In recent times, there has been a surge in demand for Ethereum (ETH), particularly driven by Wall Street corporations. On-chain data analysis reveals that long-term investors have shown a preference for Ether, marking a shift from the dominance of Bitcoin (BTC) in net cash inflows over the past year.

Ethereum Sees Increased Interest from Long-term Investors

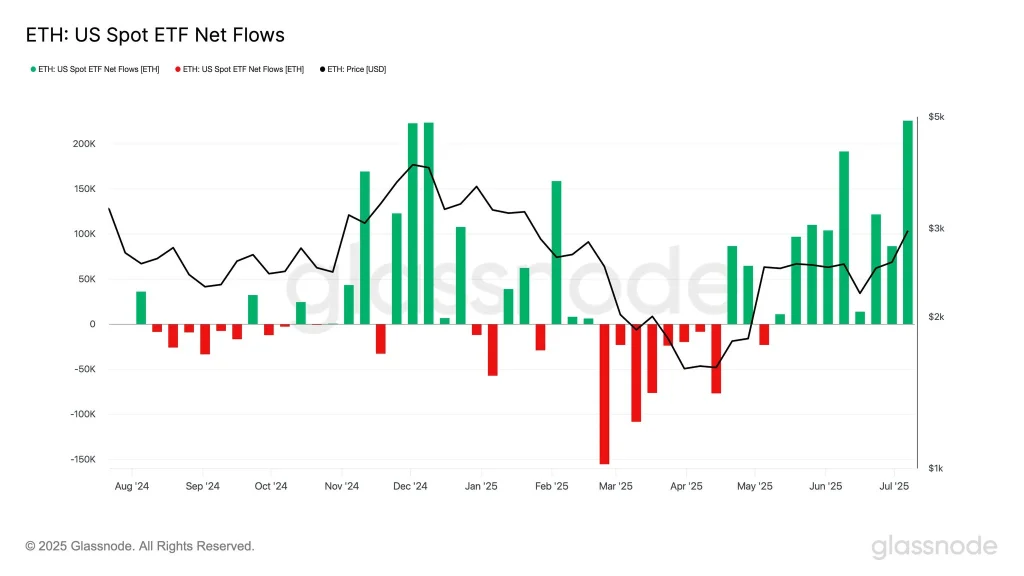

Notably, U.S. spot Ether ETFs, led by BlackRock’s ETHA, experienced their highest weekly cash inflow of around $908 million since their establishment. This contributed to a continuing streak of cash inflows, totaling over $2.7 billion in net cash inflows over the last four months.

Corporations have also shown a significant uptick in their demand for Ether. For example, publicly traded company BitMine announced an Ether holding exceeding $500 million, with an increase to 163,142 coins following a $250 million private placement.

“We are delighted to have bolstered our ETH treasury shortly after completing our private placement,” noted Jonathan Bates, CEO of BitMine. “It’s evident that Wall Street is becoming increasingly interested in Ethereum.”

Midterm Price Targets for ETH

Following a period of consolidation, Ethereum’s price recently surpassed $3k for the first time since January 2025. With a fully diluted valuation of approximately $363 billion, the altcoin has shown bullish momentum.

From a technical analysis perspective, Ether is eyeing $3,400 as the next target, with a clearer path towards $4k. Additionally, the weekly MACD indicator has displayed bullish signals, as the MACD line recently crossed above the zero line amid rising bullish histograms.