- Even as Dogecoin’s price drops, its funding rate remains positive.

- The price has decreased by nearly 5% since the last update.

In recent days, Dogecoin has seen significant price fluctuations, reaching one of its highest points before a sharp decline. This volatility has raised concerns among investors about the potential for further drops if the bearish trend continues.

By analyzing DOGE’s price movements, the NVT ratio, and overall market sentiment, we can gain insights into where the coin may be headed in the near future.

Price Trend Indicates Possible Downtrend for Dogecoin

After reaching a peak, Dogecoin’s price chart shows a clear downtrend.

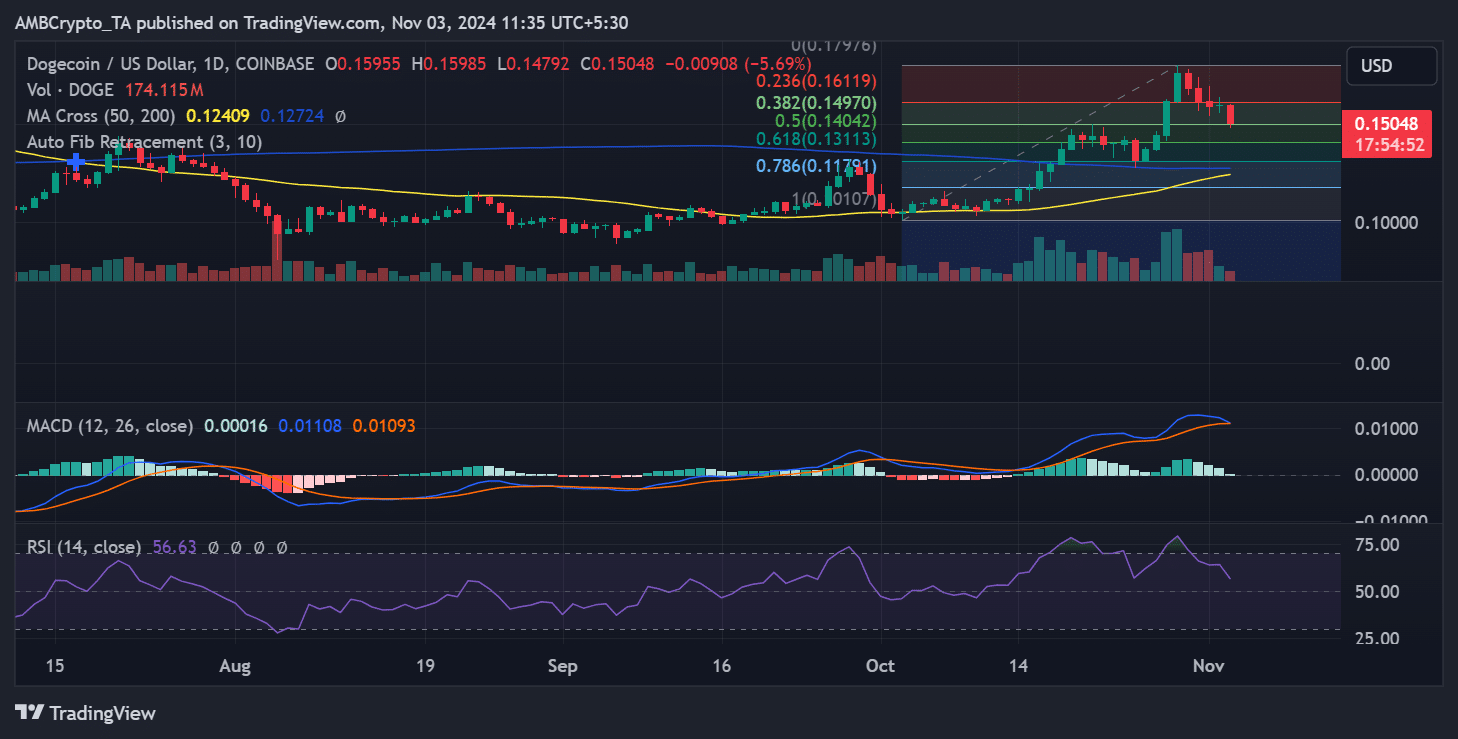

Following a bullish surge that pushed the price to $0.17976, the asset has since dropped to around $0.15048. This decline is accompanied by decreasing trading volume, indicating a weakening buying momentum.

