This is an excerpt from the 0xResearch newsletter. To access full editions, please subscribe.

The blockchain industry is overloaded with various chains, causing frustration among users.

In 2025, launching a new chain will likely face skepticism on social media platforms like Twitter, as seen with recent L1 blockchain projects.

- Camp Network, focusing on intellectual property, raised $30 million with a valuation of $400 million.

- Unto, an SVM-based L1, secured $14.4 million at a valuation of $140 million.

- Miden, a zk rollup, received $25 million in funding (valuation undisclosed).

Questions arise: “Why another chain?” The simplest answer seems to be driven by greed, evident in the surge of the L1 premium.

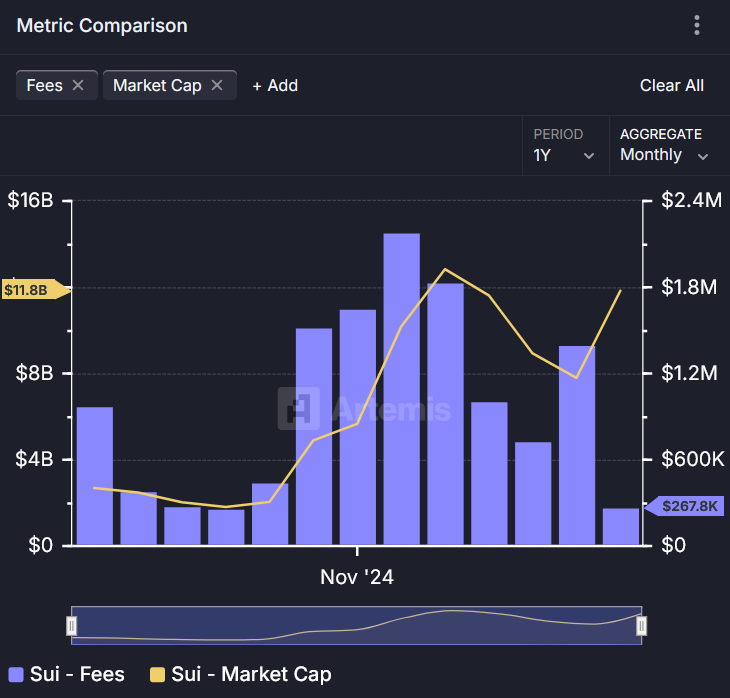

For instance, the notable price spike of SUI’s token, with a market cap close to $6.8 billion, despite minimal fees generated on the platform.

While some view this as an anomaly, the L1 premium persists, motivating the launch of new chains.

Another perspective suggests that founders have diverging views on optimizing chain functionalities, such as design, MEV capture, data layers, and oracle systems.

These differences influence developer choices and can determine a chain’s long-term success.

Protocol builders’ disagreements resemble a buffet menu debate among a hundred individuals.

Moreover, social considerations play a role, exemplified by Rogue’s zk rollup project aiming for a fair launch akin to Bitcoin’s principles.

Diverse opinions lead to the creation of new chains, reflecting economic freedom and innovation.

A Changing Landscape

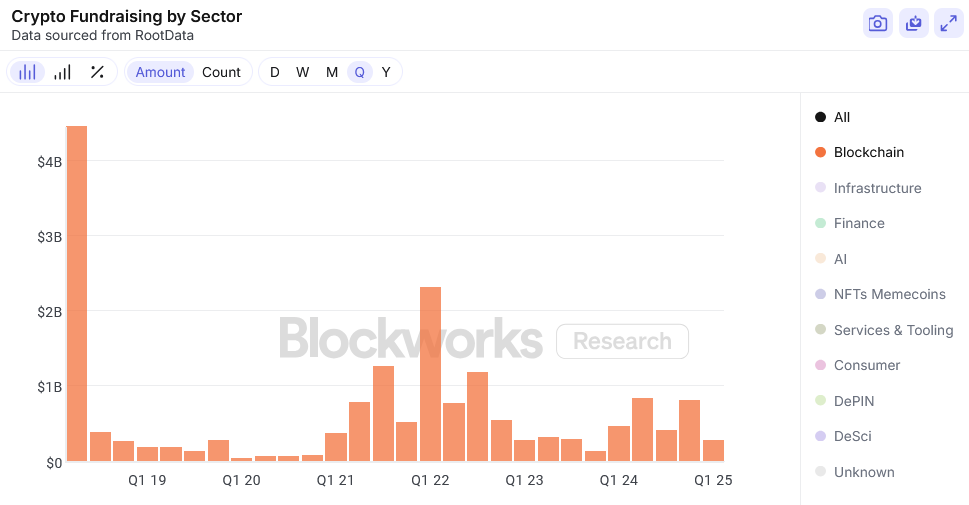

Despite the ongoing chain launches, L1 valuations are gradually decreasing, contrasting with previous cycles.

Notable examples include Monad and Initia L1, valued at unicorn status and $350 million respectively, indicating a shift in market trends.

Public and private markets are adjusting to the oversaturation of new chains, signaling a correction in the industry.

