- ENA’s breakout from a descending channel tested its critical support, with key levels at $0.35 and $0.47

- On-chain signals were bearish, with long liquidations exceeding shorts

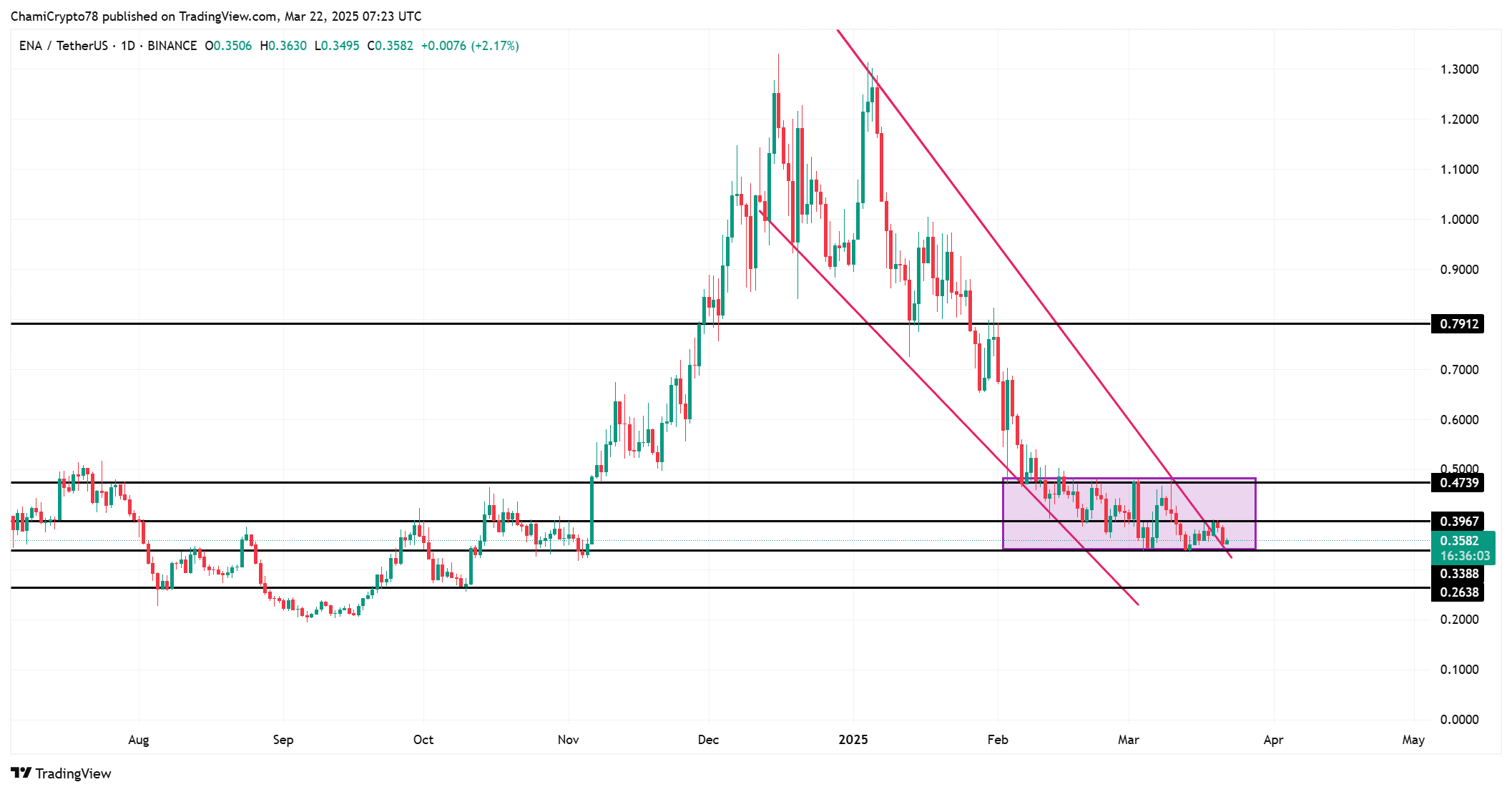

Ethena [ENA] token recently broke out of a descending channel pattern, sparking optimism among investors. At the time of writing, the altcoin was valued at $0.3583, following a 3.44% decline on the charts. ENA’s market capitalization stood at $1.89 billion, with a 24-hour trading volume of $135.5 million.

Despite the breakout, however, the altcoin’s price is still testing crucial levels, leaving the market uncertain. Can ENA maintain this breakout momentum, or will it struggle to keep upward pressure?

Price action analysis – Is ENA poised for a rally or a retreat?

ENA’s price had previously been in a phase of consolidation, before a breakout from the descending channel. This breakout created a new price action structure for the altcoin. With the price now hovering near $0.3583, support levels around $0.35 might be critical for price sustainability.

