- WIF experienced a 20% surge in a 24-hour span amidst a broader market rally on US election day.

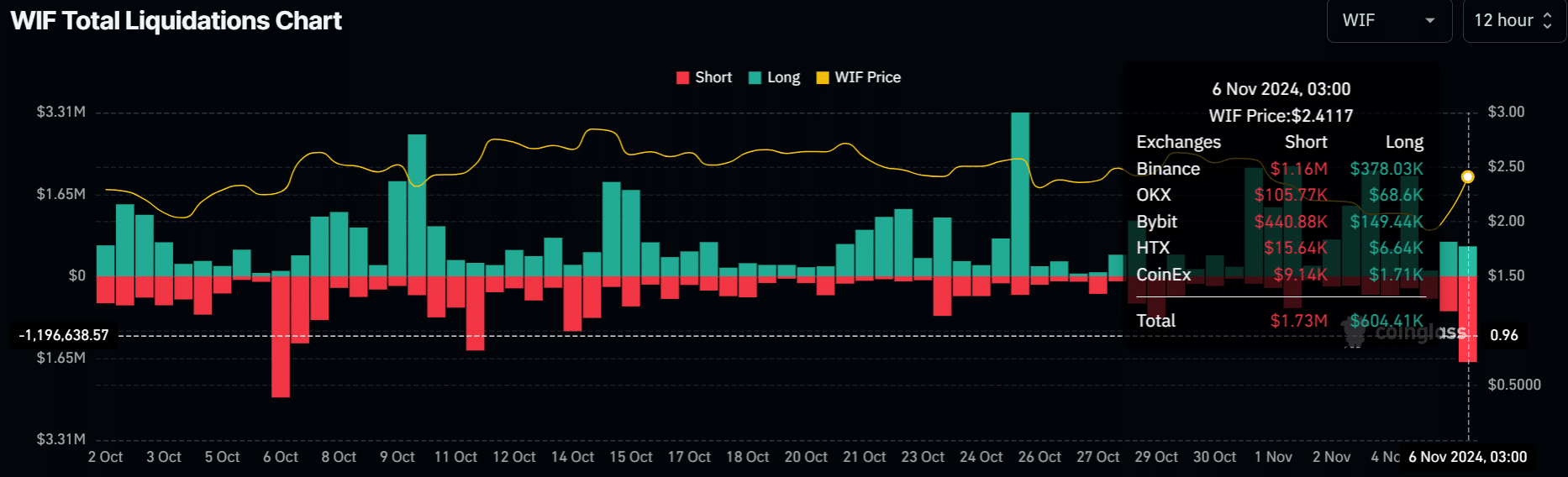

- Within just 12 hours, nearly $2 million worth of short positions were liquidated.

The cryptocurrency markets saw a significant uptick during the US election day, with Bitcoin [BTC] reaching a new all-time high as the likelihood of a Trump victory became apparent. Memecoins experienced even more dramatic gains, with dogwifhat [WIF] surging by 20% in just one day.

At the time of writing, there was already a notable wick on the daily candlestick, indicating a potential cooldown following the election day rally. What lies ahead for one of the top memecoins post-US election?

WIF’s Next Move

![dogwifhat [WIF]](https://ambcrypto.com/wp-content/uploads/2024/11/WIFUSDT_2024-11-06_10-03-42.png)

![dogwifhat [WIF]](https://ambcrypto.com/wp-content/uploads/2024/11/WIFUSDT_2024-11-06_10-03-42.png)

Source: WIF/USDT, TradingView

On the charts, WIF adhered to a typical pullback pattern and retraced to the golden zone on the Fibonacci retracement tool (50%-61.8% Fib level, highlighted in white). The recent 20% surge was triggered by the $1.2 – $2.0 support zone (marked in white).

Given that some traders may take profits following the election-driven rally, a cooldown could see WIF dropping to $2.245 (38.6% Fib level) or back to the golden zone before potentially resuming its upward trajectory.

In such a scenario, sidelined bulls might consider re-entering the market at the aforementioned support levels.

That being said, a close above $2.5 could propel WIF towards previous highs around $3, assuming Bitcoin maintains its bullish momentum.

WIF Whales’ Positioning

![dogwifhat [WIF]](https://ambcrypto.com/wp-content/uploads/2024/11/Binance-USD%E2%93%88-M-Perp_WIFUSDT_2024-11-06_10-26-17.png)

![dogwifhat [WIF]](https://ambcrypto.com/wp-content/uploads/2024/11/Binance-USD%E2%93%88-M-Perp_WIFUSDT_2024-11-06_10-26-17.png)

Source: Hyblock

Interestingly, the surge on election day appeared to be driven by large players. According to Hyblock, whales significantly increased their WIF holdings on November 5th, as indicated by the Whale vs Retail Delta metric.

This stands in contrast to the substantial reduction in positions before the election, which led to a decline in WIF prices. If whale interest in the memecoin persists, it could propel the rally even further.

Read dogwifhat [WIF] Price Prediction 2024-2025

Furthermore, a significant number of short positions were liquidated, with $1.7 million worth being wiped out in the 12-hour period leading up to the current moment. This suggests that bears had little influence, at least in the short term, as enthusiasm surrounding the election reached a peak.

Source: Coinglass

In summary, it seems that bears were at a disadvantage, at least in the short term, as election excitement reached a fever pitch. This suggests that any potential pullback in WIF could present a favorable buying opportunity if the upward trend persists.

message: The message is to be rewritten.