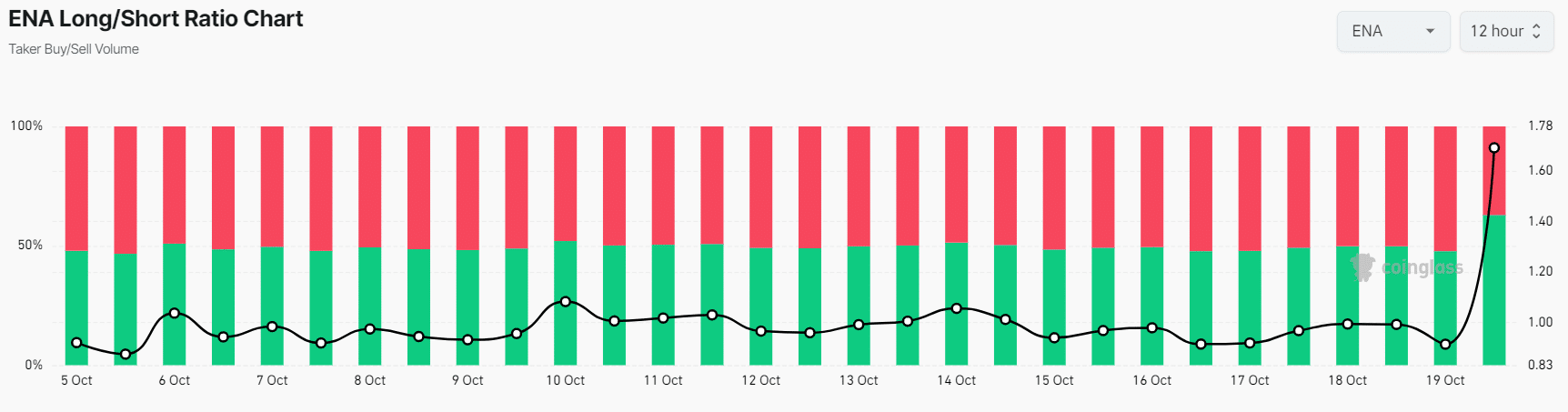

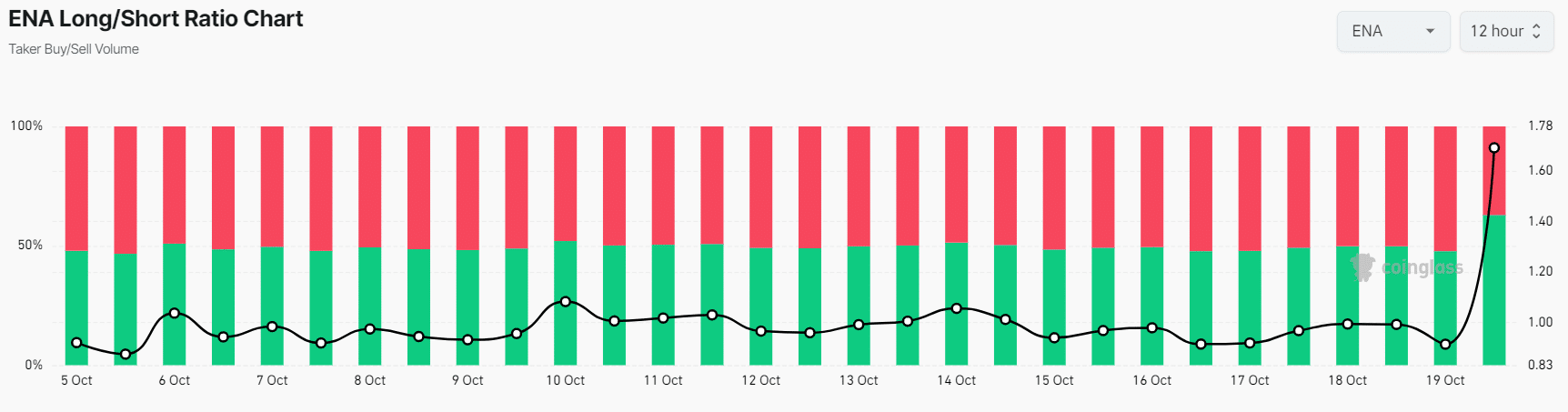

- ENA’s Long/Short Ratio over the past 12 hours was at 1.69, signaling strong bullish sentiment.

- Notable liquidation levels were identified near $0.395 and $0.409, with traders heavily leveraged at these points.

