- DOGE has shown strength, trading above a strong support with a bullish pennant indicating a potential breakout.

- Despite a sharp rise in the Stock-to-Flow Ratio, on-chain metrics for DOGE remain weak, hinting at renewed scarcity.

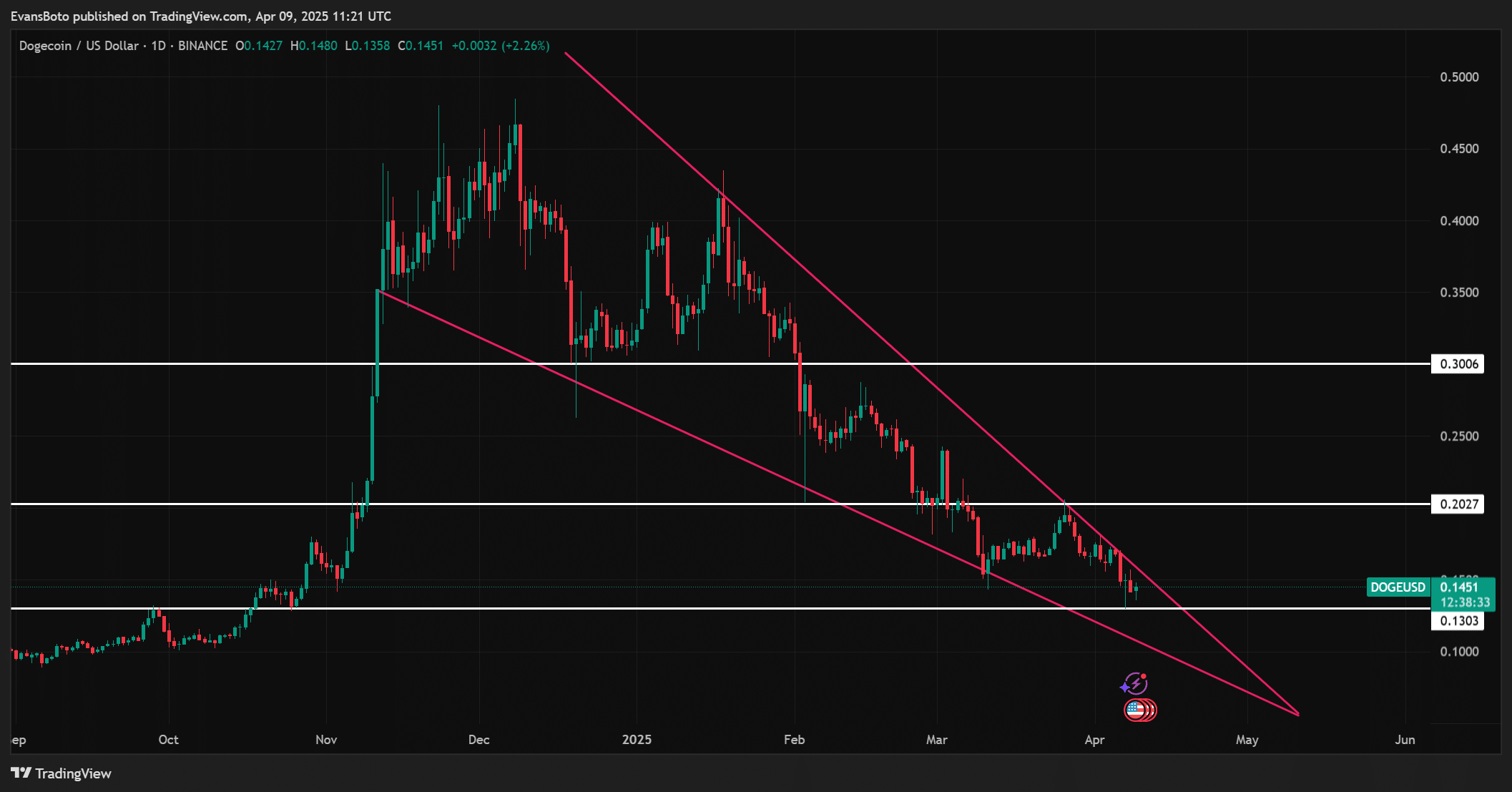

Dogecoin [DOGE] has been steadily trending upwards since October 2023, now reaching the critical 61.8% Fibonacci retracement level at $0.13.

The convergence at this level presents a strong bullish signal, especially if price action remains above it.

Previous bounces from this level have often preceded upward moves, raising anticipation for a potential breakout.

Is DOGE gearing up for a significant trend reversal?

At the current moment, DOGE is trading at $0.1446, showing a 4.90% decrease in the past 24 hours. However, the overall structure suggests a potential bullish breakout, with DOGE positioned at the edge of a falling pennant formation.