The MACD indicator, which previously showed bullish signals, is now flattening, suggesting a potential shift towards bearish dominance.

Source: TradingView

The RSI is hovering around 56.63, moving away from overbought levels. If this trend continues, Dogecoin may test key support levels at the 0.382 ($0.14970) and 0.5 ($0.14042) Fibonacci retracement levels.

Rising NVT Ratio Indicates Potential Overvaluation for Dogecoin

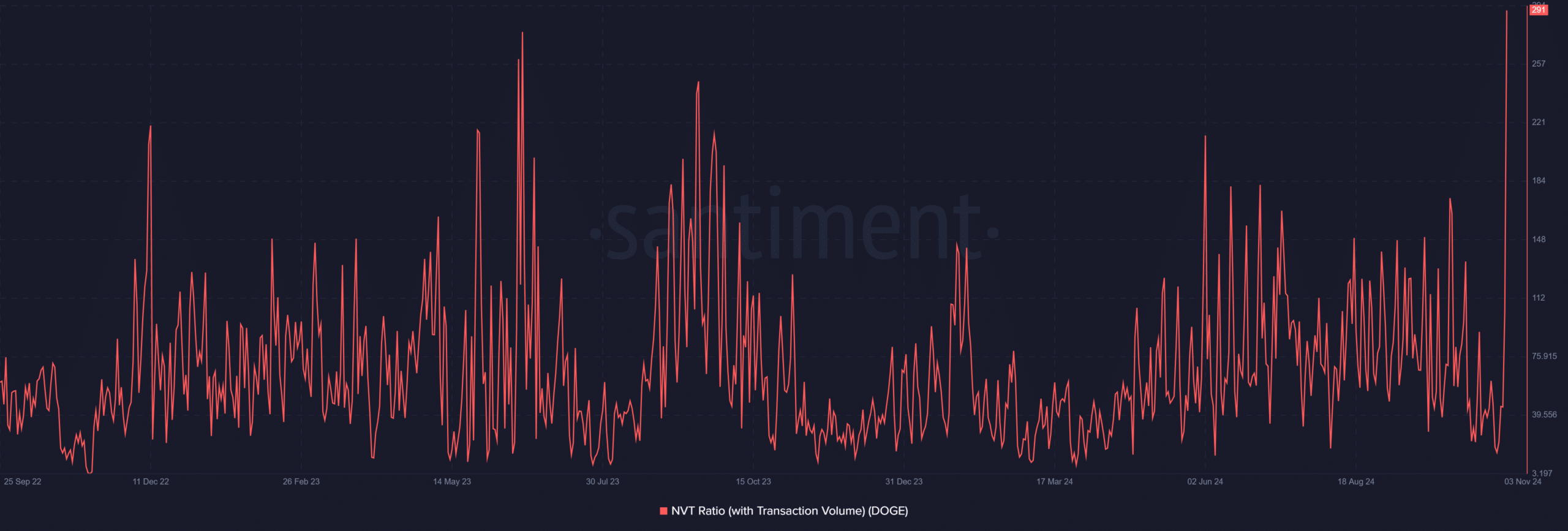

The Network Value to Transaction (NVT) ratio for Dogecoin is a crucial metric to monitor. Historically, peaks in Dogecoin’s NVT ratio have often preceded market sell-offs.

Source: Santiment

The recent increase in the NVT ratio suggests a possible overvaluation compared to current transaction volume, indicating a potential price correction.

A high NVT ratio could indicate inflated valuation driven by speculation rather than actual network usage.

If this trend continues, it could signal further downside risks for Dogecoin.

Key Levels to Monitor Amidst Bearish Sentiment

Apart from the mentioned support levels, traders are closely watching the 50-day and 200-day moving averages for Dogecoin, located around $0.12409 and $0.12724, respectively.

A breakdown below these averages could lead to more selling pressure, potentially pushing DOGE back to the $0.12 range. Conversely, stabilization around $0.15 may indicate the downtrend is losing steam.

Is your portfolio green? Check out the Dogecoin Profit Calculator

Despite current market sentiment and the rising NVT ratio, the short-term outlook leans towards the downside.

The recent price trend and elevated NVT ratio suggest a challenging path ahead for Dogecoin. If bearish sentiment persists, the coin may retest lower support levels before finding stability.