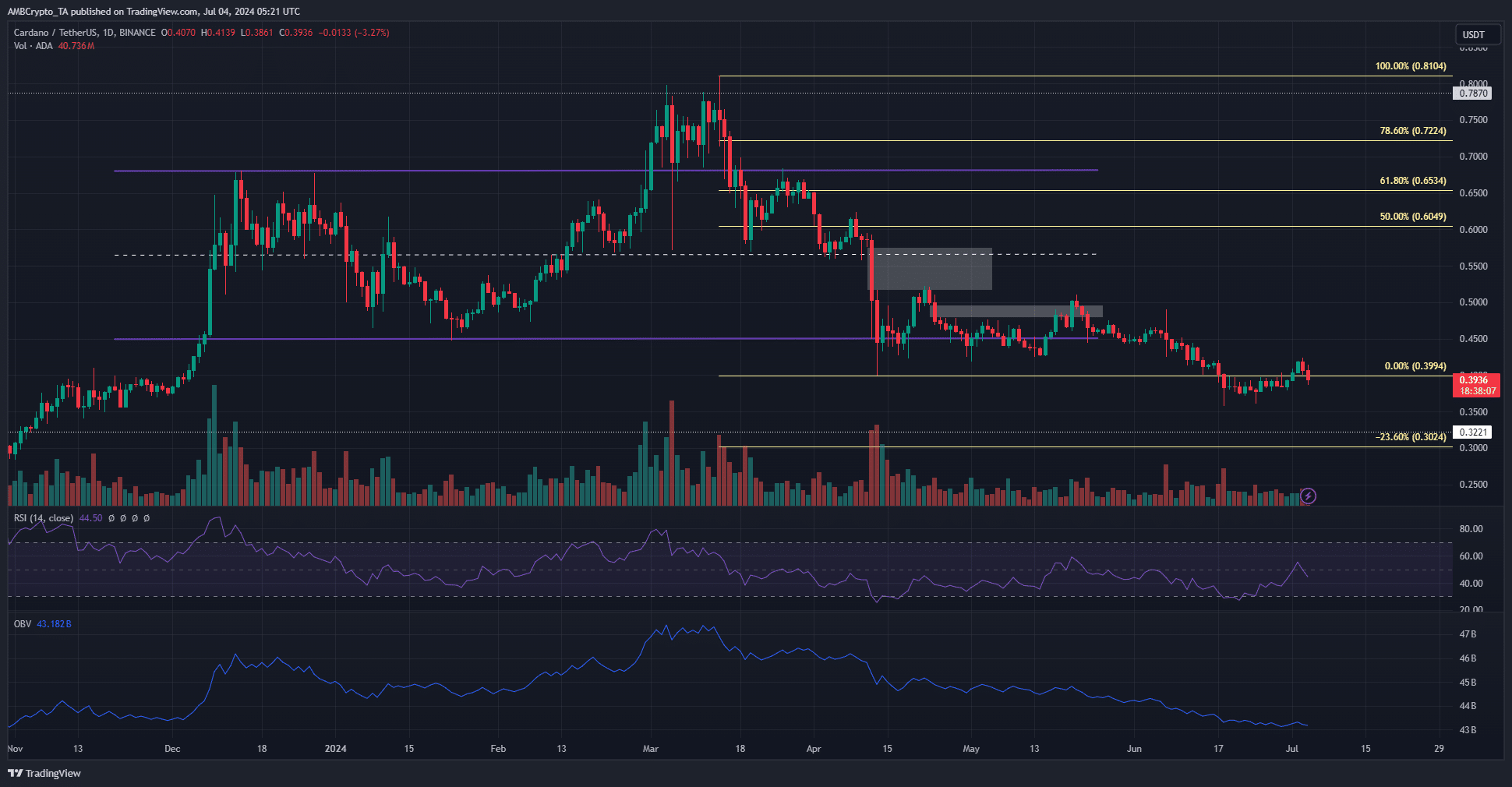

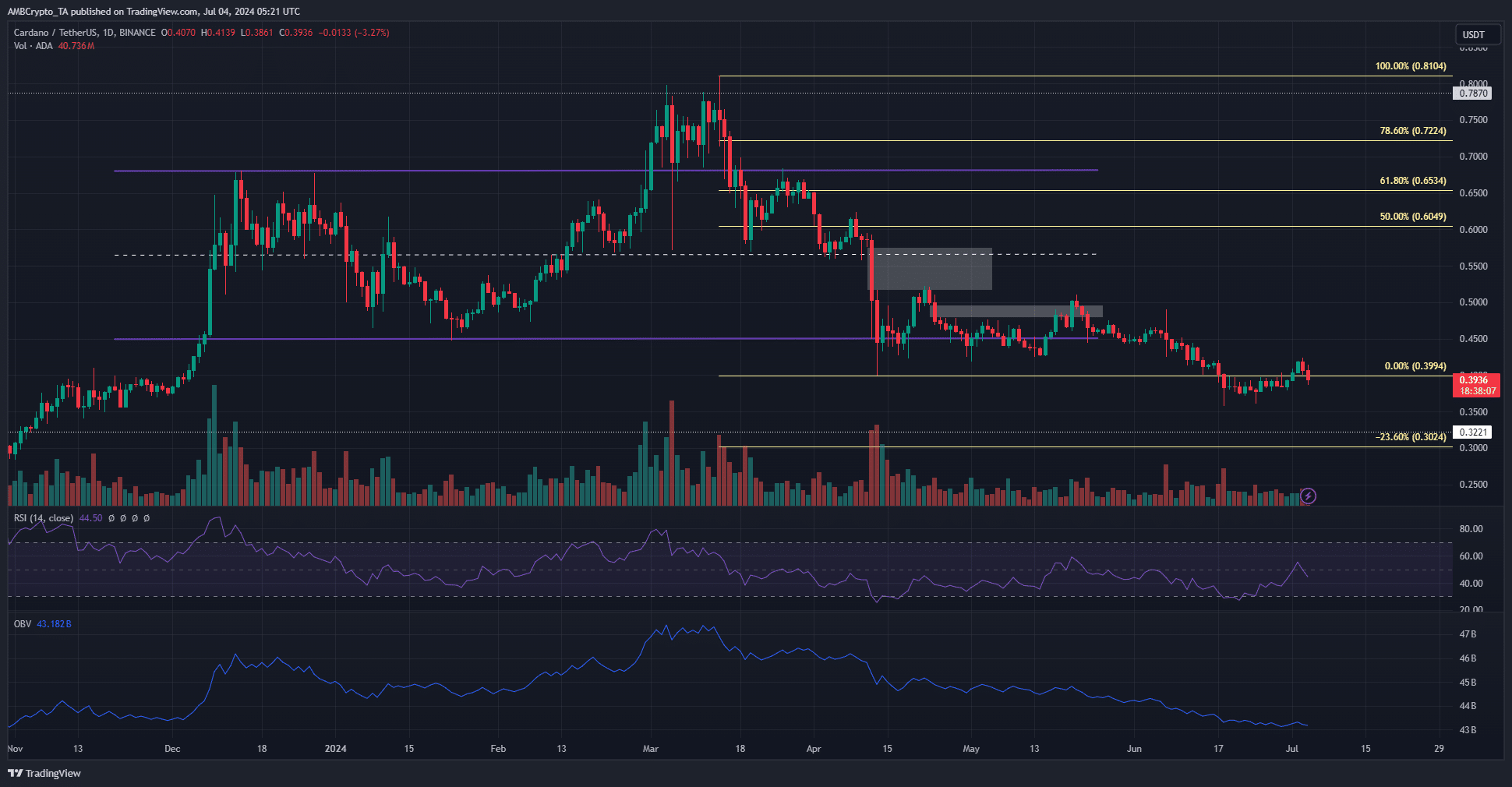

- Cardano’s market structure and technical indicators on the 1-day timeframe were signaling a bearish trend.

