- Bitcoin’s yield has now surpassed that of U.S. 30-year Treasury Bonds, enhancing its attractiveness as a macro hedge.

- Senator Lummis and former Treasurer Rios have thrown their support behind Bitcoin as a potential reserve asset, bolstering long-term bullish sentiment.

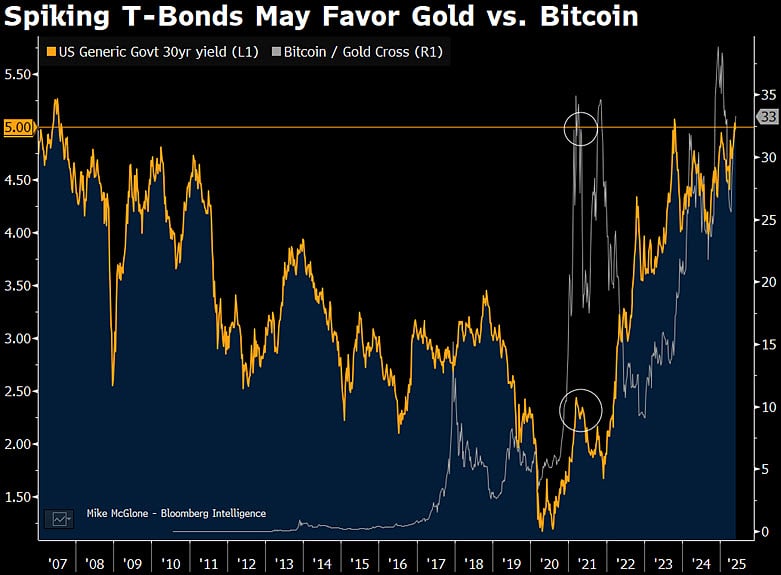

Bitcoin’s [BTC] yield has exceeded that of the 30-year U.S. Treasury Bond, marking a significant macro indicator that cannot be ignored.

This development is fueling speculation that Bitcoin may have more value than just being a speculative instrument.

As traditional bond yields lag behind, institutional investors are finding it increasingly difficult to overlook Bitcoin.

Furthermore, the divergence in yields is not an isolated incident. It coincides with Bitcoin’s price behavior mirroring that of gold, solidifying its position as “digital gold.”

Source: X

Gold and Bitcoin moving in sync

The significant observation here is the increasing correlation between gold and Bitcoin, with both assets now moving more closely together. This is not merely a technical coincidence; it reflects a shift in investor behavior.

The appeal of Bitcoin as a hedge is gaining widespread recognition.

Source: Newhedge

Senator Lummis and U.S. Treasurer endorsing BTC

U.S. Senator Cynthia Lummis made headlines when she suggested that the U.S. should aim to hold 5% of the global Bitcoin supply, similar to its gold reserves.

She was not alone in expressing this sentiment.

Former U.S. Treasurer Rosie Rios further fueled the discussion with her statement,

“Bitcoin is not going away… The momentum is building.”

These public statements by prominent figures are seen as early signs of government interest. They also capture the market’s nascent consideration of a future where BTC could be part of national reserves.

Open Interest surges as institutions embrace Bitcoin

Since early May, Bitcoin’s Open Interest has seen a sharp increase, indicating a rising demand from institutional investors.

With yields surpassing long-term bonds and growing political backing, Bitcoin is emerging as a serious contender for reserve asset status.

This setting lays the foundation for a potential long-term bullish breakout. The confluence of macroeconomic shifts and vocal government support could propel Bitcoin’s price even higher.

Source: CryptoQuant

What lies ahead for Bitcoin?

As Bitcoin continues to outperform traditional assets and strengthens its connection to gold, it is being reconsidered in a new context.

If politicians persist in advocating for its inclusion in reserves, Bitcoin could follow a trajectory similar to that of gold.

above sentence:

Please rewrite the sentence.