- Avalanche is showing signs of potential growth, with historical trends suggesting it could surpass $100 in the long run.

- The upcoming final AVAX token vesting unlock on August 20th may drive a rally in its price.

Following a market-wide downturn that saw its price drop to $17.29, Avalanche [AVAX] is now on the road to recovery.

Currently priced at $21.07 with a market cap exceeding $8.2 billion, AVAX has seen a 2.05% increase and a 30% rise in trading volume, indicating potential for a rally.

Anticipating AVAX’s Surge to $100

Crypto analyst Kaleo pointed out the strengthening ETH/BTC ratio as a positive sign for Avalanche and other layer 1 EVMs, setting the stage for a possible rally.

The ETH/BTC ratio reflects Ethereum’s performance relative to Bitcoin, with an increasing ratio suggesting growing interest and momentum in Ethereum and platforms like Avalanche.

Kaleo’s analysis indicates that Avalanche is at a critical juncture similar to before the 2021 rally that pushed its price to $147.

Source: X

The analyst predicts a potential surge in AVAX’s price, mentioning a crucial fundamental catalyst that could support the rally.

“Pump to start the year, bleed off, send to $100+.”

In addition to technical indicators, Kaleo highlights the final major AVAX token vesting unlock on August 20th as a significant factor that could contribute to the projected price increase.

This last unlock is viewed positively, signaling stability in Avalanche’s token distribution strategy and boosting investor confidence.

While Kaleo is optimistic about AVAX, AMBCrypto delves into other fundamental factors affecting its performance.

Evaluating Avalanche’s Fundamentals

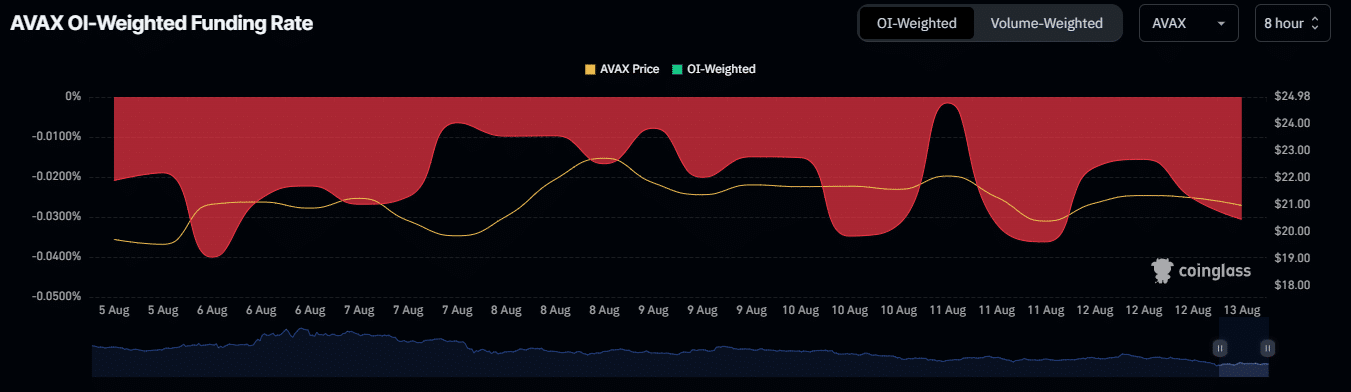

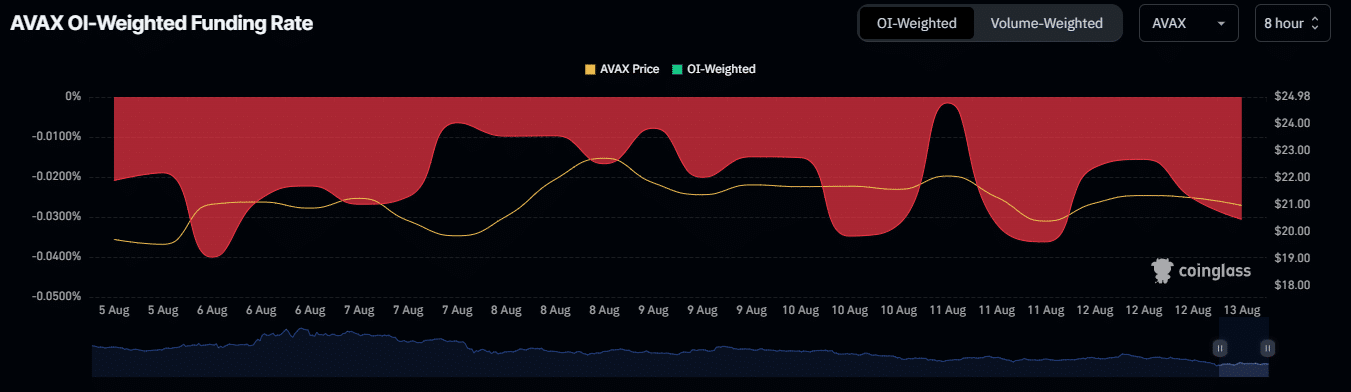

AMBCrypto analyzes Avalanche’s open interest and OI-weighted Funding, revealing mixed signals in the current market environment.

