- There has been a bearish market structure forming in Dogecoin.

- The rejection from the daily moving averages has strengthened the bearish momentum.

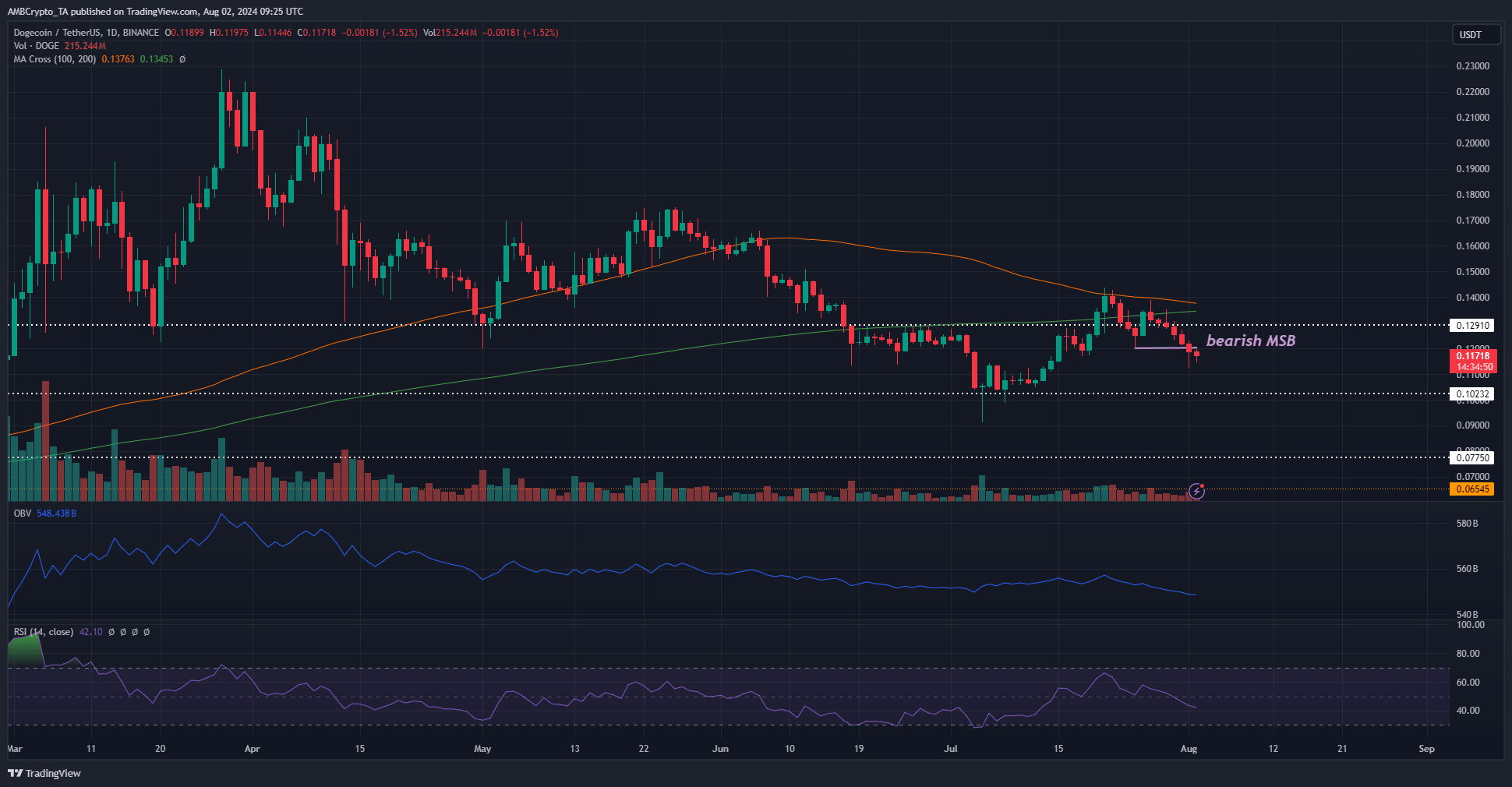

