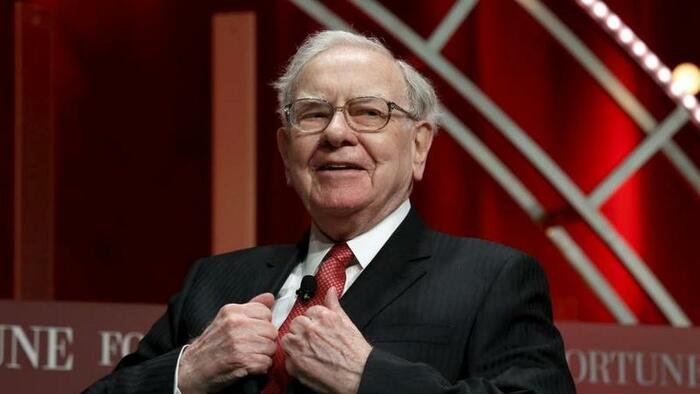

Warren Buffett, the legendary investor and CEO of Berkshire Hathaway, has announced his decision to step down from his position at the end of the year. This marks the end of an era for America’s largest hedge fund/private equity/insurance conglomerate. Greg Abel, the vice chairman for non-insurance operations, has been named as Buffett’s successor. The news was met with a standing ovation from the thousands of Berkshire shareholders at the annual pilgrimage to Omaha.

Buffett, along with his long-time partner Charlie Munger, has built Berkshire Hathaway into a business valued at over $1.16 trillion. Their investing prowess has yielded impressive returns for shareholders, outperforming the S&P 500 by a wide margin. Buffett’s strategic acquisitions and stock picks have made Berkshire a diverse conglomerate with interests in various industries, from insurance to energy to retail.

Despite facing challenges such as a drop in operating earnings and a decline in insurance profits, Berkshire remains a formidable force in the business world. Buffett’s careful management of the company’s cash hoard and strategic decisions regarding stock buybacks have ensured its stability and growth.

As Buffett prepares to pass the torch to Greg Abel, the future of Berkshire Hathaway remains bright. With a strong portfolio of businesses and a record cash reserve, the company is well-positioned to continue its legacy of success. Buffett’s legacy as a master investor and capital allocator will undoubtedly endure, shaping the future of Berkshire for years to come.