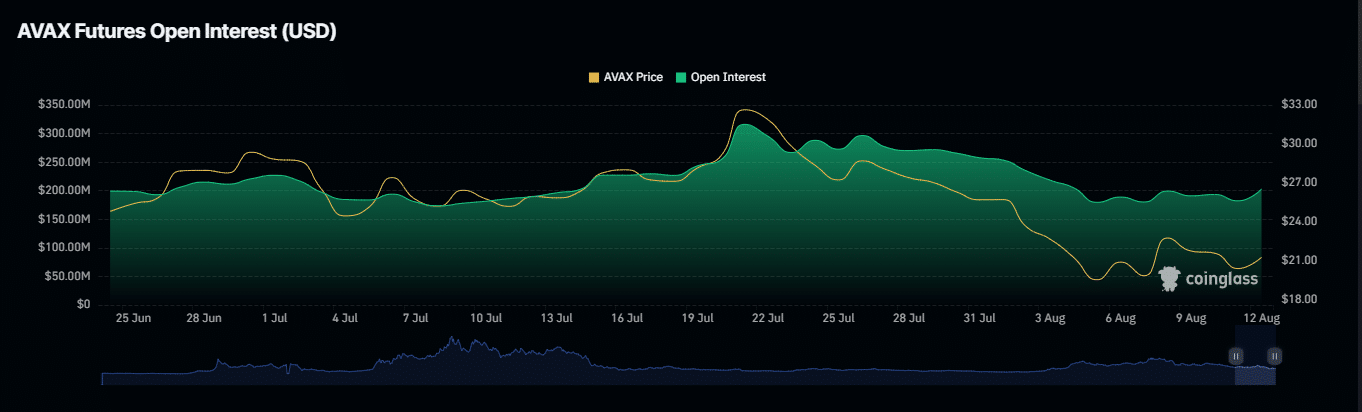

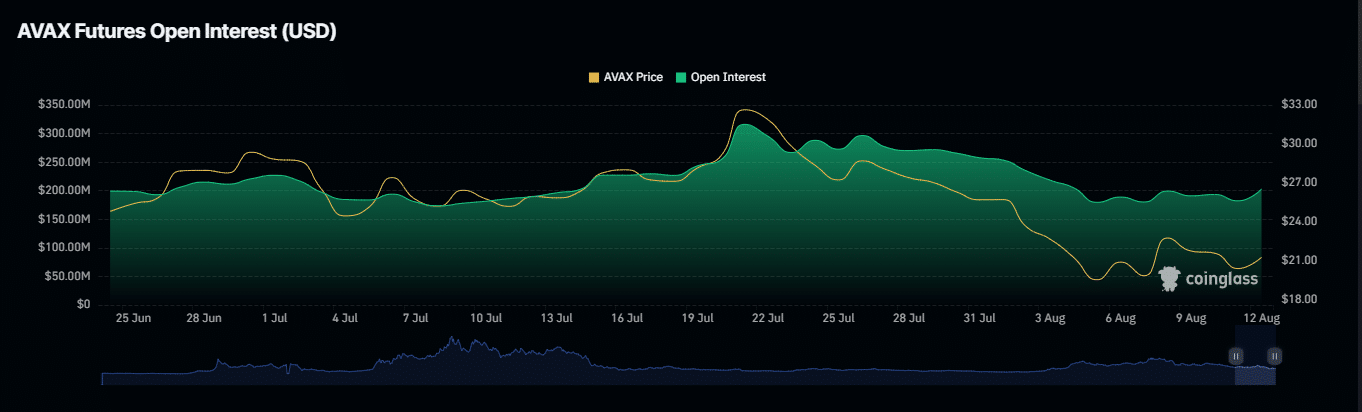

Despite a predominantly negative OI Funding Rate indicating bearish sentiment, the Open Interest has been steadily increasing since early August.

Source: Coinglass

An uptick in Open Interest signifies increased market participation and liquidity, potentially leading to a price upsurge.

Is your portfolio green? Check out the AVAX Profit Calculator

As of the latest data, the Open Interest has grown by 8.14%, reaching $202.11 million.

Source: Coinglass

The growing Open Interest indicates a potential influx of new capital and increased market activity, which could lead to a rise in price.

following sentence in a more concise manner:

“The company is currently in the process of reviewing all potential candidates for the position.”

“The company is reviewing all potential candidates for the position.”

![Can Avalanche [AVAX] return huge gains? Here’s what to know](https://doorpickers.com/wp-content/uploads/2024/08/ABDUL-WEBP-1000x600.webp)