- Cardano’s technical analysis indicates a bullish breakout, sparking enthusiasm among bulls.

- Despite surpassing $0.4, social sentiment for Cardano remained weak.

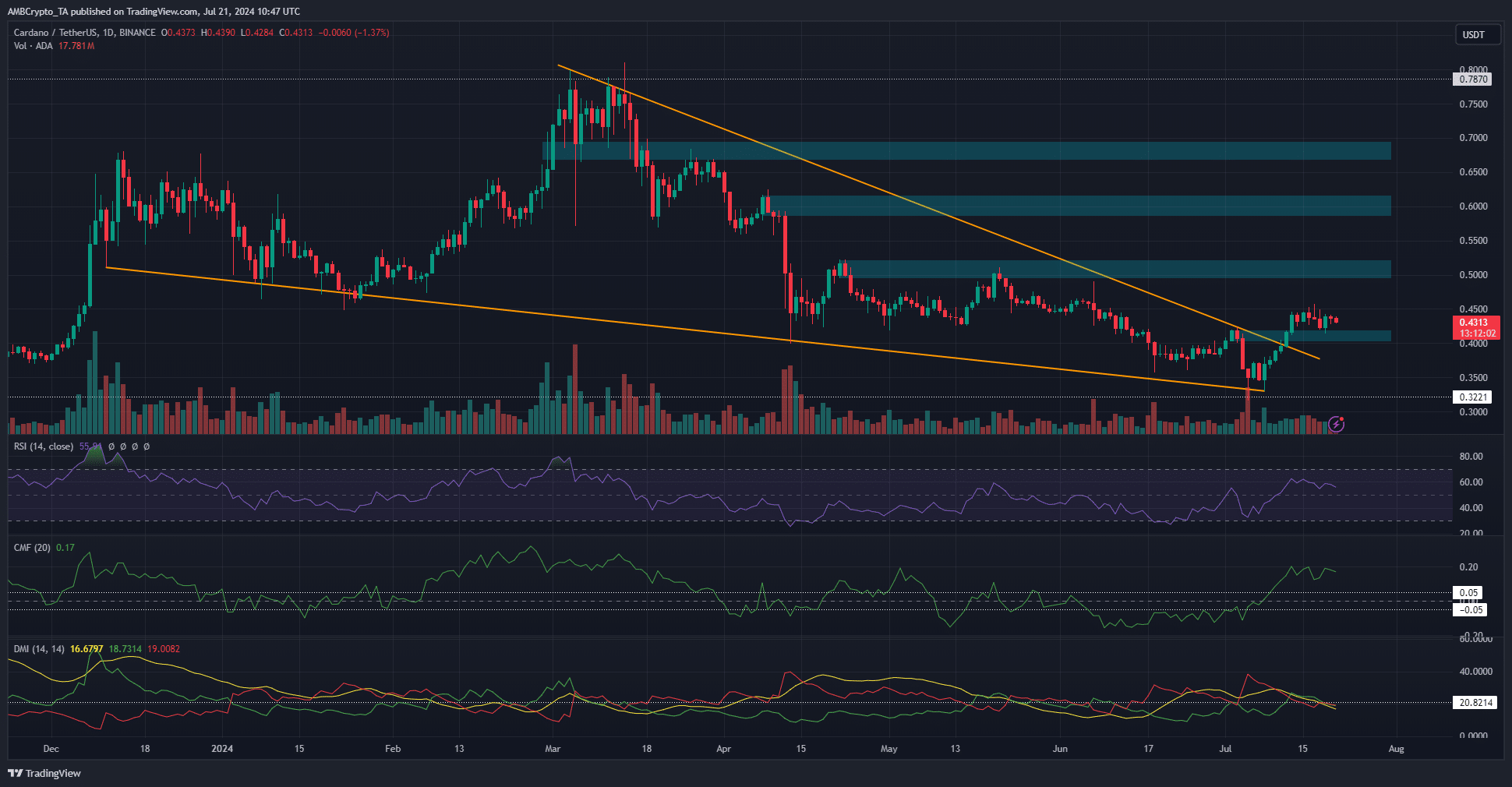

Cardano [ADA] recently broke out of a falling wedge pattern, signaling a potential 70% rally. However, challenges lie ahead for the bullish momentum.

Source: ADA/USDT on TradingView

The daily chart for Cardano displayed a bullish structure, with strong upward momentum in RSI and significant capital flow in CMF.

DMI indicated a potential trend change on July 13th as the DIs crossed over.

The previous resistance at $0.4 now acts as support, suggesting a possible further upward movement if defended by the bulls. AMBCrypto analyzed additional metrics to assess market sentiment.

