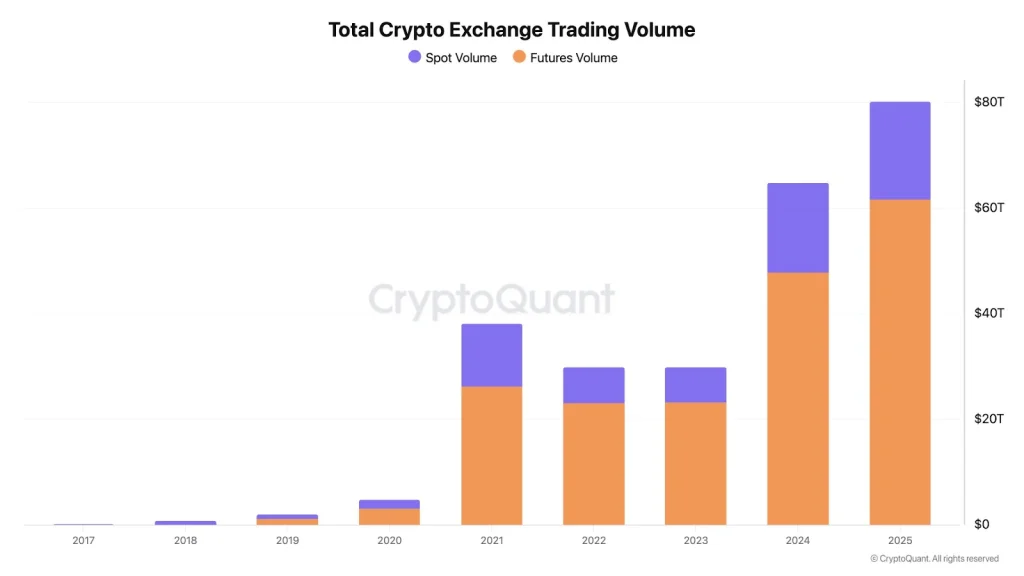

Cryptocurrency exchanges experienced significant growth in trading volume in 2025 compared to the previous year. According to a report from CryptoQuant, crypto exchanges, with Binance and Bybit leading the way, saw a combined trading volume of over $79 trillion in 2025.

Binance Perpetual Trading Drives Growth in Crypto Volume in 2025

The report indicated that spot crypto trading reached around $18.6 trillion in 2025, marking a 9% increase from the previous year.

Moreover, perpetual futures trading volume in 2025 amounted to approximately $61.8 trillion, showing a growth of about 29% from the prior year.

Source: X

The notable increase in crypto trading volume in 2025 was primarily attributed to Binance. Binance represented about 41% of the top 10 CEX spot volume in 2025, with traders favoring Ethereum (ETH), XRP, BNB, TRX, and Solana (SOL).

Additionally, the report disclosed that Binance managed $25.4 trillion in Bitcoin perpetual futures volume, equivalent to 42% of the top 10 exchanges. In terms of stablecoins, Binance held $47.6 billion in USDT and USDC reserves, accounting for approximately 72% of stablecoin balances among the top 10 exchanges.

What’s on the Horizon?

The crypto trading volume in 2026 is poised for growth driven by various factors. Institutional investors are projected to increase their crypto allocations in 2026, supported by a clearer regulatory environment.

Furthermore, the crypto industry anticipates the implementation of the Clarity Act in 2026. With the Genius Act already underway, crypto exchanges are positioned to achieve higher trading volumes by the end of the year.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author’s own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.