This article is also available in Spanish.

XRP has experienced a significant amount of selling pressure in the past few hours, leading to a drop in price to new local lows around $2.65. This decline comes after a period of increased volatility in the wider cryptocurrency market. While the long-term outlook for XRP remains positive, the recent drop highlights risks that investors need to keep a close eye on.

Related Reading

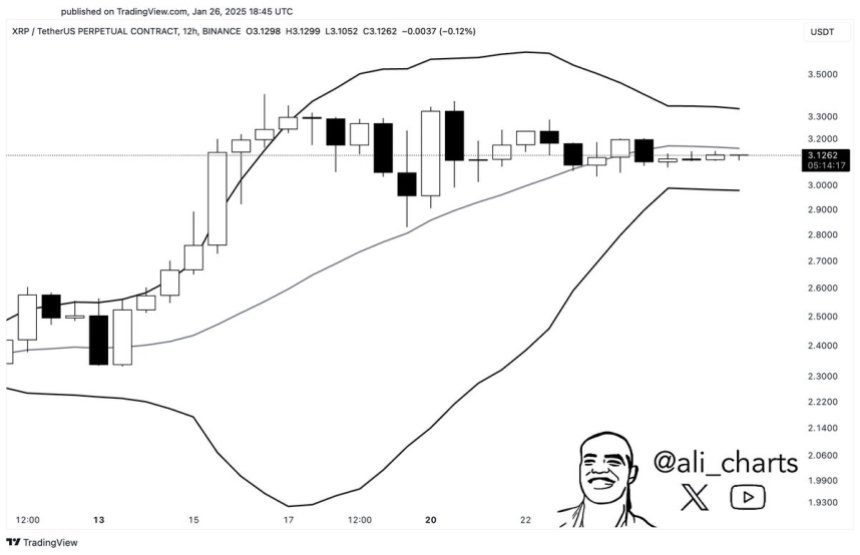

Renowned analyst Ali Martinez provided insights on X, pointing out a crucial development on XRP’s daily chart. He noted that the Bollinger Bands, a popular technical analysis indicator, were tightening before the drop. This “squeezing” pattern often indicates a significant price movement, signaling a shift in market dynamics.

As XRP crossed key demand levels, traders are speculating about the next potential move. Some view this as a temporary setback within a larger bullish trend, while others caution that continued selling pressure could lead to further declines.

Currently, XRP is at a crucial juncture. Investors and analysts are closely monitoring signs of stabilization and a possible rebound, which are essential for maintaining confidence in the token’s long-term trajectory. The upcoming days will reveal whether XRP can regain momentum or continue to face downward pressure.

XRP Faces Intense Volatility Amid Speculation

XRP has been at the center of market activity, with significant price swings dominating recent weeks. The cryptocurrency has experienced considerable volatility, and analysts anticipate even more aggressive movements in the coming days. Despite the turbulence, many investors see this as a strategic opportunity, remaining optimistic about XRP’s long-term growth potential.

Top crypto analyst Ali Martinez recently shared a key technical insight on X, highlighting tightening Bollinger Bands on XRP’s daily chart. This pattern is often associated with periods of reduced volatility followed by sharp price movements. As expected, the anticipated move occurred, resulting in a significant price drop of over 15% in just a few hours.

This sharp decline has raised concerns about XRP’s immediate future. While many remain positive about the long-term outlook, the recent drop has sparked worries that XRP may be entering a deeper consolidation phase. Such phases are often necessary for market recalibration but can test investor patience and resilience.

Related Reading

The current market sentiment is mixed, with bullish investors viewing this period as a potential accumulation phase. Analysts are monitoring key technical indicators to determine whether XRP is primed for a rebound or further downside. The next few days will be crucial in shaping XRP’s trajectory and whether it can uphold its reputation as a resilient player in the crypto space.

Signs of Recovery Amid Recent Volatility

XRP is currently trading at $2.76 after a sharp drop to the $2.65 level during recent market turbulence. Despite the downturn, the price has shown resilience, bouncing back approximately 5% in the past few hours. This recovery has instilled a sense of cautious optimism among investors and traders.

To regain momentum and steer XRP back towards bullish territory, it is crucial for bulls to hold above the critical $2.80 level. This level has become a key threshold for maintaining upward pressure and preventing further downside. A strong defense of this level could pave the way for a broader recovery, attracting new buying interest and improving market sentiment.

Related Reading

While the long-term outlook for XRP remains positive, the current market conditions are characterized by uncertainty and heightened volatility. Traders are closely watching for confirmation of strength above the $2.80 level, indicating that bulls are taking charge. Failure to hold this level could lead to a retest of the recent $2.65 lows, potentially triggering a deeper consolidation phase.

Featured image from Dall-E, chart from TradingView