- Uniswap Labs is pushing back against the SEC’s proposed rule change to broaden the definition of ‘exchange.’

- UNI has been fluctuating between $6 and $12 since April.

Uniswap Labs [UNI] has raised concerns about the U.S. SEC’s potential expansion of the term ‘exchange’ and its authority over DeFi (Decentralized Finance).

Discussing the SEC’s proposal, Katherin Minarik, Chief Legal Officer of the company behind Uniswap, stated,

“Today, Uniswap Labs urged the SEC not to proceed with its proposed rulemaking that would dramatically and improperly expand the definition of an ‘exchange’ to include DeFi and more.”

The SEC is looking to broaden the definition of an exchange under the Exchange Act of 1934, with DeFi potentially falling under this expansion as outlined in the proposed amendments released in April 2023.

If adopted, even DeFi would come under the jurisdiction of the SEC. Uniswap Labs believes that the SEC’s broadening of the term ‘exchange’ is unwarranted as the agency lacks the authority to make such broad interpretations.

“The SEC and the industry have better ways to spend their resources than in litigation over an unlawful rule.”

Additionally, Uniswap Labs claimed that such a move would enable the SEC to continue enforcing regulations, causing unease in the industry.

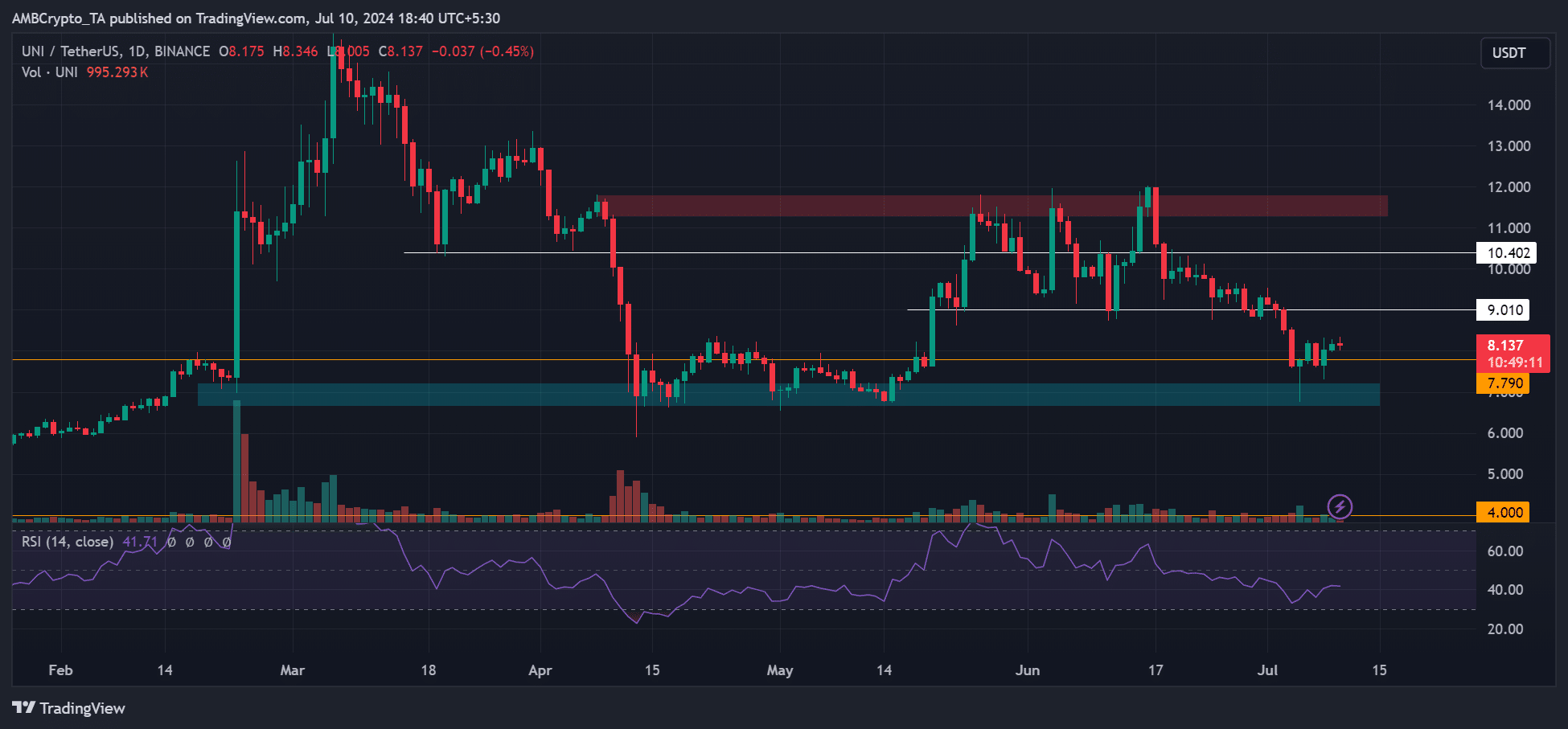

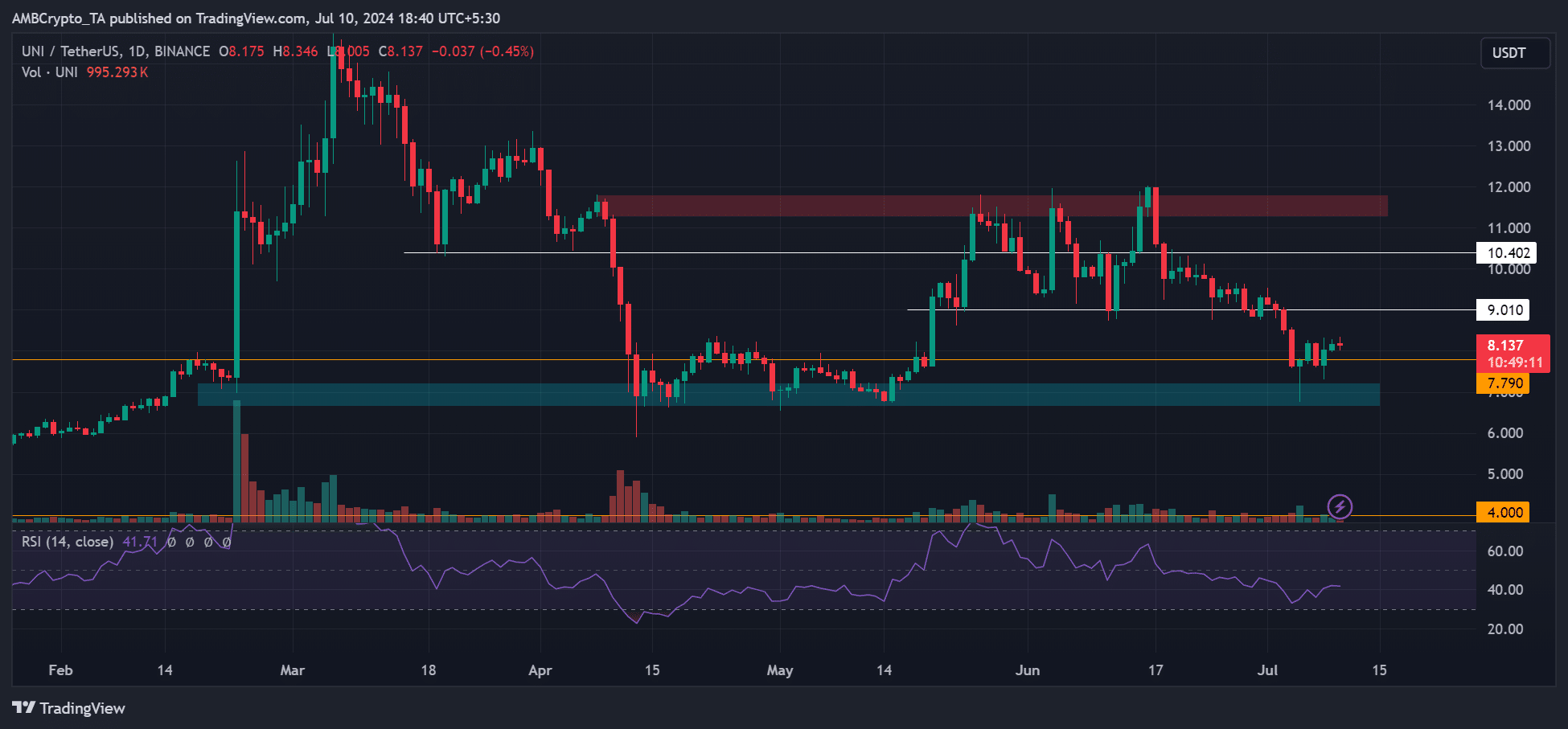

UNI’s Price Movement

Source: UNI/USDT, TradingView

Following the SEC’s Wells Notice in April 2024, UNI has seen a 40% decline in value, dropping from $12 to above $6, with the cyan demand zone as a key support level.

Improved regulatory clarity in the U.S. helped UNI bounce back from the demand zone to reclaim the $12 level. However, negative sentiment overall pushed it back to the demand zone in July.

The question now is whether UNI will revisit the $12 red supply zone. The Relative Strength Index (RSI) shows signs of increased buying pressure, although it remains below the neutral level, potentially delaying short-term recovery.

Furthermore, recent whale sell-offs could hinder UNI’s recovery and postpone the bulls’ journey to the $12 mark.