Over the past few days, the cryptocurrency market has seen a significant decrease in prices. Ethereum (ETH), the second-largest cryptocurrency by market capitalization, has hit a critical level near $1,800 for the first time since 2023. Despite this, many investors and long-term holders see this as a prime opportunity to buy.

Key Level for Ethereum (ETH)

On March 13, 2025, a well-known crypto expert shared a post on X (formerly Twitter), revealing that the key level for Ethereum is $1,887, where whales and investors have amassed 1.63 million ETH tokens. This post has garnered significant attention from the crypto community, sparking discussions about whether it signals a bullish trend for investors or presents an ideal buying opportunity.

Ethereum (ETH) Technical Analysis and Upcoming Levels

According to expert technical analysis, ETH is currently hovering near a crucial support level of $1,800. If the asset fails to hold this level, there could be a substantial price decline in the near future.

Based on recent price movements and historical trends, if ETH remains above $1,800, it could potentially surge by 20% to reach $2,200 in the coming days. However, if ETH drops below $1,780 and closes a daily candle, it could plummet by over 16% to hit $1,500.

Currently, ETH’s Relative Strength Index (RSI) is approaching the oversold territory, suggesting weakness in the asset and hinting at a potential price decline in the days ahead.

Current Price Momentum

At the moment, ETH is trading around $1,840, showing a decline of over 2.5% in the last 24 hours. However, within the same period, its trading volume has dropped by 30%, indicating reduced engagement from traders and investors compared to previous days.

Traders Over-Leveraged Levels

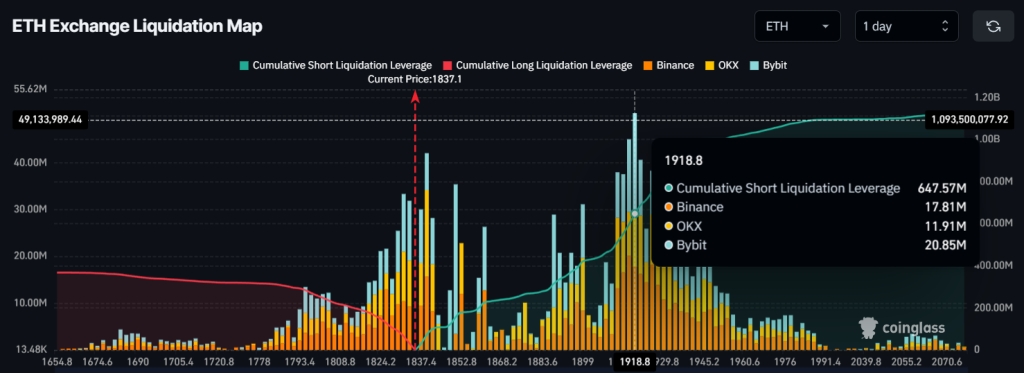

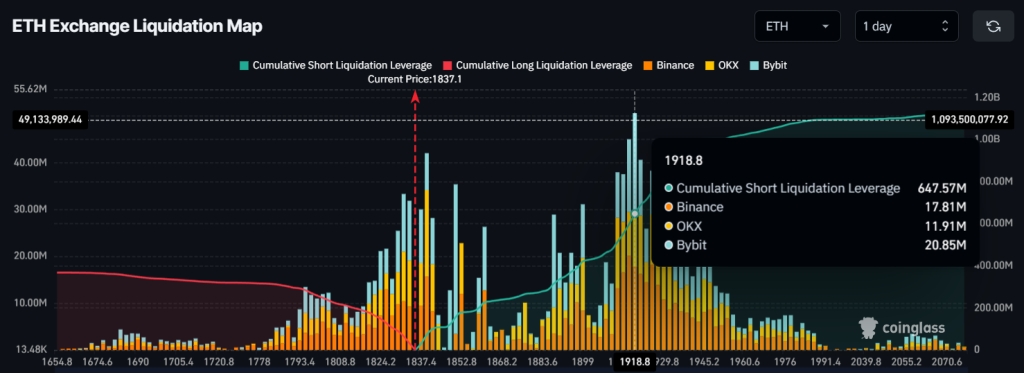

With the recent price drop, intraday traders appear to have a bearish stance, as per data from the on-chain analytics company Coinglass.

The data reveals that traders are over-leveraged at $1,795, holding $285 million worth of long positions. Another over-leveraged level is at $1,920, where traders have $650 million worth of short positions.

This on-chain metric suggests that traders currently hold a bearish sentiment towards ETH, indicating skepticism about the asset’s ability to surpass the $1,920 level.