- There is potential for a 23.4% price drop in Dogecoin

- The daily timeframe shows a strong downtrend

Dogecoin [DOGE] has recently seen an increase in social sentiment and engagement on social media, which could potentially lead to a bullish price action. However, current market conditions indicate a high dominance of sellers.

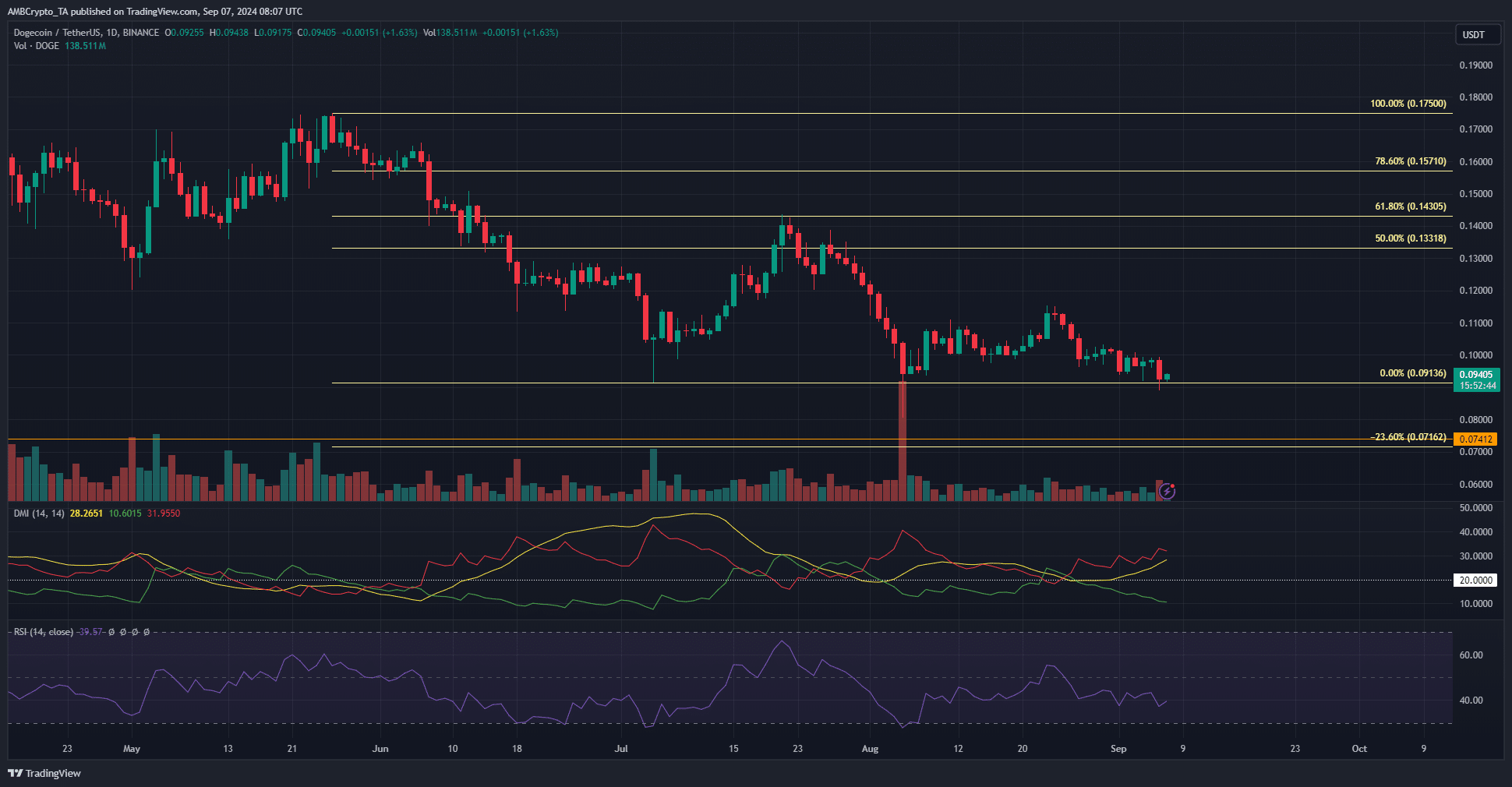

The memecoin has retested its support level at $0.09136, with technical analysis suggesting further downside movement.