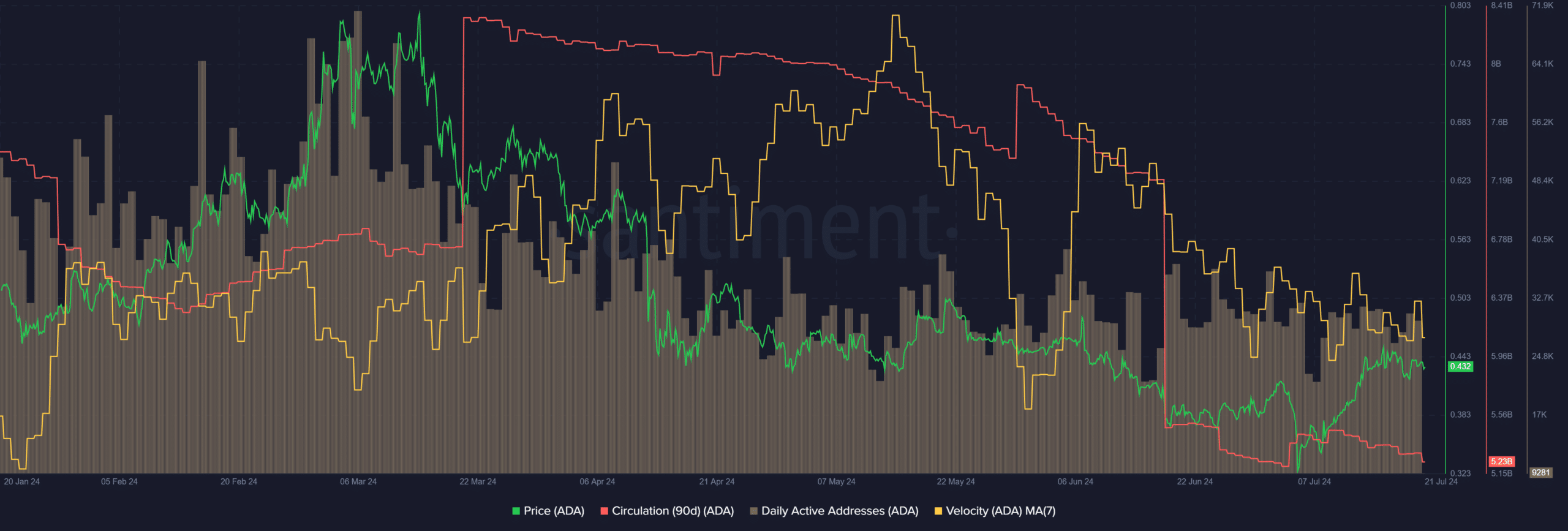

Steady Active Address Count Since April

The daily active addresses have maintained levels between 32k-34k since April, showcasing resilience despite price downtrends since May.

This stability reflects network health and confidence in the blockchain, even during challenging price conditions.

Circulation has significantly decreased in the past two months, indicating scarcity and reduced transactions. Velocity, measuring token turnover, has also declined over the last month.

These trends suggest accumulation and decreased speculation, potentially signaling an upcoming uptrend.

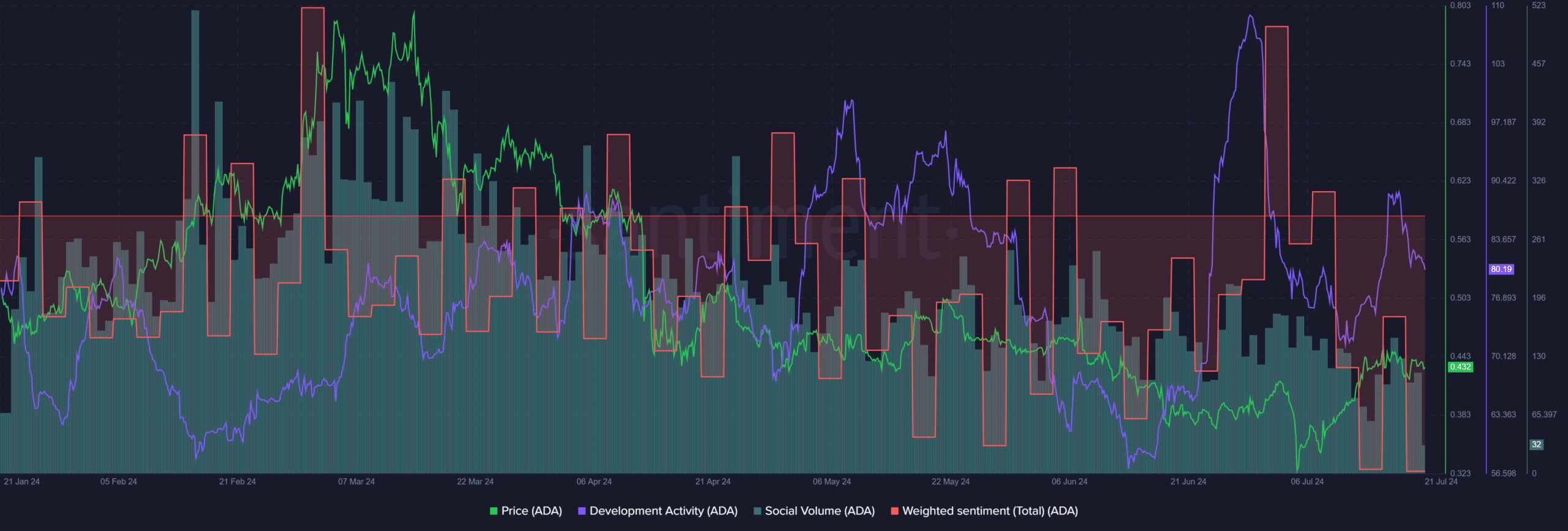

Weakened Social Metrics

Despite the price decline, development activity remained robust, a positive sign for long-term investors. However, the 3-day weighted sentiment was notably negative despite the $0.4 support zone.

Social volume has gradually decreased since early May, indicating subdued social media sentiment not aligning with the bullish momentum.

Explore Cardano’s [ADA] Price Prediction for 2024-25

The upcoming Chang hard fork could propel prices higher with renewed strength. Traders should also be prepared for news impact on price trends.

Evidence suggests a bullish advantage for Cardano, yet social media buzz remains lacking.

Please rewrite the text for me.