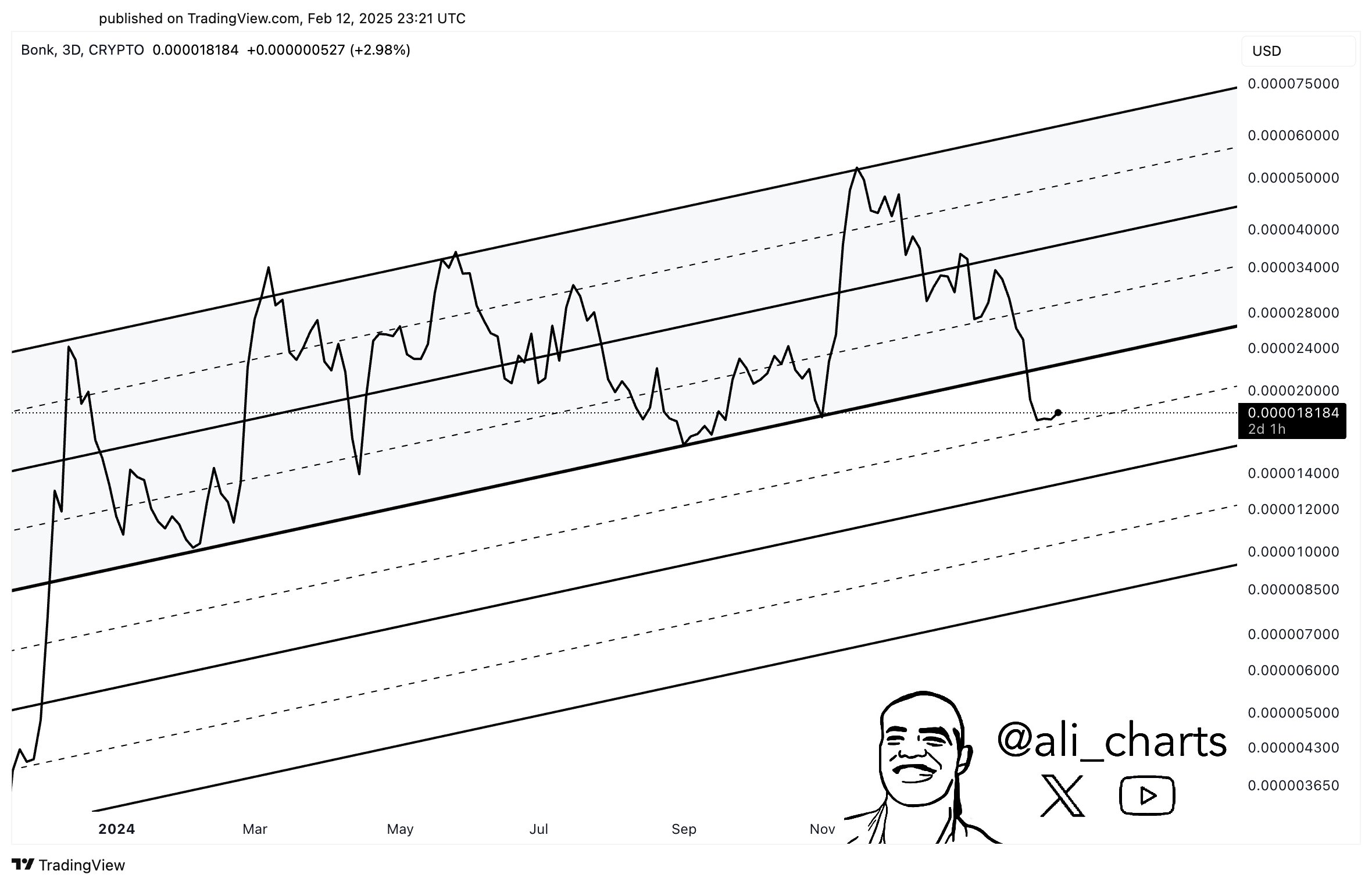

- BONK recently broke out of its previous price structure, indicating a potential move towards $0.000009