The cryptocurrency market is currently experiencing significant price movements, with many digital assets either surging or correcting in value.

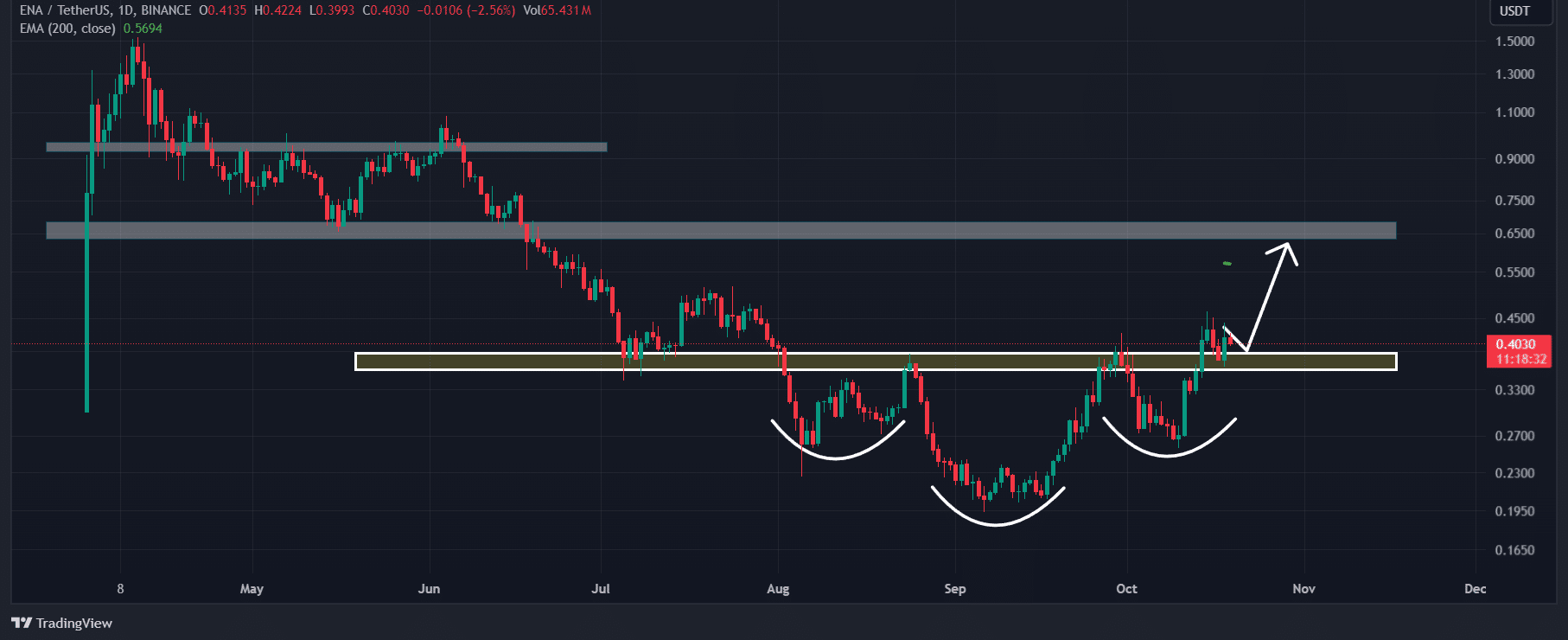

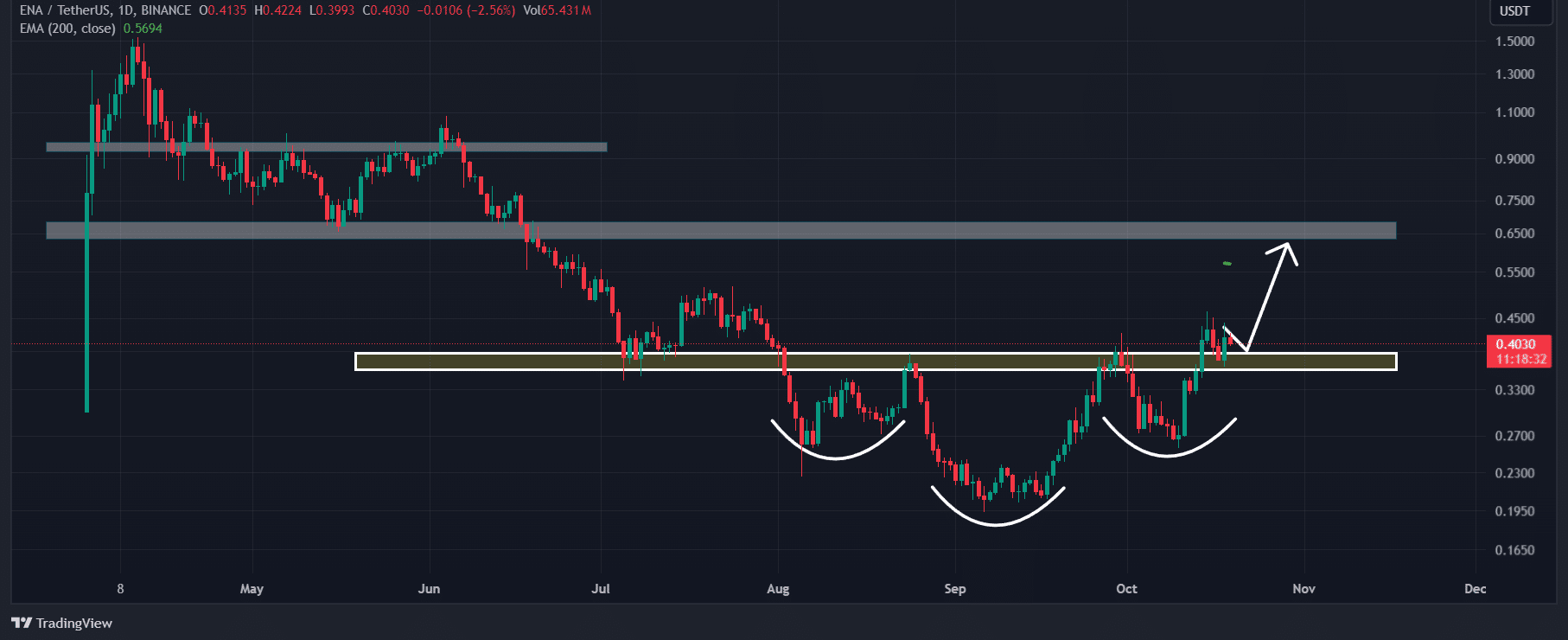

Among these, Ethena [ENA] has shown bullish signs, having recently retested a bullish price pattern and showing potential for a notable upward rally in the near future.

Ethena’s Breakout Success

Based on technical analysis by AMBCrypto, Ethena has successfully broken out from an inverted head-and-shoulder pattern and retested the breakout level at $0.362.

Following this retest, ENA has started moving upwards, a positive development for token holders.

Source: TradingView

Given the recent price momentum, there is a strong potential for ENA to surge by 60% and reach the $0.65 level in the days ahead.

The asset has already attracted significant attention from investors and traders, with expectations of similar performance as seen in the past week.

The breakout of the inverted head-and-shoulder pattern, followed by a successful retest, is viewed as a bullish indicator by many investors and traders.

Bullish On-Chain Metrics

Further supporting ENA’s positive outlook is the Long/Short Ratio, which reached 1.69 in the past 12 hours, according to Coinglass, marking the highest level since late September 2024.

This high Long/Short Ratio reflects strong bullish sentiment in the trading community.

Source: Coinglass

Furthermore, ENA’s Open Interest has shown no change in the last 24 hours, indicating a wait-and-see approach among traders for the asset to close a daily candle above $0.45.

Currently, 62.86% of top traders hold long positions, while 37.14% hold short positions.

Key Liquidation Levels

In addition, major liquidation levels are identified around $0.395 and $0.409, with traders being over-leveraged at these points, as per Coinglass data.

If the market sentiment remains unchanged and the price reaches $0.409, approximately $1.87 million worth of short positions could be liquidated.

Conversely, a shift in sentiment leading to a price drop to $0.395 could result in around $1.41 million worth of long positions being liquidated.

Read Ethena’s [ENA] Price Prediction 2024–2025

This data on liquidation indicates an active presence of short sellers anticipating a price decline below $0.395, a scenario unlikely in the current bullish crypto market environment.

Current Price Movement

At the moment, ENA is trading around $0.402, with a modest price increase of over 0.55% in the last 24 hours. Trading volume has also seen a 20% rise, signaling increased investor participation.

following sentence in a different way:

Original sentence: The cat purred softly as it curled up in a ball on the cozy blanket.

Rewritten sentence: The cozy blanket was where the cat curled up in a ball, purring softly.