- FLOKI has mirrored BNB’s structure and broken through the 200MA, although the RSI is currently oversold.

- FLOKI is absorbing sell-side liquidity on the 4-hour chart, but trading volume remains stagnant.

FLOKI, a prominent memecoin, has been garnering significant interest from the crypto community due to its success on both the Ethereum [ETH] and Binance Coin [BNB] chains.

Following substantial gains in its previous bull run, FLOKI formed a double top pattern and entered a consolidation phase similar to BNB’s before its surge.

Currently, FLOKI is exhibiting a structure on the daily timeframe that resembles BNB, raising expectations for a potential replication of BNB’s past success.

Source: TradingView

Investors are closely monitoring FLOKI’s price action for a potential upward movement in anticipation of a bull run in Q4 of 2024.

Despite dipping below the 200-day exponential moving average, the RSI being in the oversold territory suggests the potential for a rally, presenting a buying opportunity for investors.

Analysts predict a parabolic move for FLOKI, with expectations of reaching a $10 billion market cap in the near future.

Based on date and price range analysis, a new all-time high for FLOKI is anticipated by January 2025, with another peak expected by mid-2025.

Source: TradingView

Sell-side Liquidity Acquisition as Volume Stagnates

On the 4-hour chart, FLOKI is tracing a descending trendline after tapping into sell-side liquidity from two consecutive equal lows.

The strategy for FLOKI is to break above this trendline and then buy on the retest, aligning with previous analyses that indicate an imminent upward move for FLOKI.

Source: TradingView

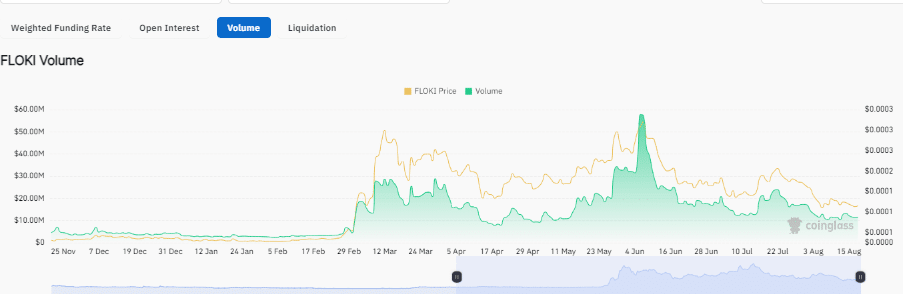

FLOKI’s trading volume has been stagnant at levels observed before its surge to a new all-time high in June.

This lack of movement indicates a potential buying opportunity for investors, as history may repeat itself with FLOKI reaching new highs.

Source: Coinglass

Realistic or not, here’s FLOKI’s market cap in BTC’s terms

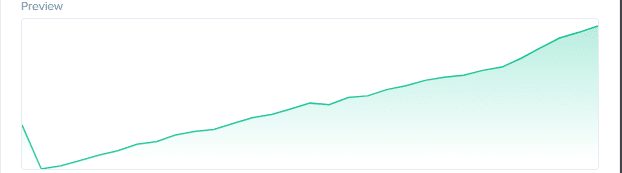

An analysis of social volume, holder count, active addresses, network growth, and profit-to-loss ratio of daily on-chain transactions indicates a rising activity level for FLOKI memecoin.

The increasing trend in these combined metrics signals growing interest and engagement, suggesting potential growth for FLOKI.

Source: Santiment

following sentence: Please be quiet during the presentation.