The next target based on Fibonacci extension levels

Source: DOGE/USDT on TradingView

Recent price action on the daily chart shows Dogecoin testing the $0.09136 support level again, with the downtrend gaining momentum. The RSI indicator has turned bearish, signaling a strong downtrend.

Low trading volume during a price bounce in August indicates a lack of conviction in the market. However, the weekly and daily structures are aligning, with the Fibonacci extension level at $0.07162 potentially becoming the next target if $0.09136 is breached.

Insights from exchange netflows and spot markets

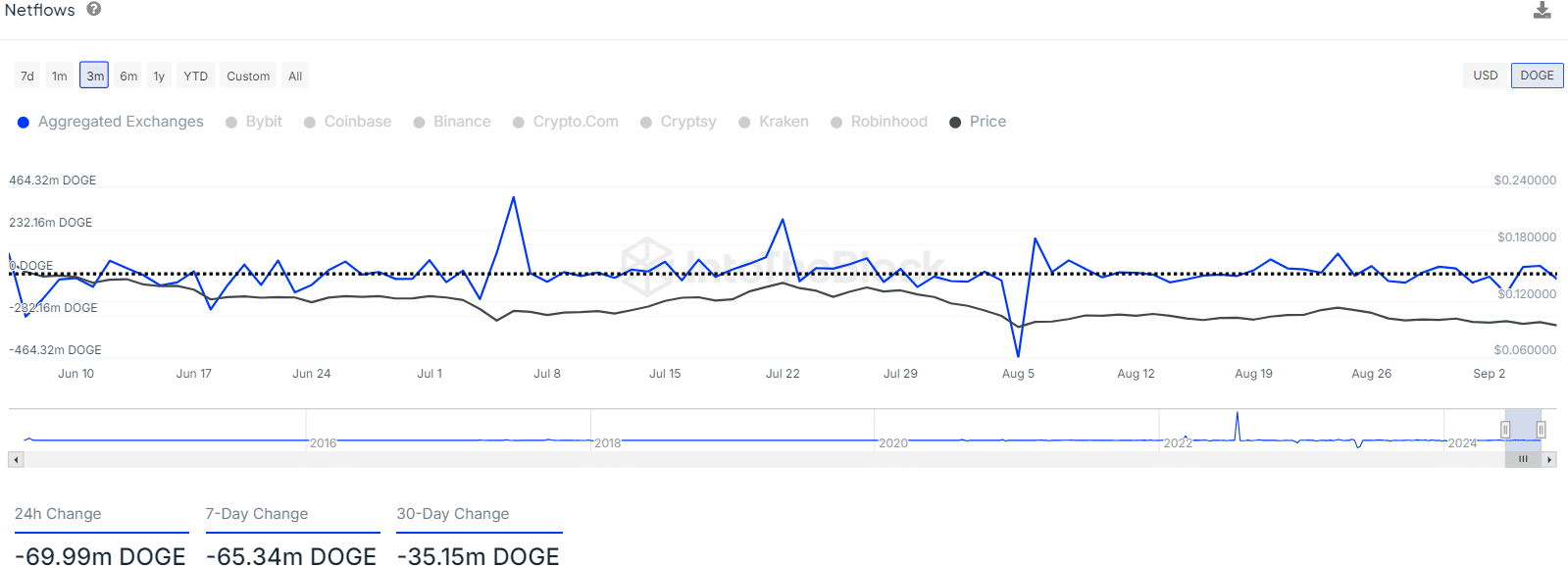

Source: IntoTheBlock

An analysis of exchange netflow data over the past three months reveals a slight accumulation of Dogecoin amidst selling pressure. Every bit of accumulation supports the bullish argument in a challenging market environment.

