- According to analysts at Citigroup, Coinbase’s COIN is expected to experience a 30% surge to reach $345, with regulatory clarity in the crypto industry being a significant driving force behind this prediction.

- The analysts have upgraded Coinbase shares to a ‘BUY’ rating, projecting a potential rally of 33% from its current price of approximately $260.

Citigroup’s analysts, led by Peter Christiansen, believe that the evolving regulatory environment surrounding cryptocurrencies is a key factor in the positive outlook for COIN. This shift is attributed to recent changes in the U.S. election landscape and the Supreme Court’s actions regarding regulatory precedents.

“The regulatory landscape has improved significantly, leading us to revise our view on Coinbase’s regulatory risks.”

With the favorable regulatory conditions in the crypto space, Citigroup anticipates an increase in institutional and retail investments in Coinbase and COIN, unlocking new opportunities for growth.

“This could potentially attract sidelined institutional capital and foster collaborations between traditional finance and the crypto industry.”

Additional Growth Catalysts for Coinbase

In addition to regulatory improvements, the analysts highlighted several positive factors within the crypto ecosystem that could further boost Coinbase’s performance.

The analysts noted the success of Coinbase’s Base, an Ethereum L2 solution, and emphasized the importance of increasing market share to capitalize on long-term opportunities.

“Enhancing customer engagement and avoiding fee hikes are crucial for sustaining growth and competitiveness.”

Furthermore, the absence of staking features in recent U.S. spot ETH ETFs was identified as a positive catalyst for driving volume to Coinbase, as investors seek staked ETH yields.

“Investors looking for native yield on ETH will likely choose digital asset exchanges like Coinbase over ETFs, which could lead to higher trading volumes.”

The analysts also highlighted the potential for retail ETH flows to be staked directly in the Ethereum network, offering higher rewards compared to ETF fees.

Christiansen and his team believe that the primary risk to the bullish outlook for COIN would be a continuation of the current administration’s strict regulatory approach.

