- Ethereum Classic’s trading volume surged to 584.46M, indicating growing investor interest amidst ETH’s decline.

- ETC maintained above the crucial $22.50 support while ETH struggled below its 50-day moving average, prompting discussions about market dynamics.

Ethereum Classic (ETC) has been showing a more favorable trend compared to Ethereum (ETH) recently, sparking speculation that it could be absorbing the liquidity that ETH is losing.

With diverging price movements and volume patterns between the two assets, investors are questioning whether ETC is emerging as a viable alternative to ETH.

Ethereum Classic’s Price Action: A Mixed Trend

At the time of reporting, Ethereum Classic was trading at $24.54, reflecting a 1.72% intraday decrease.

The price chart indicated that ETC had entered a consolidation phase following a strong rally in December, trading below its 50-day moving average of $26.87 and above the 200-day moving average of $23.15.

Remaining above the 200-day MA suggests that ETC is still in a long-term uptrend despite short-term bearish moves.

Source: TradingView

ETC’s recent price action has been characterized by lower highs, potentially indicating diminishing bullish momentum. However, the strong support at $22.50 suggests a possible rebound if the overall market stabilizes.

ETH’s Decline, ETC’s Rise?

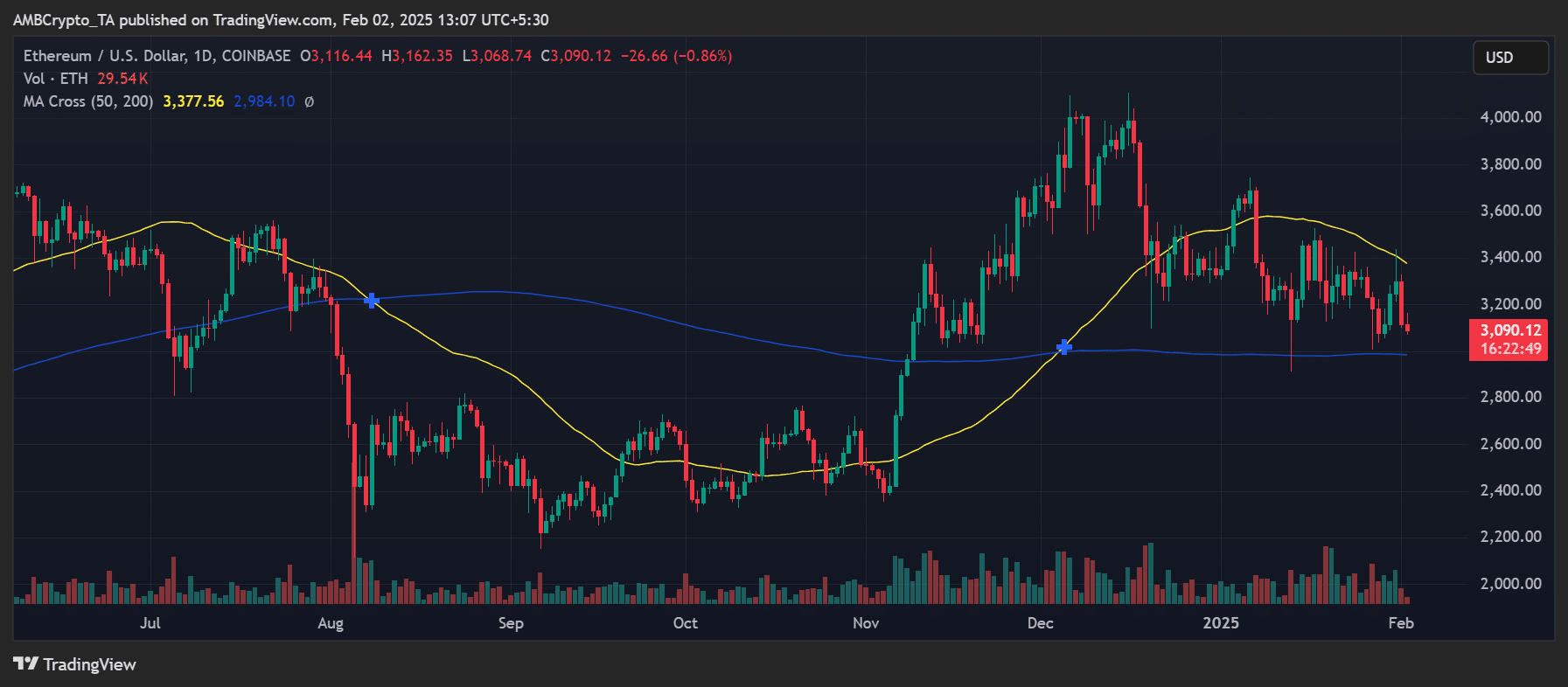

On the flip side, Ethereum was trading at $3,090.12, marking a 0.86% daily decline. While ETH was in a broader uptrend, it struggled to maintain key support levels.