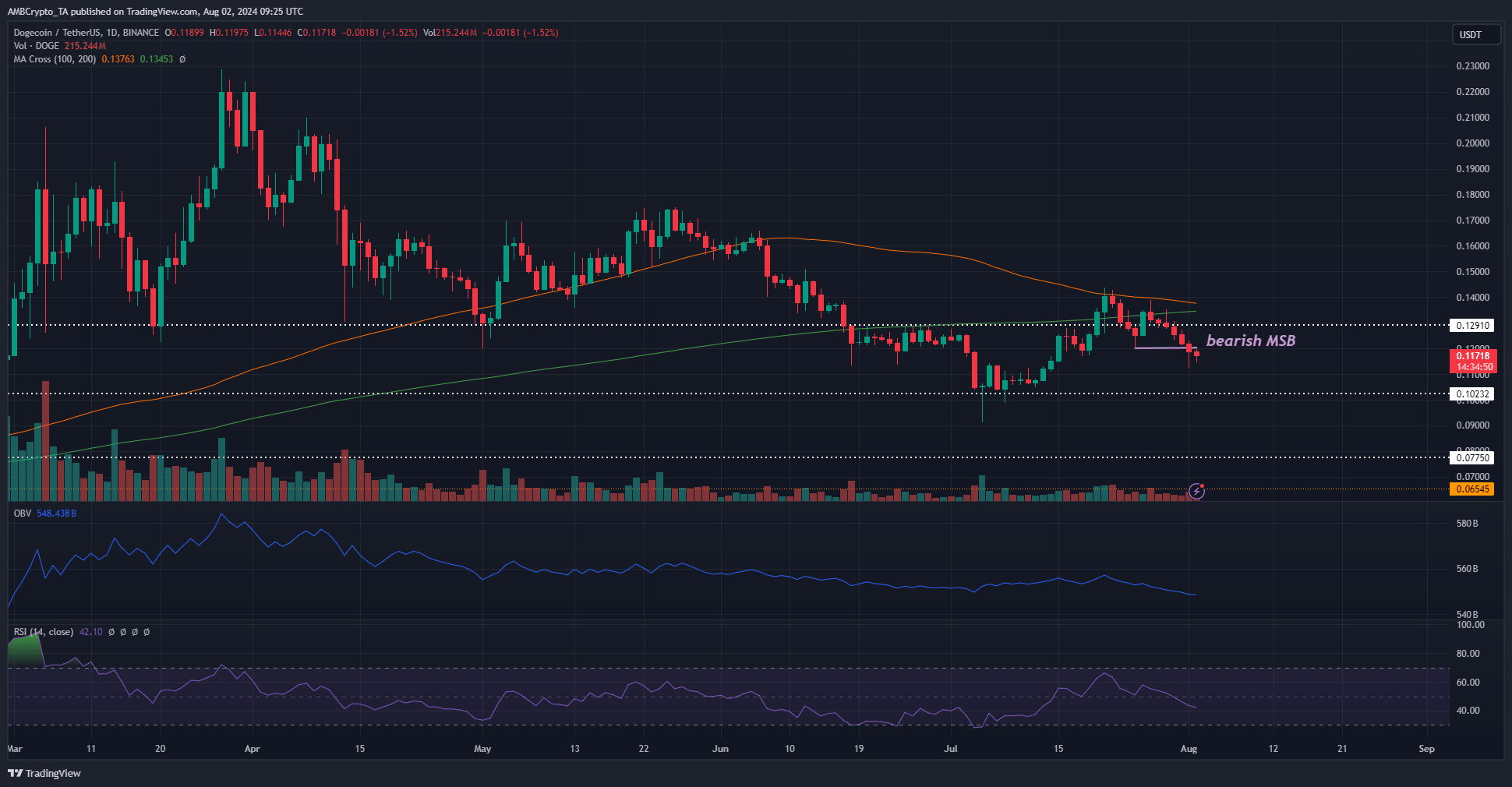

In the last ten days, Dogecoin [DOGE] has shown bearish price action. The daily moving averages were close to forming a Death Cross, a strong bearish signal.