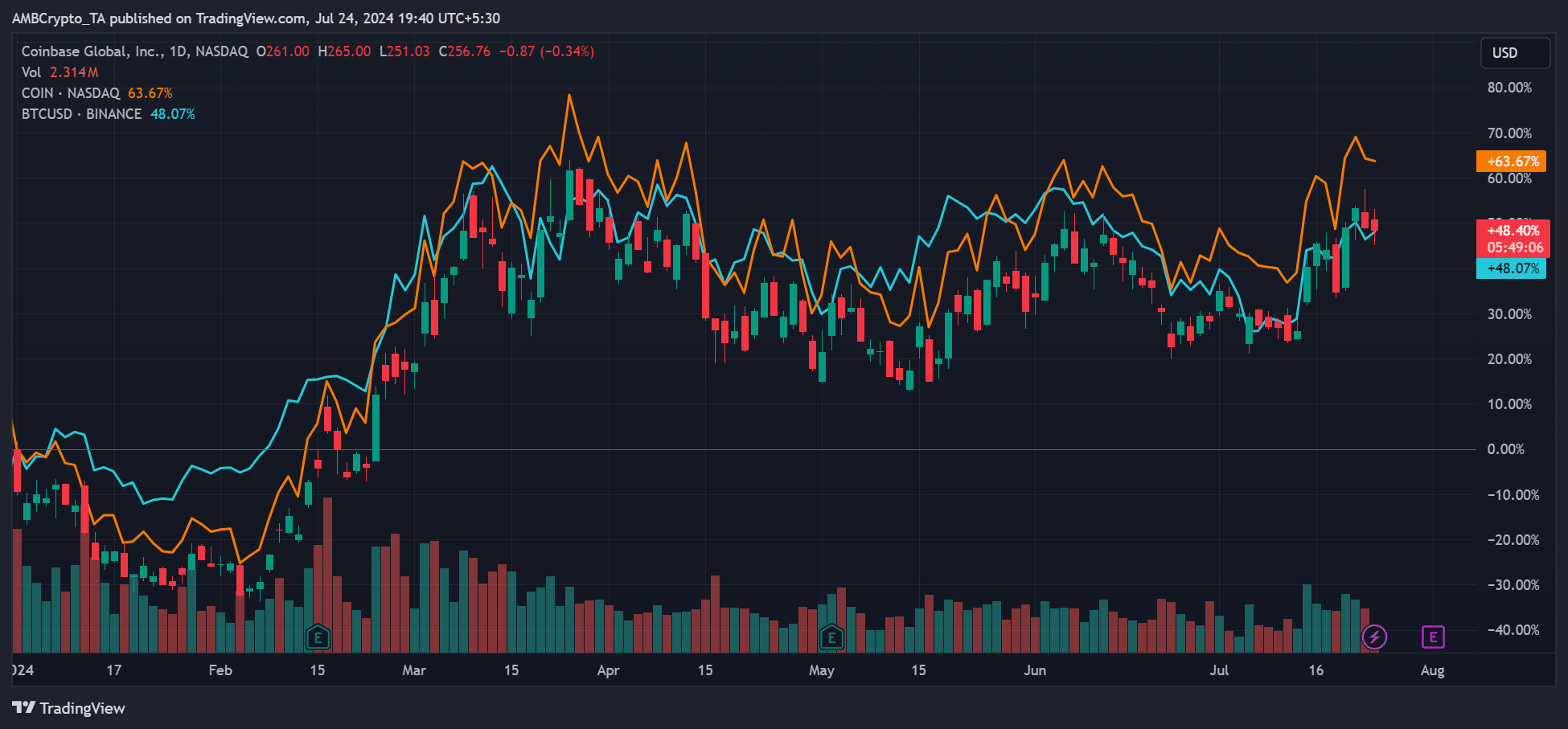

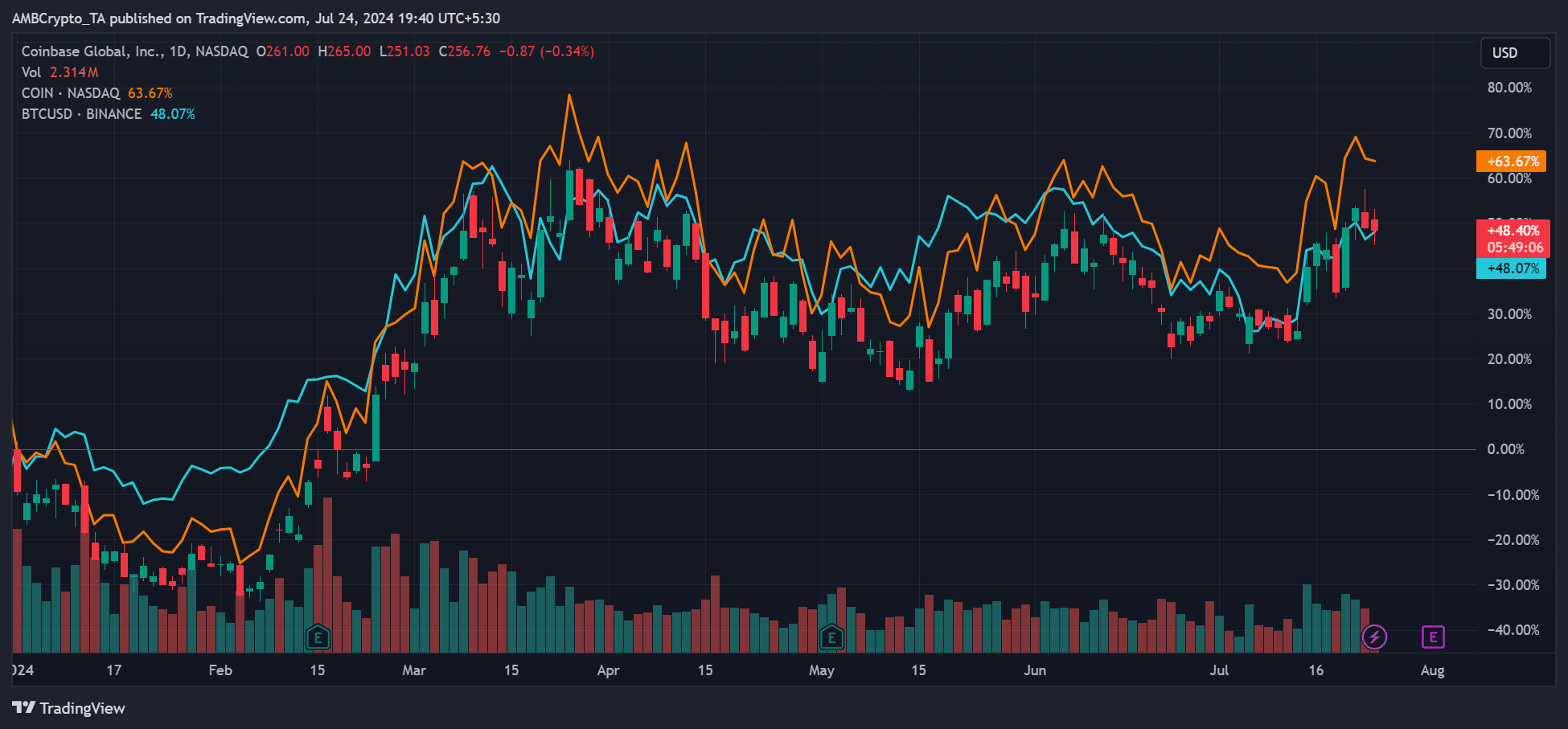

As of the latest data, COIN has outperformed Bitcoin with a 63% YTD increase, providing investors with a 15% advantage over BTC during the same period.

Source: COIN vs BTC performance