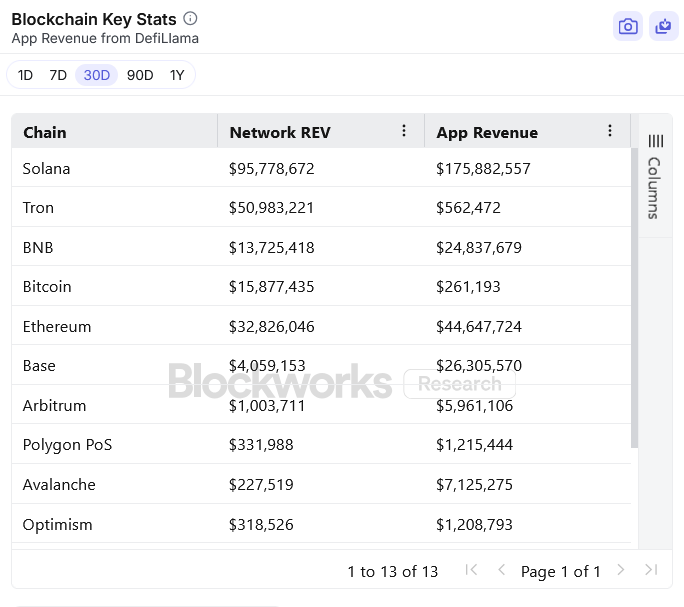

Data analysis reveals a decline in total funding raised for blockchain projects, reflecting a changing investor sentiment.

While some may prefer fewer chains, the focus on application development remains crucial for industry growth.

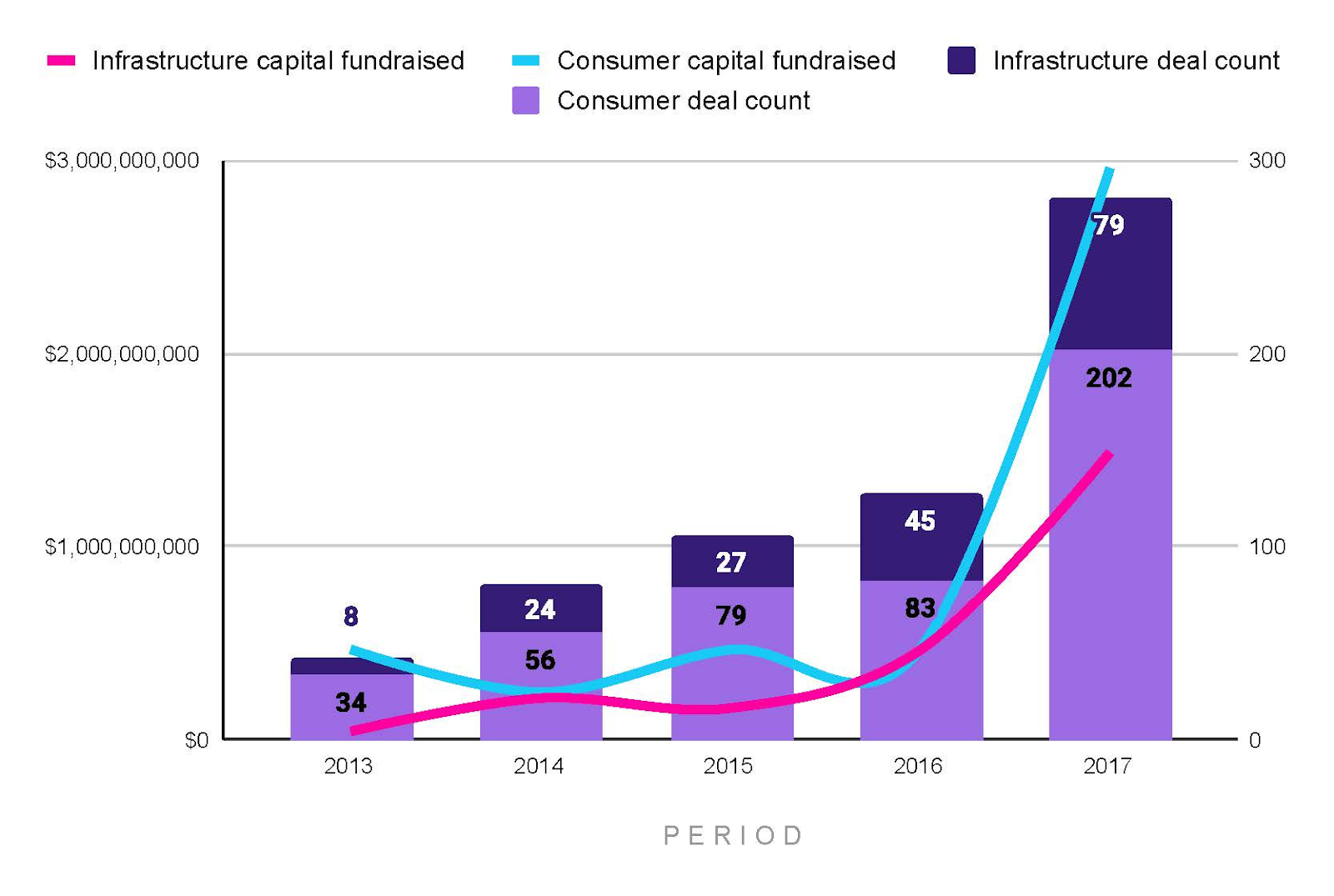

Interestingly, consumer apps received significant funding in the past, but the trend has shifted towards infrastructure projects in recent years.

Source: Outlier Ventures

VCs’ preference for infrastructure investments over applications is attributed to the immediate feedback loop and market validation challenges faced by consumer apps.

1kx partner Peter Pan highlights the importance of traction and follow-through in app success, contrasting it with the funding dynamics of infrastructure projects.