If ENA manages to hold above this level, it could target resistance zones near $0.47 and possibly, challenge higher levels such as $0.48, $0.68 and even $1.00.

On the other hand, if the price fails to maintain support at $0.35, ENA could test lower support levels at $0.26 – Signaling a potential price retreat.

Source: TradingView

On-chain signals – Will the data drive the price up or down?

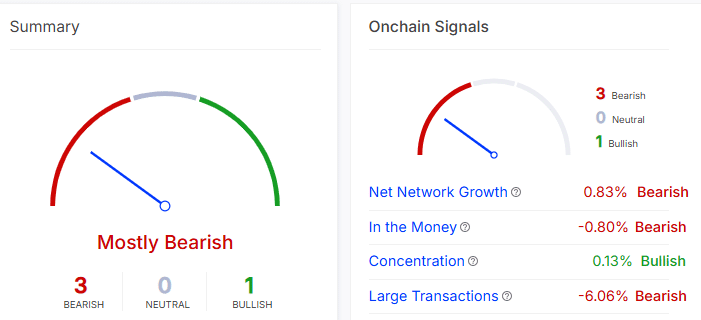

On-chain analysis painted a rather bearish picture for ENA. Despite the breakout, the net network growth highlighted a decline of 0.83% – Hinting at a drop in activity. Additionally, the “in the money” metric flashed a change of -0.80%. This suggested that a significant portion of holders are currently at a loss.

While concentration was slightly positive at 0.13%, large transactions were largely bearish, with a significant -6.06% drop pointing to more selling pressure in the market.

Taken together, these on-chain signals imply that the token could face significant hurdles despite its latest technical breakout.

Source: IntoTheBlock

ENA Open Interest and liquidations

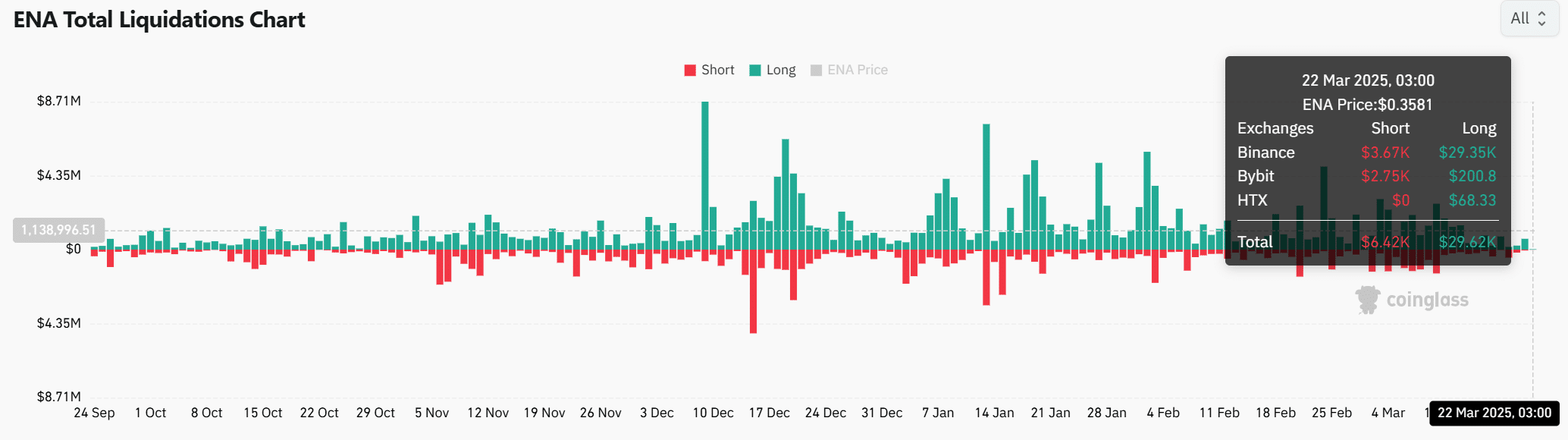

Open interest in ENA rose by 3.38%, climbing to $345.78 million to underline higher market participation, according to Coinglass. However, liquidation data revealed that long positions are being liquidated more than shorts – $29.62k in long liquidations versus $6.42k in shorts.

This fuels downward pressure, but once these liquidations are cleared, the market may rebound.

For a sustained rally, ENA needs to break resistance levels around $0.47 and $0.48.

Source: Coinglass

Can ENA sustain its breakout?

Although ENA’s latest breakout from the descending channel raised hopes for a price surge, bearish on-chain signals and support levels indicated that the token may face challenges. If ENA can hold above $0.35 and push past the resistance at $0.47, it might see a sustained rally towards higher price targets.

However, without breaking through these critical levels, ENA could struggle to maintain any upward momentum. Therefore, while there is potential for a further rally, ENA must prove its ability to hold key support levels to confirm any upside.

sentence to make it more clear and concise:

Please let me know if you have any questions or need further clarification.