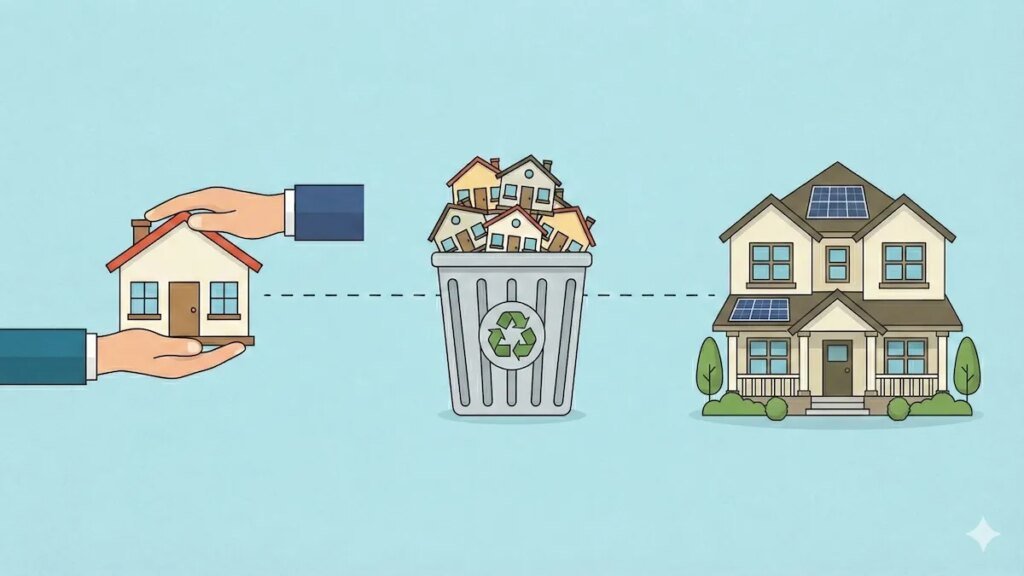

Analysts have long anticipated the ‘Silver Tsunami’ phenomenon, where a surge of homes owned by the aging Baby Boomer generation would flood the housing market. However, recent data suggests that this wave may not be as impactful as initially predicted and could instead manifest as a gentle, rolling wave.

California’s tax incentives lock in homes

In California, tax policies incentivize families to retain inherited homes rather than sell them, the report reveals.

State regulations restrict property tax hikes to 2% annually and grant tax benefits on the first $1 million of real estate value to descendants who make the home their primary residence.

In 2025, nearly 60,000 homes in California were inherited, constituting 18% of all property transfers in the state. For the first time, the number of inherited homes surpassed the count of newly sold homes.

Cotality highlights that these incentives “offer a substantial financial motivation for beneficiaries to maintain the inherited property as their primary residence, effectively limiting the supply available in the market.”

Boomers hold more homes and stay put

The minimal impact of inheritances on housing supply is partly attributed to the behavior of baby boomers compared to previous generations.

Boomers possess a significantly high proportion of homes and are less inclined to relocate or downsize as they age, according to the report.

Analysis of U.S. Census Bureau data by Cotality reveals that individuals born in 1948 owned 50% more homes at age 65 than those born ten years earlier.

Furthermore, older cohorts were more likely to remain in their homes between the ages of 65 and 75. While over 22% of homeowners born in 1938 relocated during that decade, only 17% of those born in 1946 did so.

The report notes that “Aging in place slows down the natural cycle of downsizing, moving in with family, and eventually passing on homes to the next generation.”

While inheritances can provide relief to families grappling with soaring housing expenses, statistical trends indicate that demographic shifts alone will not resolve the overarching affordability crisis.

The report emphasizes that “Policymakers cannot solely rely on demographic changes to address affordability issues. While inheritances may assist some families in coping with escalating housing costs, those banking on inheritances to rebalance supply and demand may find themselves at a disadvantage.

“To boost housing supply, proactive measures must be taken.”