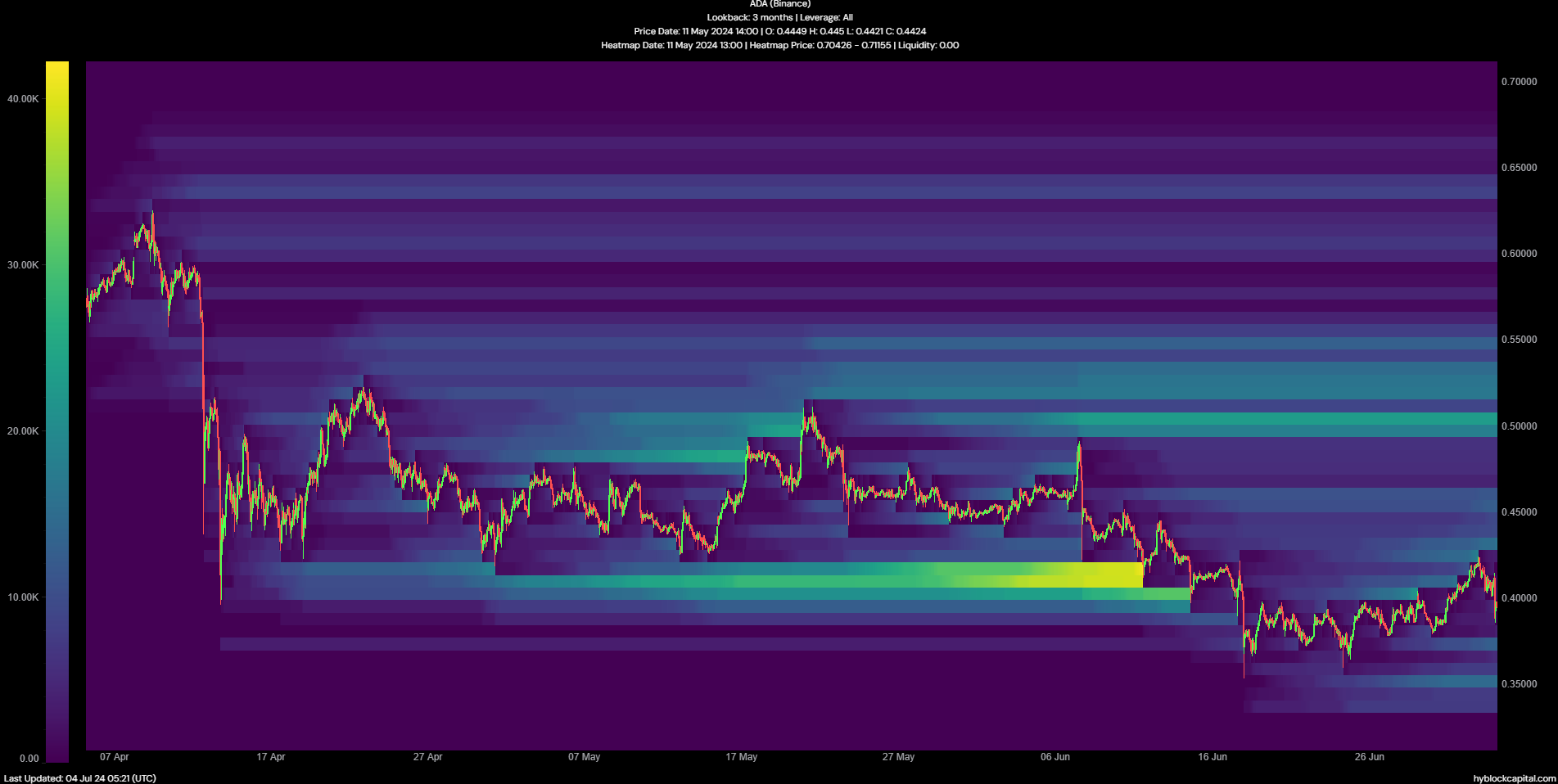

- The liquidation heatmap highlighted important short-term levels to monitor.

Cardano [ADA] has been following a downward trajectory on the price chart. The price prediction for Cardano has been bearish on higher timeframes since the loss of the $0.56 support level in mid-April. In the latter half of June, bears once again showed their dominance.

The support level at $0.4 from mid-April failed to hold, with the price hovering precariously around it. A breakthrough could potentially trigger a significant price drop. Where do sellers aim next?

Cardano Price Prediction Points Towards Further Bearishness

Source: ADA/USDT on TradingView

The range that ADA had maintained from December 2023 to May 2024 was breached and turned into resistance. By referencing the Fibonacci levels during the March price decline, we can identify the 23.6% extension level at the $0.3 support level as the next target for the bears.

Technical indicators on the daily timeframe also leaned towards bearishness. Despite an attempt by the RSI to cross above the neutral 50 mark, it was rejected, confirming the prevailing bearish momentum.

The OBV indicator was on a consistent downtrend, indicating substantial selling pressure and a lack of buying volume, increasing the likelihood of a descent towards $0.3.

Liquidation Heatmap Suggests Potential Range Formation

In early June, the $0.4-$0.415 range attracted significant liquidity with numerous liquidation levels. Although initially tested as support, it eventually succumbed to selling pressure and has now become a resistance zone over the past ten days.

Read Cardano’s [ADA] Price Prediction 2024-25

The liquidation heatmap indicated a buildup of liquidity at $0.427, slightly above the recent high. The $0.35 level also emerged as a point of interest in the short term.

It is conceivable that ADA’s price might fluctuate between the $0.42-$0.37 levels to enhance liquidity above these two zones before consolidating them in the coming weeks.

Disclaimer: The information provided should not be considered financial, investment, trading, or any other form of advice and solely represents the author’s perspective.