The 50-day moving average stood at $3,377.56, with the 200-day moving average at $2,984.10.

A breach below the 50-day MA indicated a potential loss of short-term momentum, leaving Ethereum susceptible to further downward pressure.

Notably, Ethereum’s trading volume has been decreasing, with Santiment’s volume chart showing reduced trader participation.

This declining interest could explain why some investors are turning their attention to Ethereum Classic, which has exhibited higher relative strength.

Volume Trends: ETC’s Growing Momentum

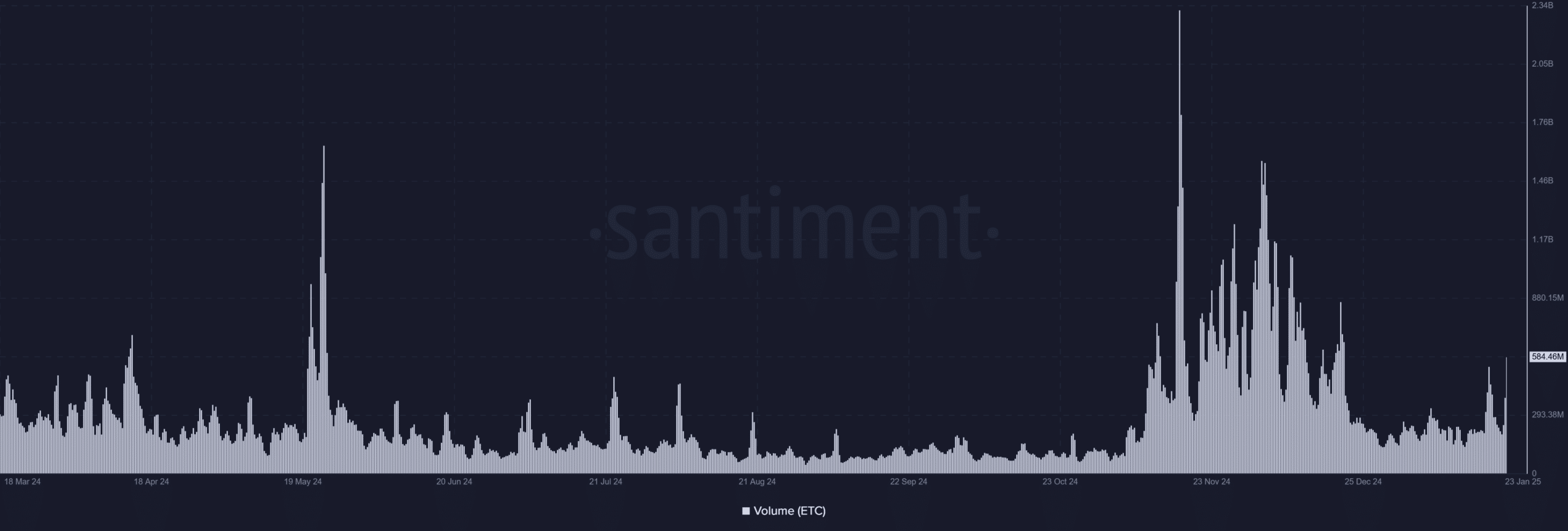

An analysis of Santiment’s volume chart revealed a steady rise in ETC’s trading volume, reaching a recent peak of 584.46M.

This uptick indicated renewed investor interest and increasing confidence in Ethereum Classic as an alternative to Ethereum.

In contrast to ETH’s declining volume, ETC’s liquidity remained strong, suggesting a shift in market interest.

Source: Santiment

Volume surges in late January 2025 corresponded with price movements, suggesting active involvement with ETC.

This shift could be attributed to speculation that ETC provides a hedge against Ethereum’s weakening momentum or anticipation of network developments favoring ETC.

Ethereum Classic’s Future Moves

Looking ahead, ETC needs to sustain its current trading volume and remain above the $22.50 support level to solidify its position as a compelling alternative to Ethereum.

If Ethereum’s weakness persists, ETC could gain further traction. However, investors should monitor resistance around $27.50, where previous selling pressure has capped gains.

Is your portfolio thriving? Explore the Ethereum Classic Profit Calculator

On a macro level, Ethereum Classic’s correlation with Ethereum implies that broader crypto market trends will influence its trajectory.

If ETH rebounds, ETC might also benefit, although its independent surge in volume indicates that traders are increasingly viewing it as a standalone asset rather than an Ethereum derivative.

following sentence:

The cat chased the mouse around the house.

The mouse was chased by the cat all around the house.