- Chainlink exhibited a bearish structure and momentum.

- While the CMF indicated significant buying pressure, the short-term spot demand was weak.

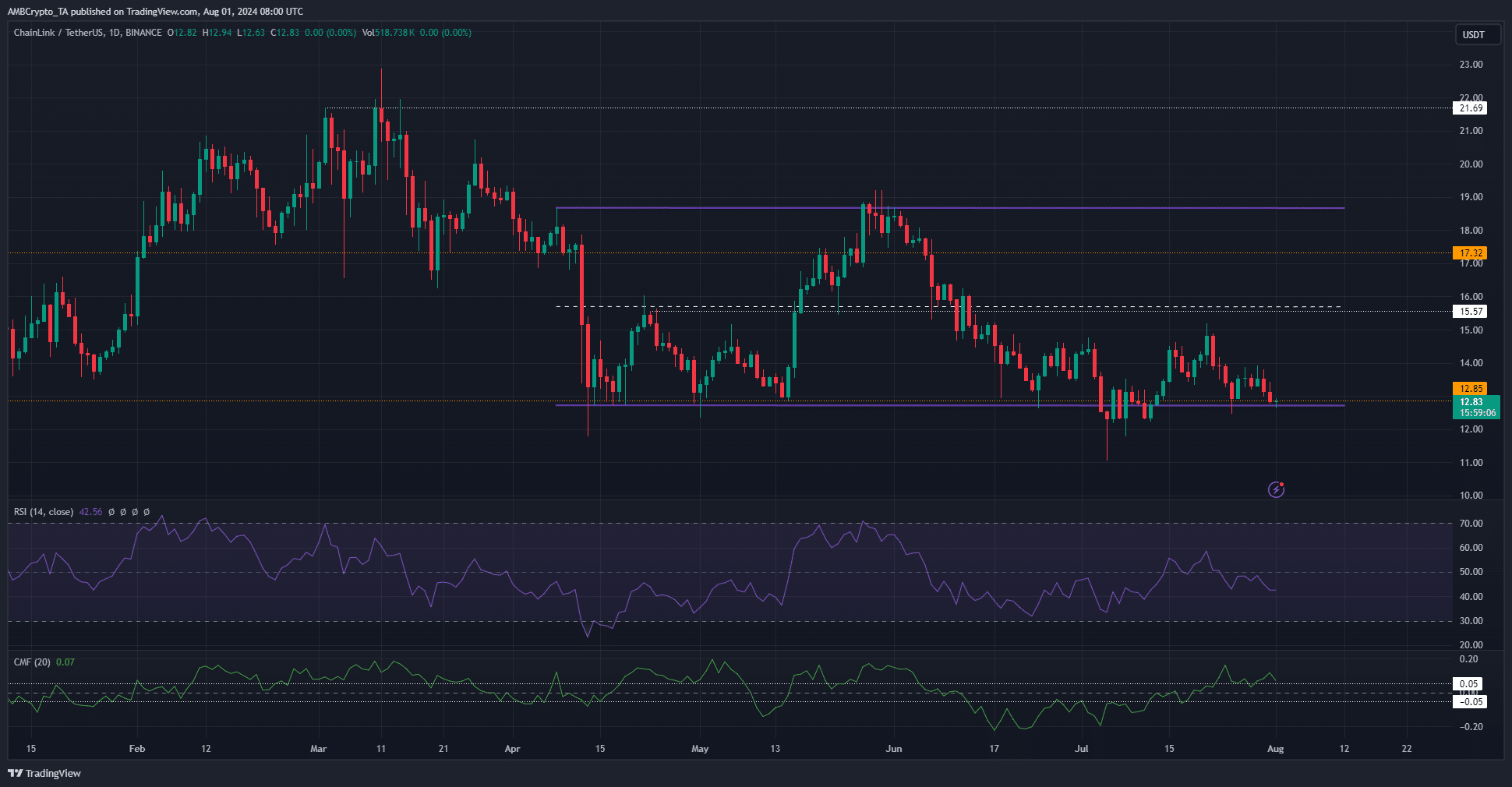

Chainlink [LINK] experienced a bearish trend for most of the period between May and July. On July 21st, a market structure breakout was observed in the 1-day timeframe as LINK surpassed $14.75.

Although price gains were made in mid-July, they were erased in the recent week’s trading. Despite conflicting momentum and volume indicators, a price rebound was expected.

Potential support at range lows

Source: LINK/USDT on TradingView

Since April, Chainlink has traded within a range of $12.73 to $18.68. A bearish sentiment in early July pushed the price down to $11.07, with a brief period of trading at $12.33. Therefore, $12.3 could act as a support zone for a possible reversal in the upcoming days.