Historically, such patterns have signaled trend reversals, especially when supported by strong levels of support and improving market sentiment.

If DOGE decisively breaks above the pennant, it could target resistance levels at $0.20 and potentially $0.30 in the coming weeks.

Source: TradingView

Are user metrics strong enough to support a rally?

Unfortunately, Dogecoin’s on-chain activity has not matched its bullish technical structure. Daily active addresses are at 42,816, with transaction count at 20,793.

These low figures indicate limited user engagement, which could hinder sustained upward movement.

While price action looks promising, meaningful participation is crucial to validate any bullish breakout.

Source: Santiment

Is the MVRV ratio signaling undervaluation?

Dogecoin’s MVRV ratio stands at 1.47%, indicating holders are near their breakeven point, suggesting minimal selling pressure.

Historically, such MVRV levels have preceded upward price movements, signaling potential undervaluation.

However, the lack of significant accumulation by large holders could limit momentum without fresh interest.

Traders should monitor this metric as a rising MVRV ratio could indicate evolving price action.

Source: Santiment

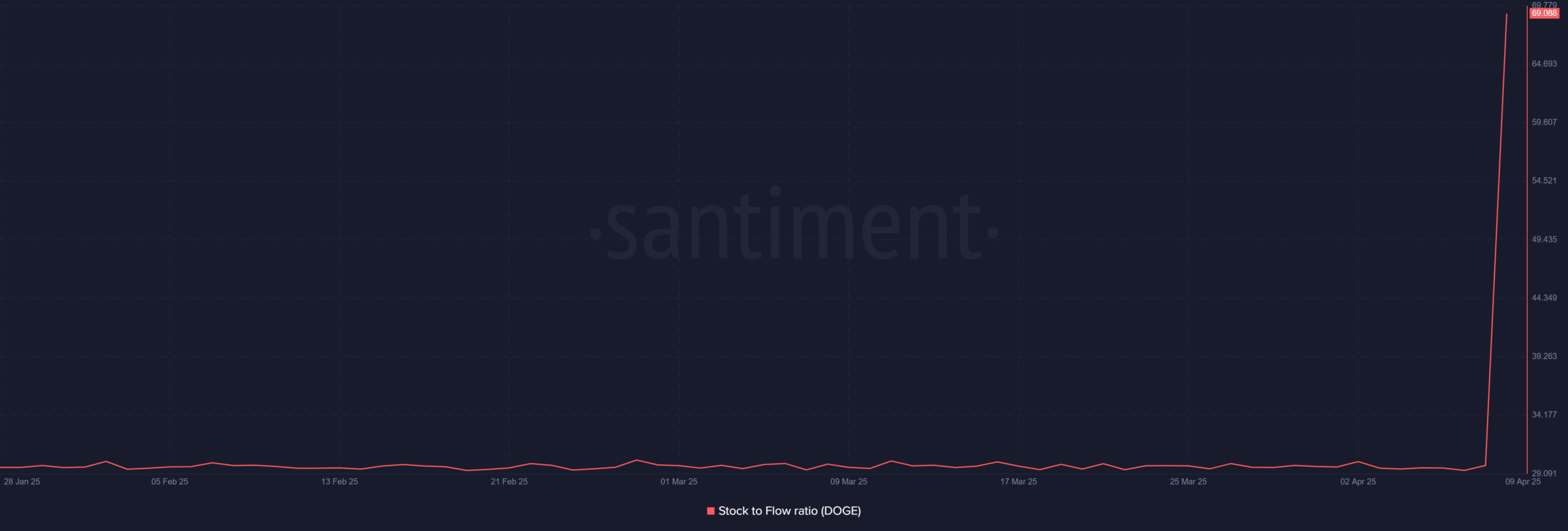

What does the spike in the Stock-to-Flow ratio mean?

The Stock-to-Flow ratio for Dogecoin has surged to 69.09, up from a consistent 29 range, indicating a shift in perceived scarcity and potentially driving interest from long-term investors.

A rising S2F ratio often correlates with price appreciation, especially with aligning market sentiment.

This spike could be an early sign of renewed accumulation, supporting the notion that supply dynamics are favoring DOGE.

Source: Santiment

What’s next for DOGE

Dogecoin is holding firm at a key support zone, supported by strong technical signals and the rising Stock-to-Flow ratio, indicating potential for a reversal.

For a significant rebound, increased user engagement and transactional activity are vital. DOGE could see a recovery if it maintains support at $0.13 and confirms a breakout alongside improving on-chain fundamentals.

following sentence:

The cat sat lazily in the sunbeam, purring contentedly.

The cat lounged in the sunbeam, emitting a peaceful purr.