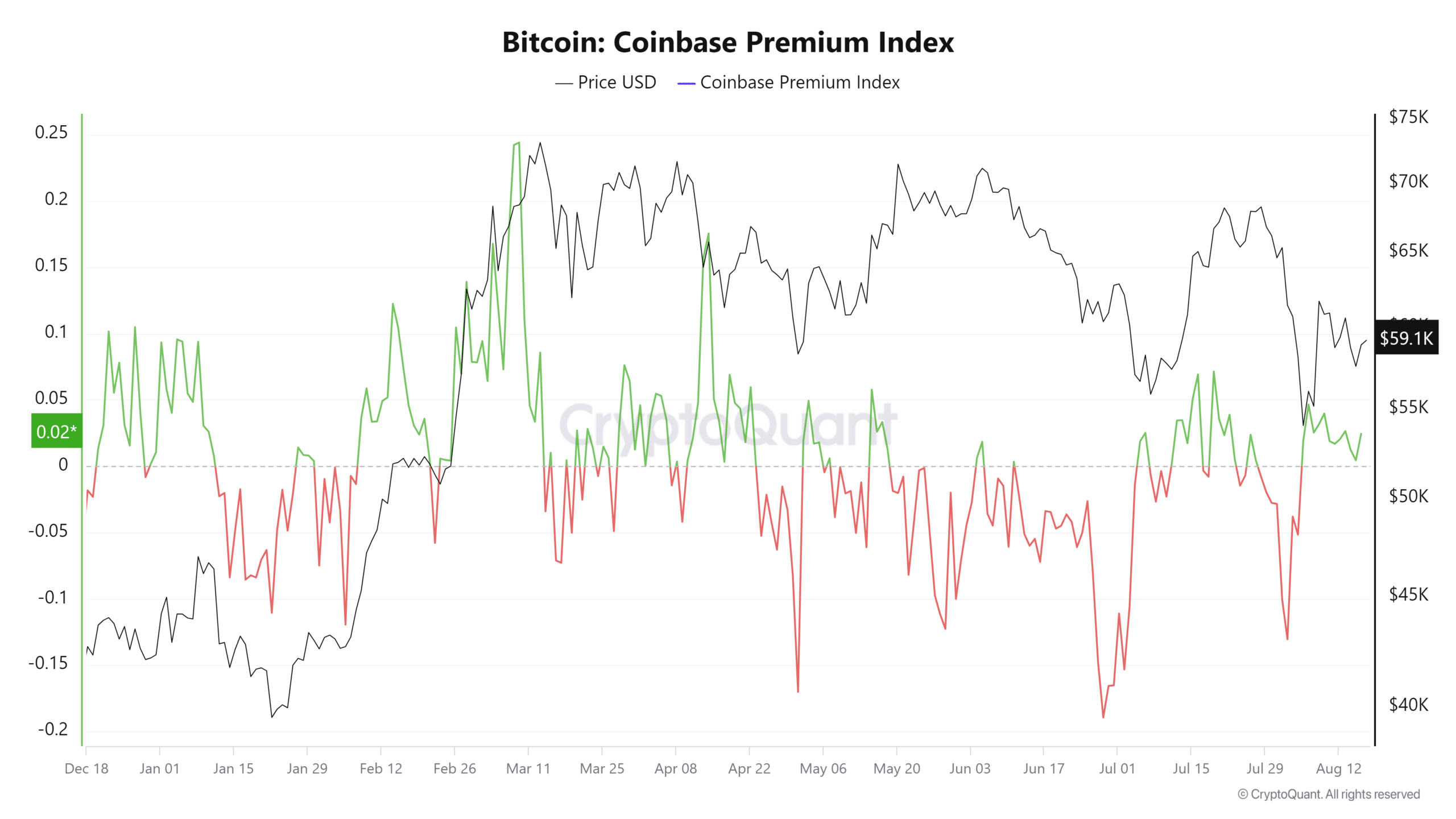

Source: CryptoQuant

The Coinbase Premium for both Bitcoin and Ethereum remains positive, indicating a higher demand from U.S.-based investors. However, the premium for BTC has declined in the past two weeks.

