Recent developments in the Cronos ecosystem have brought the CRO price to a critical juncture, with bullish on-chain metrics and technical signals aligning at a key support level. A surge in whale activity, coupled with stabilizing momentum indicators, has drawn attention to Cronos crypto as market participants anticipate a potential high-volatility move in the near future.

Whale Activity Indicates a Shift in Positioning

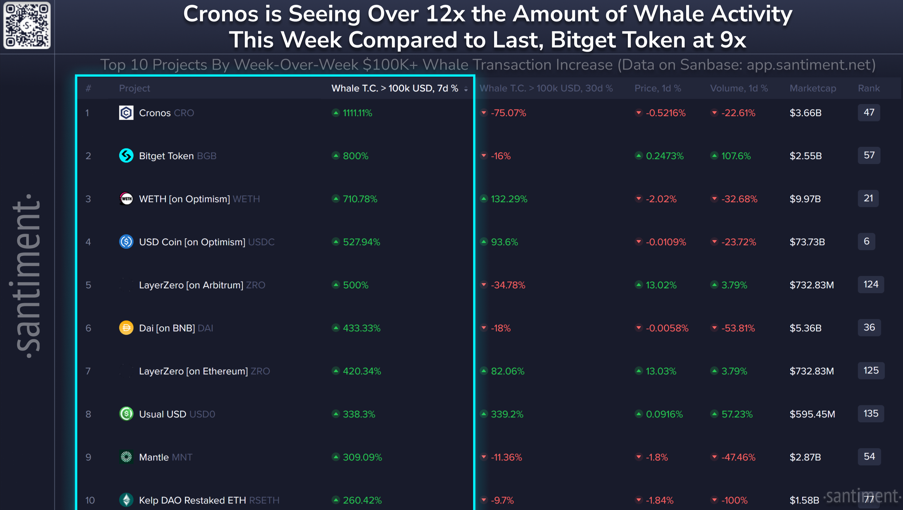

Whale transactions on the Cronos network have spiked significantly in the past week, surpassing $100,000 and increasing by over 1,100% compared to the previous week. This surge in whale interest places Cronos crypto among the top large-cap assets experiencing heightened whale activity, surpassing even established coins like Bitget Token and stablecoins such as USD Coin on Optimism.

Historically, such spikes in whale behavior have coincided with increased trading volume and network usage, suggesting that large holders may be reshuffling their positions within the ecosystem.

CRO Price Chart Highlights Long-Term Support

Analysis of the CRO price chart on a weekly timeframe reveals a well-defined ascending support trendline that has previously acted as a base for consolidation and triggered significant rallies. The current return to this support level after a prolonged correction underscores its historical significance. Additionally, resistance levels from previous rallies continue to trend higher, forming an ascending broadening structure that poses volatility risks but also hints at potential upside if demand strengthens.

Spot market participants are closely monitoring CRO price movements around this key support level.

Momentum Indicators Point to Easing Selling Pressure

Several momentum indicators indicate a cooling phase rather than aggressive distribution in the market. The MACD histogram on the weekly chart shows a weakening bearish momentum, while the Chaikin Money Flow remains deeply negative, signaling an oversold condition. The Relative Strength Index hovering near 39 suggests that selling pressure may be approaching exhaustion.

These signals indicate that if the price maintains its support, a potential recovery phase could unfold, shifting focus towards positive price predictions for CRO.

Trust with CoinPedia:

Since 2017, CoinPedia has been a trusted source for accurate and timely cryptocurrency and blockchain updates. Our expert analysts and journalists follow strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness) to ensure content accuracy and reliability. All articles are fact-checked against reputable sources to uphold transparency and credibility. Our unbiased review policy guarantees impartial evaluations of exchanges, platforms, and tools. We strive to deliver timely updates on all things crypto & blockchain, from startups to industry leaders.

Investment Disclaimer:

The opinions and insights shared in this article reflect the author’s views on current market conditions. It is advisable to conduct your own research before making investment decisions. Neither the author nor the publication assumes responsibility for individual financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may be present on our site, clearly marked as advertisements. Our editorial content remains independent from our advertising partners to maintain integrity and transparency.