- There were more than 47,000 active addresses for LINK.

- LINK was showing a slight bullish trend.

Chainlink [LINK] has historically attracted whale investors, especially during times of price volatility. Recent data indicates a continued increase in whale activity, while the number of active Chainlink addresses remains stable.

Chainlink Whales on the Move

Recent data from Lookonchain shows significant activity among Chainlink holders, particularly whales and institutional investors.

93 new wallets have collectively withdrawn around 12.75 million LINK tokens from Binance since June 24th, valued at approximately $167 million.

These movements suggest strategic positioning by large holders, reflecting their long-term confidence in LINK or a response to market conditions.

Increase in LINK Supply to Whales

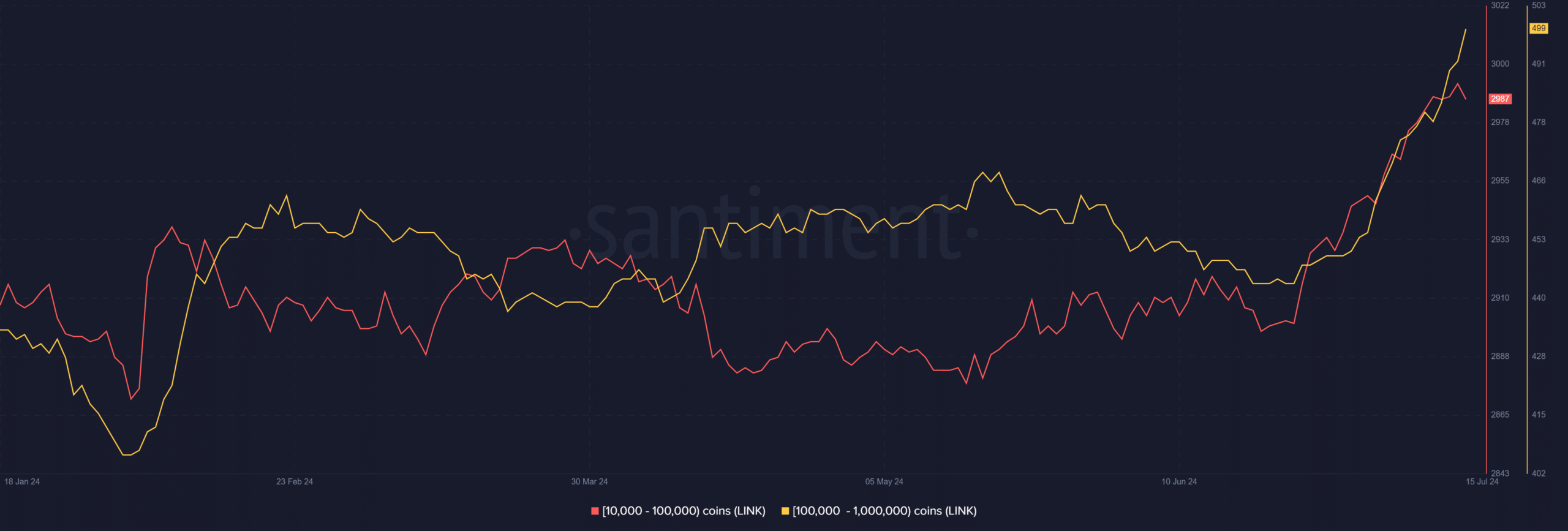

Analysis of Chainlink whale addresses by Santiment reveals a notable change in holdings among larger investors.

Addresses holding between 10,000 and 100,000 LINK tokens increased from 2,946 to 2,987 since July 1st. Similarly, wallets with 100,000 to 1 million tokens rose from 451 to 499 during the same period.

Source: Santiment

In the past two weeks, the total value held by these addresses has increased by approximately $120 million, impacting market liquidity and price stability.

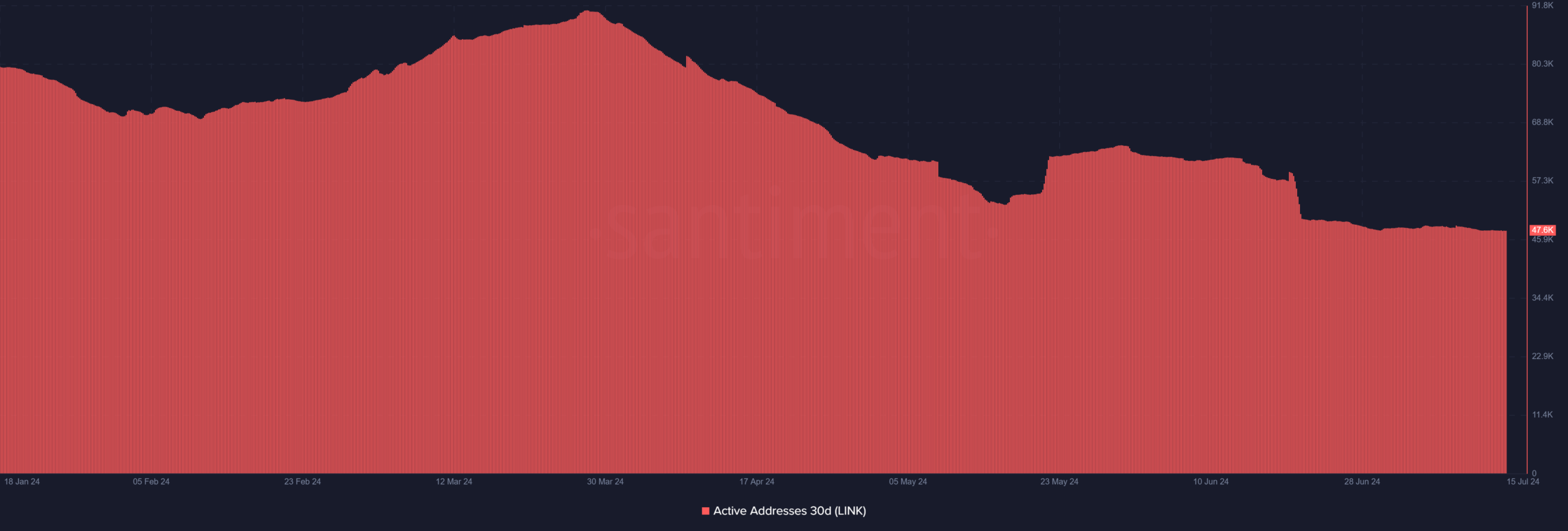

Steady Chainlink Active Addresses

Despite whale activity, the number of active Chainlink addresses has remained steady.

A 30-day analysis by Santiment shows no significant increase in active addresses in recent weeks. The count was around 48,817 at the start of the month and now stands at 47,686.

Source: Santiment

This stability suggests that whale activity has not translated into broader market participation or new entries into the Chainlink market.

Realistic or not, here’s LINK market cap in BTC’s terms

Existing participants seem to be adjusting their holdings strategically rather than expanding the user base, with LINK trading at around $13.7 and a 2% increase.

information in a more concise manner.