Despite the recent price drop, the CMF remained above +0.05, indicating prevailing buying pressure. However, the RSI dropping below the neutral 50 level suggested a shift towards bearish momentum.

These conflicting signals, along with the range lows, indicate a potential recovery by the bulls in the coming week, although caution is advised.

Bearish short-term price prediction for Chainlink

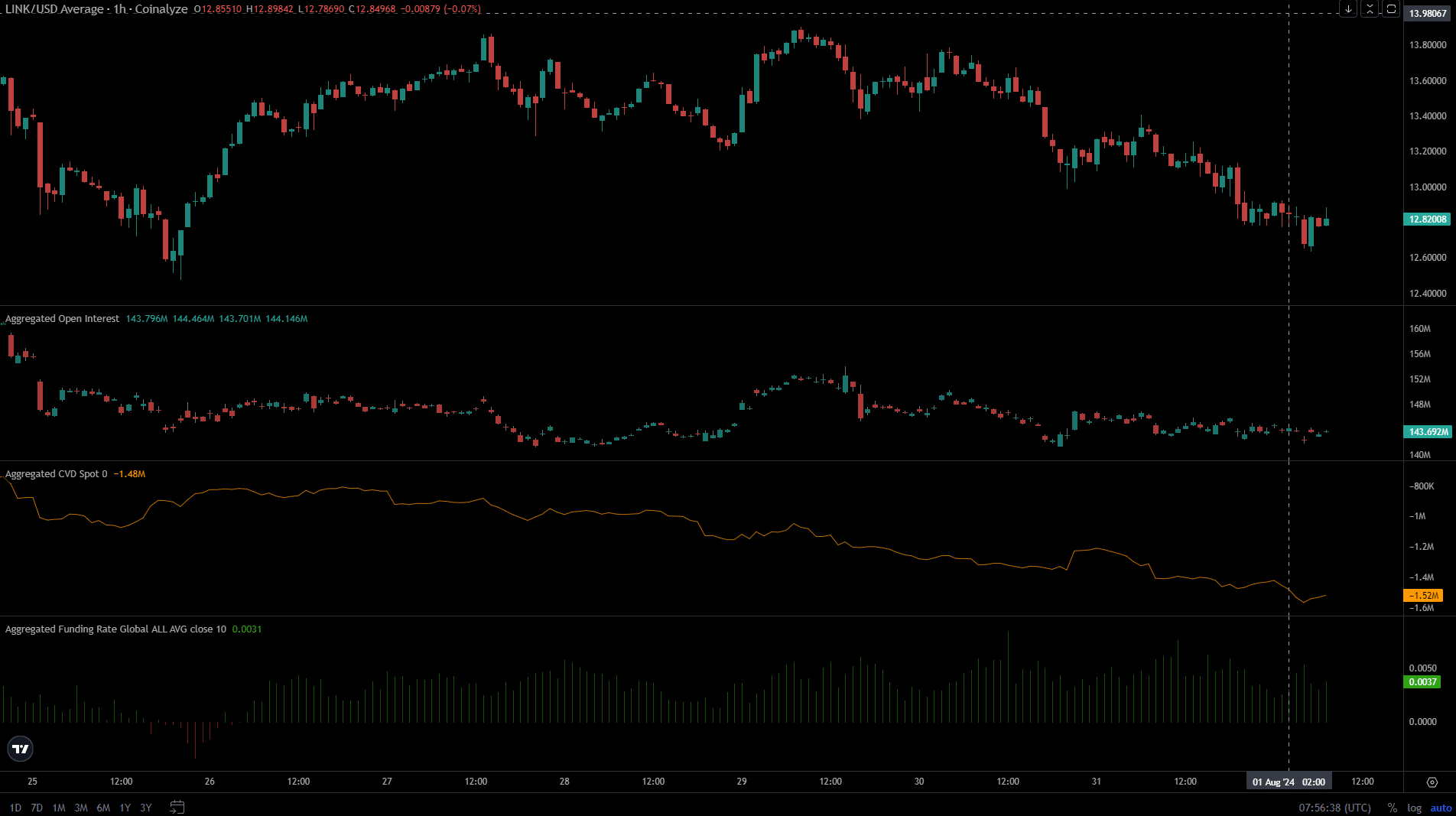

Over the past three days, LINK’s price has gradually declined, accompanied by a drop in Open Interest from $152 million to $143.7 million. The simultaneous decrease in OI and price indicates a bearish sentiment.

Read Chainlink’s [LINK] Price Prediction for 2024-25

Speculators have shown a lack of confidence and reluctance to go long on the token.

The spot CVD has been on a downward trend, signaling weak demand while futures traders maintain a bearish stance. These factors suggest the potential for further losses in Chainlink’s price.

Disclaimer: The information provided is the author’s opinion and does not constitute financial, investment, trading, or any other form of advice.