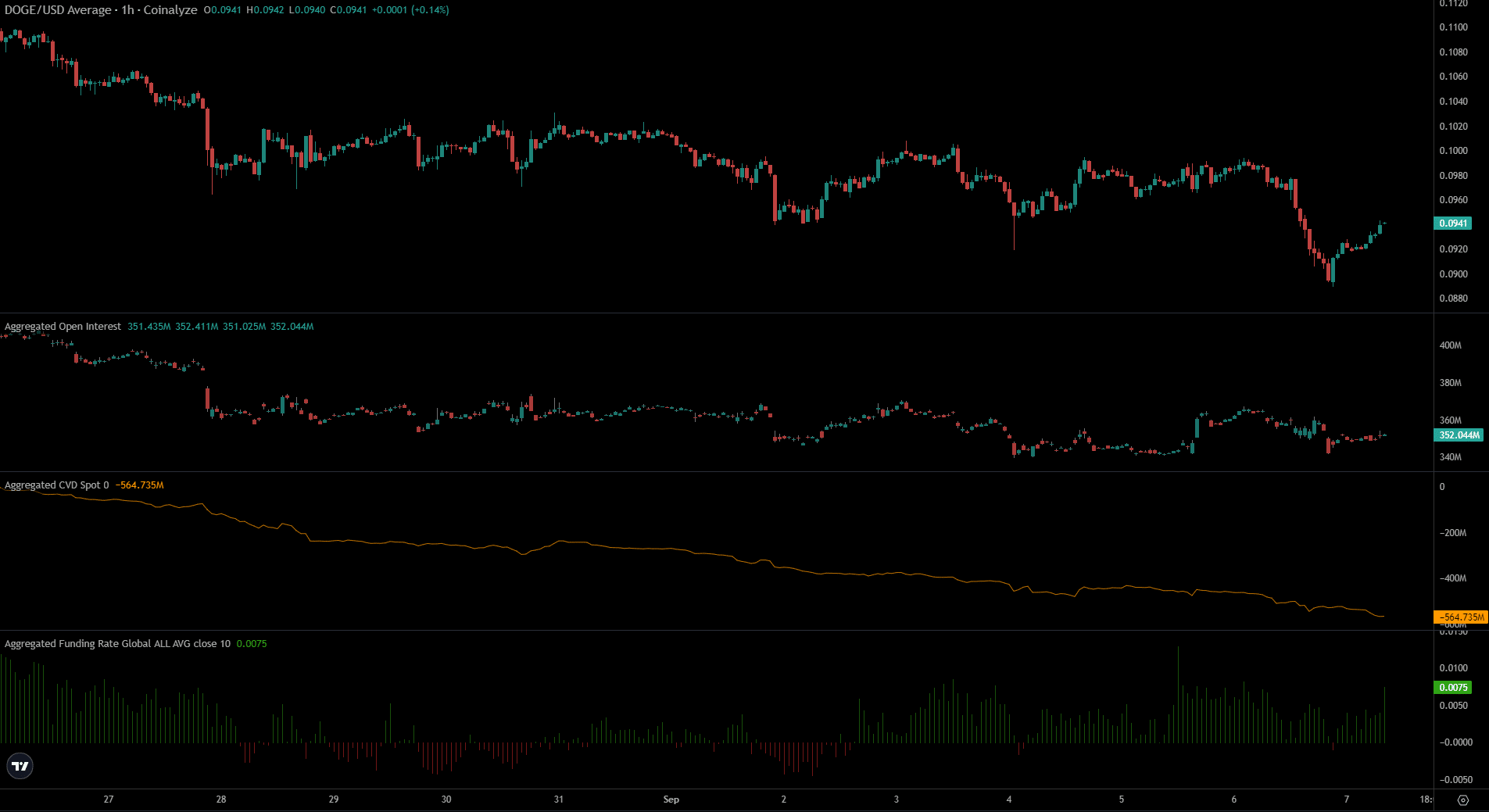

Source: Coinalyze

While some market participants move tokens out of exchange wallets, others continue to sell. The spot Cumulative Volume Delta (CVD) indicates a consistent downtrend as prices decline.

Is your portfolio green? Check the Dogecoin Profit Calculator

Open Interest remains stable within the $340 million to $360 million range, but a recent price drop saw a rise in Open Interest, reflecting short-selling and bearish sentiment.

Disclaimer: The information provided is the writer’s opinion and does not constitute financial advice

sentence in a different way:

Please let me know if you have any questions.