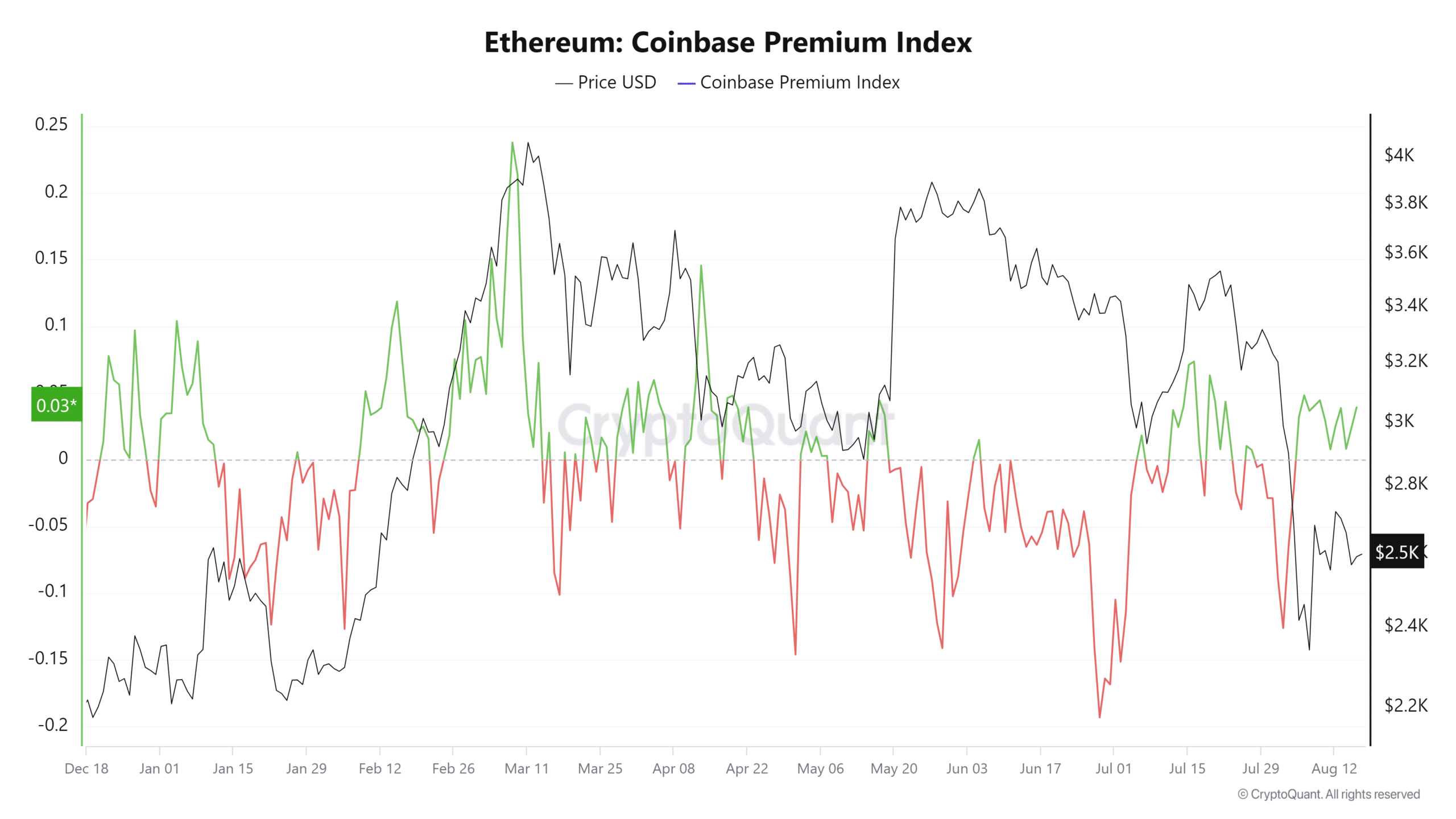

Source: CryptoQuant

On the other hand, the Ethereum Coinbase Premium has remained slightly more positive, indicating stronger demand for ETH compared to BTC over the past ten days.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Overall, Ethereum seems to have an edge over Bitcoin based on the analyzed metrics. While BTC holds the advantage in price action, both cryptocurrencies are showing bearish trends on selected timeframes.

A breakthrough above the key resistance levels at $60k and $2.6k could instill confidence in the crypto market.

phrase “the quick brown fox jumps over the lazy dog” as “the swift brown fox leaps above the sluggish dog”.