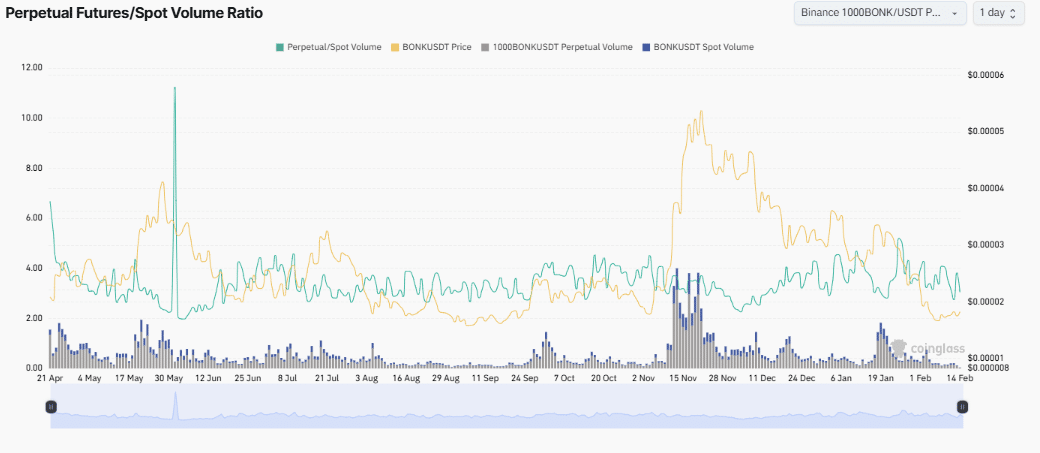

- The perpetual futures to spot volume ratio chart for Memecoin provided further insights into market activity

The cryptocurrency market experienced significant price volatility, with BONK gaining attention from investors due to its price structure breakout. The movement of BONK suggests a potential move towards $0.000009 on the charts.

Development of a bullish trend

The MACD indicator for BONK showed a clear signal of momentum shifting in favor of buyers. The chart indicates a bullish crossover as the MACD line crossed above the Signal line, signaling positive momentum for the memecoin market.

Source: CoinGlass

This shift typically precedes price increases as buying momentum accelerates. The bullish crossover combined with the price breakout in BONK suggests a potential move towards $0.000009.

The growing momentum of BONK indicates potential upside and a higher target on the charts if the trend continues.

Factors that could drive BONK higher

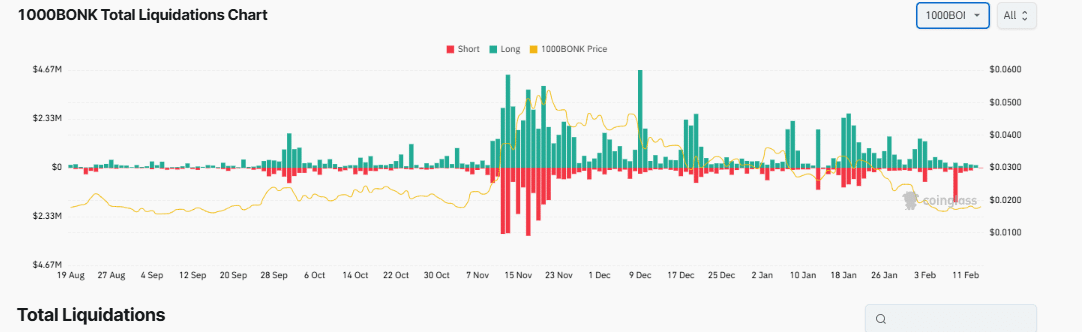

The total liquidations chart for BONK revealed insights into market sentiment and potential price impact. Recent data showed a significant increase in both long and short liquidations, with short liquidations surging after the price structure break.

Source: Coinglass

An increase in short liquidations can lead to a short squeeze, where forced closures of bearish positions drive upward pressure on prices.

According to analysis, as short positions close, buying activity is expected to increase, boosting BONK’s price. The liquidation pattern supports this bullish sentiment and the potential hike to $0.000009.

Signs of speculative activity for potential growth

The perpetual futures to spot volume ratio chart for BONK showed an increase, indicating greater interest in futures trading associated with speculative activity.

Source: CoinGlass

This increase in futures trading aligns with the price structure breakout, indicating heightened anticipation. Traders may be positioning for a price surge, using leverage to capitalize on the expected shift.

Supporting factors for BONK’s growth

The bid and ask delta, along with Open Interest, provided additional insights into market depth and trader sentiment. Consistent activity in Open Interest, with occasional spikes, indicates sustained interest in BONK’s futures contracts.

The bid-ask delta highlights periods of higher buying interest over selling interest, suggesting underlying bullish sentiment. These signals, combined with the price breakout and other indicators, point to a favorable environment for BONK moving forward.