This downward trend followed DOGE’s rejection at the $0.141 resistance level.

Crypto analysts have suggested that Dogecoin could potentially reach $10 in the current bull run based on historical patterns. However, the looming death cross could hinder this bullish scenario.

Should DOGE investors sell and wait for a trend reversal due to the feared death cross?

Source: DOGE/USDT on TradingView

In technical analysis, a death cross occurs when two long-term moving averages cross bearishly. In this case, the 200 and 100 daily moving averages were used.

Dogecoin has already faced resistance at the 100 DMA at $0.141 and has since declined.

The price being below the moving averages indicates growing bearish momentum. The daily RSI has dropped below the neutral 50 level, showing a lack of buying pressure.

The OBV also aligns with the bearish price action. Despite a brief recovery in July, the bears regained control, leading to a break in the bearish market structure on August 1st.

Overall, it is likely that the $0.102 support level will be tested in the near future.

Social sentiment and sell activity show conflicting signals

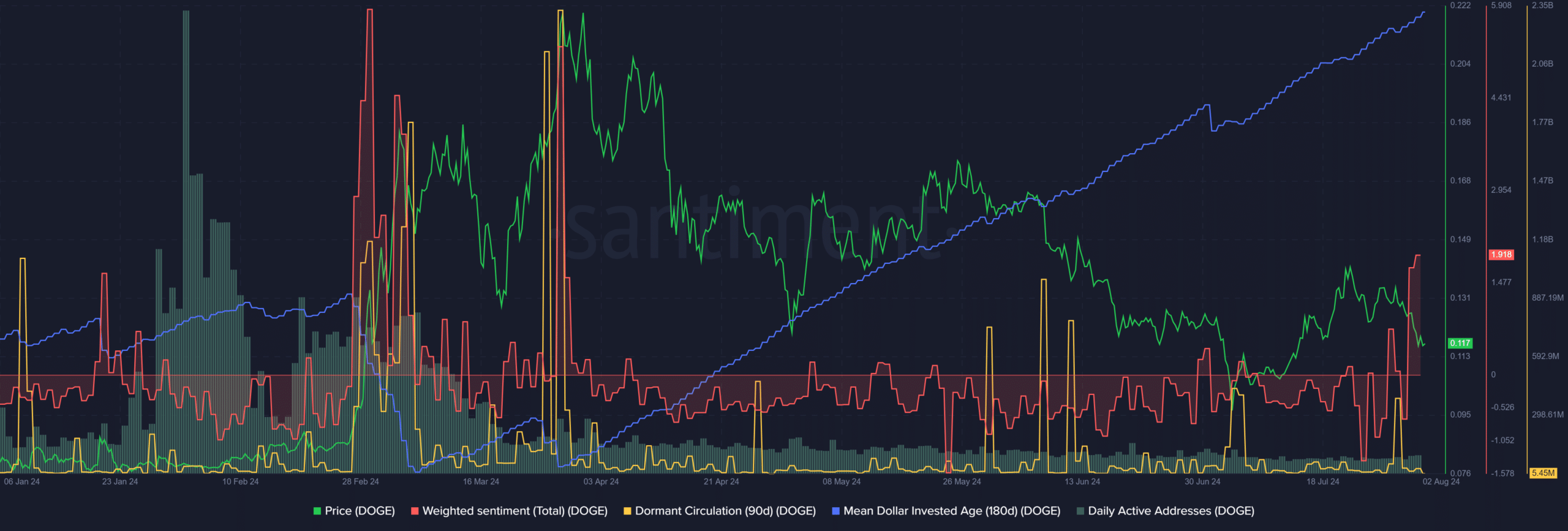

The Weighted Sentiment has turned positive, indicating bullish and hopeful social media engagement. However, other metrics do not support this sentiment.

There has been a spike in dormant circulation similar to the one seen in early July.

Read Dogecoin’s [DOGE] Price Prediction 2024-25

Nevertheless, the mean dollar invested age of Dogecoin has been increasing since March. This suggests that old tokens are not being traded, and new investments are not flowing in.

Network stagnancy is on the rise, and a reversal in this trend could pave the way for a bull run.